DMEautomotive

• Hurt the employer’s reputation, or disparage the company or its officers;

• Disclose proprietary information (maybe even inadvertently);

• Result in vicarious liability for the employer (for example, supervisor harassment via Facebook); or

• Otherwise violate company policies.

DMEautomotive

• Hurt the employer’s reputation, or disparage the company or its officers;

• Disclose proprietary information (maybe even inadvertently);

• Result in vicarious liability for the employer (for example, supervisor harassment via Facebook); or

• Otherwise violate company policies.

No Comments

DMEautomotive

The Current Service Retention Dilemma…Not only are today’s automotive service customers demanding fast and responsive customer service for their vehicles, they have many options which allow them to easily defect to a competitor. Everyone knows that competition in the automotive services arena is fierce. Many consumers equate vehicle service and maintenance to commodity level events with the belief that “any service center” can service and maintain their vehicle and that the lowest price or convenience wins.

For most people, having their vehicle serviced is not a priority in their everyday lives and at any given time, most people are not thinking about having their vehicle serviced. Basically, two events stimulate a decision to have service performed on a vehicle: 1) a problem with the vehicle or the red light appears, or 2) a service reminder arrives communicating a time or mileage based specific need with a strategic offer.

Since there is no schedule for the timing of vehicle break downs, the first event above requires your store to be top of mind. In the second and most frequently occurring event, dealers search for the best way to remind customers when it is time to have service maintenance performed. To do this, first understand the genetic make-up of your DMS database.

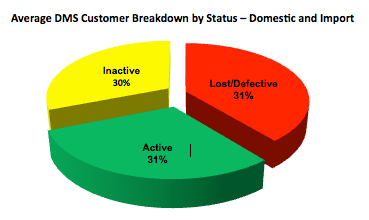

In any DMS, there will be three types of customers:

-

Active – customers who have had service performed within the required interval

-

Inactive – customers who have missed 1-4 intervals

-

Lost/Defective – customers who have missed more than 4 intervals

|

|

Active service customers represent about 39% of the average DMS service database. These are your best customers. Most Service Managers will say that 50% of their Active customer database in their DMS will come in for service when it is due. The real question is… “Which 50% of the Active customer base will actually come in and when? Normally, Active customers will respond to a regular reminder communication without a discount option.

Inactive customers are the most fickle and represent about 30% of the DMS. The longer they wait to return to the dealership, the greater likelihood they will defect. For most, their behavior has changed and they need to be motivated by a specific offer. The good news is that these are customers that need the most work done and their RO value is 30-40% higher then average. Inactive customers can be converted to Active status if properly segmented and communicated with using targeted communications with specific offers.

Lost/Defective customers represent about 31% of the DMS database and really should not be recognized as service customers any longer. If they have not been in for service within 4 intervals, there is a good chance they are not coming back. Their likeliness to return depends upon such factors as distance from store, age of or mileage on the vehicle and other traits. These are the most difficult customers to reactivate and require specialized marketing programs.

A wise marketer once said, “Know your customer, earn their business!”

To know and understand your customer requires sophisticated software tools and a marketing process or program that effectively communicates with customers by type. In service, the slogan changes to “Know your customer and re-earn their business.”

No Comments

DMEautomotive

The Current Service Retention Dilemma…Not only are today’s automotive service customers demanding fast and responsive customer service for their vehicles, they have many options which allow them to easily defect to a competitor. Everyone knows that competition in the automotive services arena is fierce. Many consumers equate vehicle service and maintenance to commodity level events with the belief that “any service center” can service and maintain their vehicle and that the lowest price or convenience wins.

For most people, having their vehicle serviced is not a priority in their everyday lives and at any given time, most people are not thinking about having their vehicle serviced. Basically, two events stimulate a decision to have service performed on a vehicle: 1) a problem with the vehicle or the red light appears, or 2) a service reminder arrives communicating a time or mileage based specific need with a strategic offer.

Since there is no schedule for the timing of vehicle break downs, the first event above requires your store to be top of mind. In the second and most frequently occurring event, dealers search for the best way to remind customers when it is time to have service maintenance performed. To do this, first understand the genetic make-up of your DMS database.

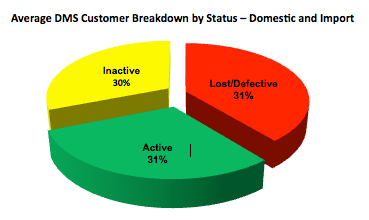

In any DMS, there will be three types of customers:

-

Active – customers who have had service performed within the required interval

-

Inactive – customers who have missed 1-4 intervals

-

Lost/Defective – customers who have missed more than 4 intervals

|

|

Active service customers represent about 39% of the average DMS service database. These are your best customers. Most Service Managers will say that 50% of their Active customer database in their DMS will come in for service when it is due. The real question is… “Which 50% of the Active customer base will actually come in and when? Normally, Active customers will respond to a regular reminder communication without a discount option.

Inactive customers are the most fickle and represent about 30% of the DMS. The longer they wait to return to the dealership, the greater likelihood they will defect. For most, their behavior has changed and they need to be motivated by a specific offer. The good news is that these are customers that need the most work done and their RO value is 30-40% higher then average. Inactive customers can be converted to Active status if properly segmented and communicated with using targeted communications with specific offers.

Lost/Defective customers represent about 31% of the DMS database and really should not be recognized as service customers any longer. If they have not been in for service within 4 intervals, there is a good chance they are not coming back. Their likeliness to return depends upon such factors as distance from store, age of or mileage on the vehicle and other traits. These are the most difficult customers to reactivate and require specialized marketing programs.

A wise marketer once said, “Know your customer, earn their business!”

To know and understand your customer requires sophisticated software tools and a marketing process or program that effectively communicates with customers by type. In service, the slogan changes to “Know your customer and re-earn their business.”

No Comments

DMEautomotive

Today I want to discuss with you what some claim to be the most important aspect of Direct Marketing – Identifying your most important targets.

Factors in Determining Your Dealership’s Buying Base

1. Past Sales Customers

2. Past Service Customers

3. Competitors’ Customers

4. New Market Customers

5. Market Share / Brand Share

If you had $1 to spend on direct marketing, where would you get the best ROI? I know you think I am asking a very simplistic question, but many people have a hard time with this! So, I ask again, if you really had to, whom would you target first? The answer is so simple we sometimes do not want to admit the correct answer for our business.

Focus a portion of your marketing expenditures towards the group that will represent over 80% of your sales – those customers in your backyard!

Now you can see who I think should be your target customer should be. You might not completely agree with me, but ask yourself this question: Do you own these customers in your market?

Past Sales Customers – Those you sold your vehicles in the past…24/60/72/86 months ago…Are they ready to buy again? Is someone else in the household ready to buy?

Past Service Customers – Those who hired you for your services in the past… Has everyone in your service department database bought their car from you? No, on average 53% of service customers did not buy at the servicing dealership. Have they purchased their vehicle from your competitor but like servicing with you? Would they like to buy their next new car from you?

Competitors’ Customers – Those who live in your backyard… They drive right by your location to go to your competitors’ locations for services.

New Market Customers – Is there a customer that lives in one of your top selling zip codes that has not bought your brand of product, but could?

Market Share / Brand Share – What are you selling compared to your competitors? What aren’t you selling compared to your competitors?

Many dealerships feel that they already own their market but I’m suggesting you should at least continue to strive to increase your share in 3 areas: Competitors’ Customers, New Market Customers and Market Share / Brand Share. Customers in your backyard are where 80% of your sales will come from every year and, if you consistently target these customers on a monthly/quarterly basis, you can increase market share.

These targets are the key to your success in direct marketing. How you go about creating these target lists is key. Many think it is about distance, radius, and so on.

A good way to determine your best possible lists is to look at your Top Selling Zip Codes. There probably is a reason you have sold well in a particular zip code or not. Distances are not always the reason. It might be that a particular zip code is a suitcase/commuter zip code, where the consumer travels by your location every day and could buy your vehicles and/or services due to the convenience of your dealership. Not always can we answer why, but numbers do not lie and historically there is always a pattern. Take note of your Top Selling Zip Codes. Additionally, look at your Low Selling Zip Codes, as they create drag on your direct marketing campaigns.

Direct marketing is a marathon of consistent messages to the correct list of customers. When done this way, your ROI will incrementally increase on a monthly basis and enhance your Market Share / Brand Share. Do not give up after 1-3 attempts; direct marketing must be aimed at this list of best targets consistently, rotating thru on a regular basis for a period of at least a year. After completing your annual commitment, you will reap one of the best performing marketing investments in your portfolio.

~ Paul Ryan, Field Account Manager @ DMEautomotive

Bio:

Paul Ryan brings over 25 years of experience in sales, sales management, marketing, and client services. He joined DMEautomotive in February of 2008, as a Regional Territory Manager. With proven success as an inside sales representative selling the FullCircle Solutions’ Bullseye program, he was recognized frequently as Sales Person of the Month and received the highest honor of Sales Person of the Year for 2008. In August of 2009, Paul managed, “Direct-To-Dealer” - Mail Division, responsible for overseeing the sales for the “Direct-To-Dealer” Mail Division. Currently he is traveling in the Midwest as Field Account Manager. Paul graduated with a B.B.A, in Business Administration from Iowa State University in 1982.

Original blog posted at Automotive Direct Marketing

No Comments

DMEautomotive

Today I want to discuss with you what some claim to be the most important aspect of Direct Marketing – Identifying your most important targets.

Factors in Determining Your Dealership’s Buying Base

1. Past Sales Customers

2. Past Service Customers

3. Competitors’ Customers

4. New Market Customers

5. Market Share / Brand Share

If you had $1 to spend on direct marketing, where would you get the best ROI? I know you think I am asking a very simplistic question, but many people have a hard time with this! So, I ask again, if you really had to, whom would you target first? The answer is so simple we sometimes do not want to admit the correct answer for our business.

Focus a portion of your marketing expenditures towards the group that will represent over 80% of your sales – those customers in your backyard!

Now you can see who I think should be your target customer should be. You might not completely agree with me, but ask yourself this question: Do you own these customers in your market?

Past Sales Customers – Those you sold your vehicles in the past…24/60/72/86 months ago…Are they ready to buy again? Is someone else in the household ready to buy?

Past Service Customers – Those who hired you for your services in the past… Has everyone in your service department database bought their car from you? No, on average 53% of service customers did not buy at the servicing dealership. Have they purchased their vehicle from your competitor but like servicing with you? Would they like to buy their next new car from you?

Competitors’ Customers – Those who live in your backyard… They drive right by your location to go to your competitors’ locations for services.

New Market Customers – Is there a customer that lives in one of your top selling zip codes that has not bought your brand of product, but could?

Market Share / Brand Share – What are you selling compared to your competitors? What aren’t you selling compared to your competitors?

Many dealerships feel that they already own their market but I’m suggesting you should at least continue to strive to increase your share in 3 areas: Competitors’ Customers, New Market Customers and Market Share / Brand Share. Customers in your backyard are where 80% of your sales will come from every year and, if you consistently target these customers on a monthly/quarterly basis, you can increase market share.

These targets are the key to your success in direct marketing. How you go about creating these target lists is key. Many think it is about distance, radius, and so on.

A good way to determine your best possible lists is to look at your Top Selling Zip Codes. There probably is a reason you have sold well in a particular zip code or not. Distances are not always the reason. It might be that a particular zip code is a suitcase/commuter zip code, where the consumer travels by your location every day and could buy your vehicles and/or services due to the convenience of your dealership. Not always can we answer why, but numbers do not lie and historically there is always a pattern. Take note of your Top Selling Zip Codes. Additionally, look at your Low Selling Zip Codes, as they create drag on your direct marketing campaigns.

Direct marketing is a marathon of consistent messages to the correct list of customers. When done this way, your ROI will incrementally increase on a monthly basis and enhance your Market Share / Brand Share. Do not give up after 1-3 attempts; direct marketing must be aimed at this list of best targets consistently, rotating thru on a regular basis for a period of at least a year. After completing your annual commitment, you will reap one of the best performing marketing investments in your portfolio.

~ Paul Ryan, Field Account Manager @ DMEautomotive

Bio:

Paul Ryan brings over 25 years of experience in sales, sales management, marketing, and client services. He joined DMEautomotive in February of 2008, as a Regional Territory Manager. With proven success as an inside sales representative selling the FullCircle Solutions’ Bullseye program, he was recognized frequently as Sales Person of the Month and received the highest honor of Sales Person of the Year for 2008. In August of 2009, Paul managed, “Direct-To-Dealer” - Mail Division, responsible for overseeing the sales for the “Direct-To-Dealer” Mail Division. Currently he is traveling in the Midwest as Field Account Manager. Paul graduated with a B.B.A, in Business Administration from Iowa State University in 1982.

Original blog posted at Automotive Direct Marketing

No Comments

DMEautomotive

Showroom traffic control is a vital aspect of successfully operating a car dealership and depends heavily on a dealerships sales process. Dealers spend thousands of dollars every month to get people to come into the store. Therefore, it’s critical for dealers to have an effective sales process in place. I am sure you’re thinking that you have a fairly effective process in place already…but, in today’s challenging economic times, there may be more you could be doing. I’ll provide you with 3 important rules to follow to increase sales and gross profits by establishing processes for showroom control.

Rule #1: Understand the customer’s vehicle needs and financial situation up front…to decrease the number of “pencils” and increase your bottom line.

In most stores, salespeople greet a customer with “How can I help you? What are you interested in?” and hopefully strongly urges them to take a test drive. (Always require prospects to take a test drive. If they don’t they are emotionally connected to the vehicle they test drove at your competitor and financially connected to your store). The salesperson does his /her own pencil then starts going back and forth between the desk and the customer to communicate the customer’s concerns and the dealer’s desire to make a buck and move some metal. As the number of “pencils” increase, the gross profit decreases, and moving from one vehicle to another has the exact same negative effect on the bottom line.

Why does it take 3 or 4 “pencils” to get a deal done? It’s part of the sales process: it’s likely the salesperson didn’t understand the customer’s vehicle needs or they didn’t understand the customer’s financial situation before they landed on the vehicle.

Solution: Most Salespeople usually don’t ask the right questions, such as, “Why are you looking at this particular vehicle? Have you been shopping? What other vehicles have you looked at? Did you make an offer? Why didn’t you buy?” It’s the “art of a sale”. Salespeople have to have a natural ability to converse with people. We can’t start peppering the prospect with “Why? Why? Why?” But you can’t grab the keys to a vehicle without knowing something about the customer and their interests. It’s important to understand the opportunity in front of you before you take action.

Rule #2: Get a manager involved in the process UP FRONT!

After all of that, typically your staff will then get a manager involved in the transaction to “save the deal”! The salesperson’s mentality is typically, “Help me! They’re going to walk! We’re WAY OFF on monthly payments, what do I do?” Guess what? It’s too late! The manager really doesn’t stand a chance. Your sales process got him involved at the absolute worst time. It’s like asking him to get on a bucking bronco after the gate has opened. THINK ABOUT IT! Your managers are your best “closers” and you’re not even getting him in the game until it’s too late.

I know what you’re thinking…I thought it too…”We don’t have time to do that. We cut back our staff. We’re running with only 2 managers etc.” I thought the exact same thing until I learned how it was done and watched others try it. When you get your best closers involved up front you reduce the number of pencils and the number of times you move from one vehicle to another and the time it takes to make a deal. Because you already have a better understanding of your customer’s vehicle and financial needs, you will increase your gross profits.

Rule #3: Carefully manage your customer’s perception of the situation

One of the best practices I learned in my 15+ years was from a GM in a large store that insisted on greeting every customer before they took a test drive. He introduced himself as the GM and he was “the man”… the best person in his store…and he would make sure the prospect drove home in the best vehicle for their needs at the best price in their market. I asked, “How can you work every deal?” He told me he didn’t work any deals. Every salesperson told their prospect that they needed to go to the GM to make sure they got the BEST DEAL IN TOWN. The salesperson spent 2 minutes in the GM’s office and then went back to the customer and worked the deal. The customer control they established by getting managers involved up front in the process gives the customers the perception the dealer wants them to have. Customer perception is a HUGE factor in gross profit. If a customer’s perception is that he got ripped off, they will tell every person they know about “their terrible experience” at your dealership. You’ll NEVER get a chance to sell him or anyone they know another vehicle. The guy you made $3,800 on whose perception is that the “THE MAN” worked his deal. He’ll tell everyone he knows about the “outstanding experience” he had at your dealership.

In summary, by understanding your customer’s situation, getting your best people involved in the transaction up front, and managing your customer’s perception you will optimize your sales process, increase your gross profits and give your customers the perception and the vehicle you want them to drive away with.

~ Steve Dozier, Sales Director @ DMEautomotive

Bio:

Steve Dozier brings 15 years of experience in the automotive industry to DMEautomotive. Before joining Full Circle Solution and DMEautomotive, he held upper level management positions in the retail industry. Steve also owned a consulting company that specialized in CRM and direct mail, which brought in $2 Million in Sales for approximately 5 years. While serving as a consultant Steve was consistently recruited by the top 3 CRM firms of that time. Since starting with DMEautomotive Steve has held a managerial position overseeing the Dealer-to-Dealer team. He is responsible for the entire telephony sales department. Steve is married with two children and enjoys scuba diving and boating in his free time.

LinkedIn: http://www.linkedin.com/pub/steve-dozier/10/903/623

No Comments

DMEautomotive

Showroom traffic control is a vital aspect of successfully operating a car dealership and depends heavily on a dealerships sales process. Dealers spend thousands of dollars every month to get people to come into the store. Therefore, it’s critical for dealers to have an effective sales process in place. I am sure you’re thinking that you have a fairly effective process in place already…but, in today’s challenging economic times, there may be more you could be doing. I’ll provide you with 3 important rules to follow to increase sales and gross profits by establishing processes for showroom control.

Rule #1: Understand the customer’s vehicle needs and financial situation up front…to decrease the number of “pencils” and increase your bottom line.

In most stores, salespeople greet a customer with “How can I help you? What are you interested in?” and hopefully strongly urges them to take a test drive. (Always require prospects to take a test drive. If they don’t they are emotionally connected to the vehicle they test drove at your competitor and financially connected to your store). The salesperson does his /her own pencil then starts going back and forth between the desk and the customer to communicate the customer’s concerns and the dealer’s desire to make a buck and move some metal. As the number of “pencils” increase, the gross profit decreases, and moving from one vehicle to another has the exact same negative effect on the bottom line.

Why does it take 3 or 4 “pencils” to get a deal done? It’s part of the sales process: it’s likely the salesperson didn’t understand the customer’s vehicle needs or they didn’t understand the customer’s financial situation before they landed on the vehicle.

Solution: Most Salespeople usually don’t ask the right questions, such as, “Why are you looking at this particular vehicle? Have you been shopping? What other vehicles have you looked at? Did you make an offer? Why didn’t you buy?” It’s the “art of a sale”. Salespeople have to have a natural ability to converse with people. We can’t start peppering the prospect with “Why? Why? Why?” But you can’t grab the keys to a vehicle without knowing something about the customer and their interests. It’s important to understand the opportunity in front of you before you take action.

Rule #2: Get a manager involved in the process UP FRONT!

After all of that, typically your staff will then get a manager involved in the transaction to “save the deal”! The salesperson’s mentality is typically, “Help me! They’re going to walk! We’re WAY OFF on monthly payments, what do I do?” Guess what? It’s too late! The manager really doesn’t stand a chance. Your sales process got him involved at the absolute worst time. It’s like asking him to get on a bucking bronco after the gate has opened. THINK ABOUT IT! Your managers are your best “closers” and you’re not even getting him in the game until it’s too late.

I know what you’re thinking…I thought it too…”We don’t have time to do that. We cut back our staff. We’re running with only 2 managers etc.” I thought the exact same thing until I learned how it was done and watched others try it. When you get your best closers involved up front you reduce the number of pencils and the number of times you move from one vehicle to another and the time it takes to make a deal. Because you already have a better understanding of your customer’s vehicle and financial needs, you will increase your gross profits.

Rule #3: Carefully manage your customer’s perception of the situation

One of the best practices I learned in my 15+ years was from a GM in a large store that insisted on greeting every customer before they took a test drive. He introduced himself as the GM and he was “the man”… the best person in his store…and he would make sure the prospect drove home in the best vehicle for their needs at the best price in their market. I asked, “How can you work every deal?” He told me he didn’t work any deals. Every salesperson told their prospect that they needed to go to the GM to make sure they got the BEST DEAL IN TOWN. The salesperson spent 2 minutes in the GM’s office and then went back to the customer and worked the deal. The customer control they established by getting managers involved up front in the process gives the customers the perception the dealer wants them to have. Customer perception is a HUGE factor in gross profit. If a customer’s perception is that he got ripped off, they will tell every person they know about “their terrible experience” at your dealership. You’ll NEVER get a chance to sell him or anyone they know another vehicle. The guy you made $3,800 on whose perception is that the “THE MAN” worked his deal. He’ll tell everyone he knows about the “outstanding experience” he had at your dealership.

In summary, by understanding your customer’s situation, getting your best people involved in the transaction up front, and managing your customer’s perception you will optimize your sales process, increase your gross profits and give your customers the perception and the vehicle you want them to drive away with.

~ Steve Dozier, Sales Director @ DMEautomotive

Bio:

Steve Dozier brings 15 years of experience in the automotive industry to DMEautomotive. Before joining Full Circle Solution and DMEautomotive, he held upper level management positions in the retail industry. Steve also owned a consulting company that specialized in CRM and direct mail, which brought in $2 Million in Sales for approximately 5 years. While serving as a consultant Steve was consistently recruited by the top 3 CRM firms of that time. Since starting with DMEautomotive Steve has held a managerial position overseeing the Dealer-to-Dealer team. He is responsible for the entire telephony sales department. Steve is married with two children and enjoys scuba diving and boating in his free time.

LinkedIn: http://www.linkedin.com/pub/steve-dozier/10/903/623

No Comments

DMEautomotive

Opportunities Lost…but then Found!

Finding Service Revenue Opportunities at Your Dealership

Each day, during the service write-up and diagnostic process, service advisors and technicians frequently discover potential service revenue opportunities; otherwise known as “problems” to the car owner. In most cases, they present their findings to the vehicle owner with the hope of “up-selling” additional service lines. Most of the time the vehicle owner declines the proposed services for one of two reasons or both: time and/or money. The customer then leaves the building and the potential revenue is technically lost. How much is lost? Let’s play with some numbers.

Most service directors will say that up to 40% of all repair orders have at least one declined service opportunity listed. If your shop handles 75 repairs order per day then you will have up to 30 declined service opportunities each day or 780 per month (26 days). Basically, your Service Department has missed out on 780 potential revenue opportunities in just one month

Now…let’s look at the financial implications of lost service revenue opportunities. Suppose that the customer pay and parts revenue attached to each declined service opportunity equals $150. Using the numbers from above, 780 declined service opportunities missed per month equates to a potential loss of $117,000 of additional revenue ($150 x 780) or $67,860 in Gross Profit ($117,000 x 58% GP)

So we assume that 780 declined service opportunities leave because they do not have the time and/or money to have the services performed. Does this mean that they will not have the needed service completed at some other time? No…it could mean that the decision has just been delayed.

Theoretically, the money is not lost, but in a holding pattern. The key to “finding the money” is to proactively contact the declined service customers to remind them of the importance of having these services performed and to offer an incentive (i.e. 10% off, etc.) to return to the dealership.

Studies show that with an effective and automatic follow-up declined services process using multiple channels of communication; the average dealer will have a 13.5% response rate with an average RO value of $331. Again, using the numbers above, 780 declined service opportunities per month at 13.5% response rate equated to 105 RO’s at $331. By utilizing an automatic follow-up process and being proactive with the service opportunities you originally perceived to be lost, you just found $34,854 in revenue each month.

Not only have you found the lost money, but also proactively re-engaged that customer into your service department. A “Win-Win” for everyone!

~ Gary Mitchell

Director, Telephony & Virtual BDC Products, DMEautomotive

Bio:

Gary has 25 years of experience in providing franchised auto dealers with marketing and technology solutions designed to increase revenue and overall profitability. Gary has held national positions with ADP Dealer Services, LML Technologies, and DMEautomotive. He is currently responsible for researching and designing new products and marketing campaigns based on industry trends and specific dealership needs. He directly interfaces with Development and Product Management to monitor market needs and requirements, taking into account emerging technologies, competitor products / services, industry trends, and regulatory / compliance changes for both OEM and regulatory bodies. LinkedIn Profile: http://www.linkedin.com/in/garymitchellauto

Original post is located at http://www.automotivedirectmarketing.blogspot.com

No Comments

DMEautomotive

Opportunities Lost…but then Found!

Finding Service Revenue Opportunities at Your Dealership

Each day, during the service write-up and diagnostic process, service advisors and technicians frequently discover potential service revenue opportunities; otherwise known as “problems” to the car owner. In most cases, they present their findings to the vehicle owner with the hope of “up-selling” additional service lines. Most of the time the vehicle owner declines the proposed services for one of two reasons or both: time and/or money. The customer then leaves the building and the potential revenue is technically lost. How much is lost? Let’s play with some numbers.

Most service directors will say that up to 40% of all repair orders have at least one declined service opportunity listed. If your shop handles 75 repairs order per day then you will have up to 30 declined service opportunities each day or 780 per month (26 days). Basically, your Service Department has missed out on 780 potential revenue opportunities in just one month

Now…let’s look at the financial implications of lost service revenue opportunities. Suppose that the customer pay and parts revenue attached to each declined service opportunity equals $150. Using the numbers from above, 780 declined service opportunities missed per month equates to a potential loss of $117,000 of additional revenue ($150 x 780) or $67,860 in Gross Profit ($117,000 x 58% GP)

So we assume that 780 declined service opportunities leave because they do not have the time and/or money to have the services performed. Does this mean that they will not have the needed service completed at some other time? No…it could mean that the decision has just been delayed.

Theoretically, the money is not lost, but in a holding pattern. The key to “finding the money” is to proactively contact the declined service customers to remind them of the importance of having these services performed and to offer an incentive (i.e. 10% off, etc.) to return to the dealership.

Studies show that with an effective and automatic follow-up declined services process using multiple channels of communication; the average dealer will have a 13.5% response rate with an average RO value of $331. Again, using the numbers above, 780 declined service opportunities per month at 13.5% response rate equated to 105 RO’s at $331. By utilizing an automatic follow-up process and being proactive with the service opportunities you originally perceived to be lost, you just found $34,854 in revenue each month.

Not only have you found the lost money, but also proactively re-engaged that customer into your service department. A “Win-Win” for everyone!

~ Gary Mitchell

Director, Telephony & Virtual BDC Products, DMEautomotive

Bio:

Gary has 25 years of experience in providing franchised auto dealers with marketing and technology solutions designed to increase revenue and overall profitability. Gary has held national positions with ADP Dealer Services, LML Technologies, and DMEautomotive. He is currently responsible for researching and designing new products and marketing campaigns based on industry trends and specific dealership needs. He directly interfaces with Development and Product Management to monitor market needs and requirements, taking into account emerging technologies, competitor products / services, industry trends, and regulatory / compliance changes for both OEM and regulatory bodies. LinkedIn Profile: http://www.linkedin.com/in/garymitchellauto

Original post is located at http://www.automotivedirectmarketing.blogspot.com

No Comments

No Comments