DealersLink

How the Simplified Stocking Report Combats the Inventory Shortage

Stocking inventory can be a tricky, daunting task, even for veteran car dealers. To make matters worse, the current inventory shortage only adds challenge to the process. Keep reading to discover how the Dealerslink Simplified Stocking Report is helping dealers across the nation fill their inventory needs.

Stocking inventory can be a tricky, daunting task, even for veteran car dealers. To make matters worse, the current inventory shortage only adds challenge to the process. Keep reading to discover how the Dealerslink Simplified Stocking Report is helping dealers across the nation fill their inventory needs.

Whether we like it or not, inventory is currently the most restricted we’ve seen it in years, and stocking a lot has become an even more challenging task. Traditionally, determining your inventory needs has been a time-consuming process, involving a large amount of analysis, research, and a bit of guesswork. But thanks to our simplified stocking report, you can save you and your team the headaches and quickly find solutions to any of your stocking difficulties.

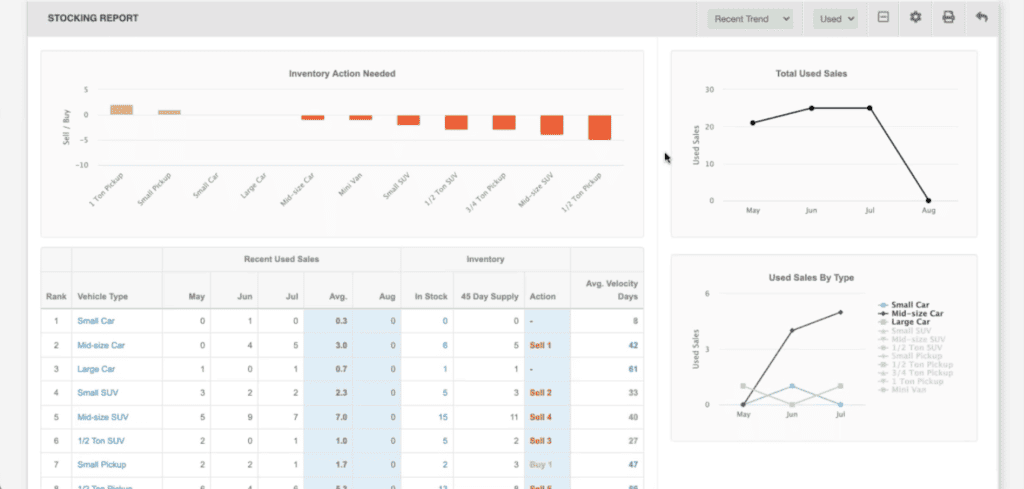

Different from a typical stocking report, ours does not break inventory down by price band. Instead, it sorts vehicles by type, ranging from small cars and minivans to half-ton SUVs and one-ton pick-ups. Rather than telling you the value of cars that you need, the DealersLink simplified stocking report tells you what your customers need, allowing you to better cater to your clients and ultimately sell more vehicles.

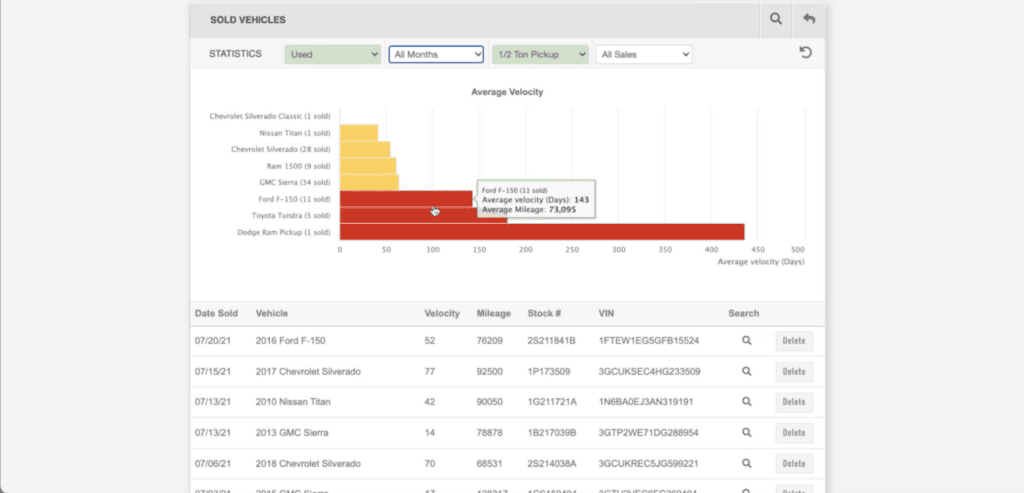

The DealersLink Simplified Stocking Report provides you with more than just streamlined analysis, however. It yields effective solutions in real-time, analyzing both recent and seasonal sales data trends to tell you how many cars you need to purchase or sell, and how they have performed statistically. Once you know which areas need to be stocked, our platform lets you “drill down” within your inventory, allowing you to see specifically which car models perform best and should be stocked, and which ones do not.

“The simplified stocking report allows store managers, who are responsible for sourcing vehicles, a quick way to identify vehicles by class where the store is low or high on inventory,” describes DealersLink performance manager Matt Childers. “By keeping the report simple, it helps dealers to make quick, informed decisions instead of having to dive through multiple layers of data analytics. In doing so, dealers can be more efficient and effective when trying to fill inventory holes on the lot.”

Once you know what you need, the DealersLink platform makes it easy for you to find it. Our stocking report is directly integrated with our DealersLink Marketplace, as well as our AuctionLink platform, allowing you to go directly from one to the other, and easily source your next vehicles. With unmatched ease of navigation and a variety of tangible, digestible data points, your lots will be perfectly stocked in no time.

So now that your team has all this extra time, it’s time to decide what you’re going to do with it… visit us online at dealerslink.com to get started.

DealersLink

How Automotive Dealers are Tackling the Inventory Void

It’s no secret that the prolonged global shortage of semiconductor chips needed for new vehicles has continued to escalate, dramatically impacting inventory levels throughout the marketplace. Estimates indicate there will be over one million fewer cars built on a worldwide basis in 2021, and per Glenn O’Donnell, VP of Research at Forrester, the shortage could last until 2023.

It’s no secret that the prolonged global shortage of semiconductor chips needed for new vehicles has continued to escalate, dramatically impacting inventory levels throughout the marketplace. Estimates indicate there will be over one million fewer cars built on a worldwide basis in 2021, and per Glenn O’Donnell, VP of Research at Forrester, the shortage could last until 2023.

This issue was created by a “perfect storm” from the COVID pandemic, where demand for electronic goods, and subsequently computer chips, was intensified. Added to this, multiple supply chain shipping problems perpetuated an intense backlog of needed parts for car manufacturers.

In the words of Jim Farley, CEO of Ford Motor Company, “… (this is) perhaps the greatest supply shock,” he has ever seen.

The point gets further proven by the fact that pre-owned vehicles are appreciating in value – a phenomenon rarely, if ever, seen in the modern era. With less inventory available, demand has skyrocketed, and so have prices.

Dramatic evidence can be seen across dealerships throughout the nation, where car lots are visibly depleted of inventory. Andy Keys, General Sales Manager at Wendle Ford in Spokane, Washington, says, “We are sitting at about 35 new vehicles on the ground of Fords. We usually have 200 to 250.”

So, what are the solutions?

The simplest, but most frustrating answer is time. There are efforts to start making more semiconductors in the U.S., but this will take time to ramp up to meet the vastly depleted supply.

New vehicle production pauses are also in effect. Auto manufactures, including Ford, GM, Honda, Mitsubishi, Nissan, Toyota, and VW have paused production on models which are less-in-demand, and models that require more chips. While this may help semiconductor manufacturers with the needed time to “catch up” to demand, this approach obviously places additional strains on the auto industry.

The optimal answer is exploring additional and more strategic sources for inventory. Products like online auctions, customer trades, and the DealersLink Marketplace make it easy for dealers to buy quality inventory that their market demands.

“The DealersLink Marketplace enables dealers to see the entire market with transparency, regardless of their business locations. Clients can stock their lots with clean, reconditioned units, locate hard-to-find vehicles for their customers, sell inventory with incurring wholesale losses, and read the market with industry-leading analytic tools.”

- - Travis Wise, Senior Vice President of Sales at DealersLink

Visit us online for more information: https://public.dealerslink.com/

No Comments

DealersLink

The Story Behind the "Appreciation Spike"

If you follow the automotive industry, you’ve likely heard that vehicles are appreciating at unprecedented rates right now. What you might not know, however, is how your dealership can fully use these conditions to its advantage. Keep reading to learn what has caused this unheard-of spike in vehicle prices and how dealers across the nation are using it to realize massive gains.

If you follow the automotive industry, you’ve likely heard that vehicles are appreciating at unprecedented rates right now. What you might not know, however, is how your dealership can fully use these conditions to its advantage. Keep reading to learn what has caused this unheard-of spike in vehicle prices and how dealers across the nation are using it to realize massive gains.

With the COVID vaccine becoming more and more prevalent, Americans are finally starting to return to some sense of normalcy as mask mandates relax and businesses begin to fully reopen. For the automotive industry, however, conditions are far from typical with inventory tighter than ever and car values skyrocketing. But dealers who have been actively buying and selling vehicles during the pandemic are now reaping the benefits, as cars on their lots are appreciating at never-before-seen rates.

There is not a simple explanation behind these conditions. Rather they are a product of a variety of different factors:

- Trouble on the Line: The COVID-19 situation affected automotive manufacturing in a variety of ways, one of which being a lack of computer chips and parts, ultimately leading to less car production. With less supply of cars, demand and prices have naturally gone up.

- Rental Fleet Inventory: Instead of selling aged inventory, rental companies are now holding onto their used vehicles for longer, meaning less inventory being placed back on the market.

- Fewer Lease Returns: Leasers are choosing to buy or extend their leases instead of leasing them back to the dealership, causing less inventory to be available for sale.

- Stimulus Checks Galore: Be it PPP loans, stimulus checks, or other types of government aid, consumers are receiving money from the government like never before, meaning they’re buying inventory like never before.

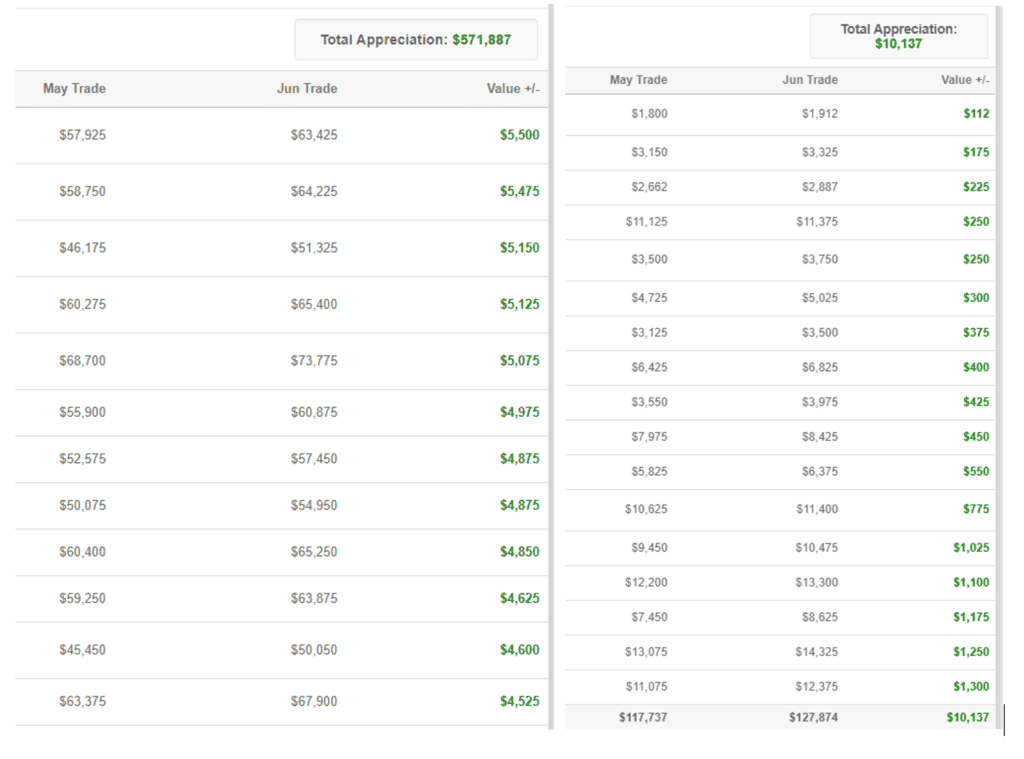

With fewer vehicles available but higher demand, dealers with low inventory are scrambling to acquire vehicles as they watch prices inflate. At the same time, those who have been actively making transactions are seeing their hard work pay off as their appreciating lots significantly gain value.

“With less inventory available, dealers are seeing their lot values skyrocket,” describes DealersLink Senior VP of Sales Travis Wise. “There are two types of dealers out there: those who have been buying inventory and seeing the benefits or those who haven’t and have been suffering.”

A dealer who has actively been making transactions vs. one who hasn’t

A recent article from AutoRemarketing confirms this “spike”, noting how the Manheim used-car price index surpassed the 200 mark in mid-May, its highest level since 1997. Additionally, the article notes that the number of unsold vehicles fell from 2.34 million at the end of March to 2.23 million at the end of April, a drastic drop.

So, what do these conditions mean for your dealership? Ultimately, this recent spike emphasizes the importance of continuing to actively make transactions, be it buying, selling, or trading vehicles. The more inventory that dealers interact with, the more money they will ultimately make.

An easy way to do this is through the DealersLink marketplace, the largest dealer-to-dealer vehicle exchange in the country with over $1 billion in retail-ready inventory. Nationwide, dealers use the marketplace to streamline the way they buy, sell, and trade inventory without the typical fees or long-term contracts. To learn more, visit our dedicated marketplace page.

No Comments

No Comments