Affinitiv

Overcoming the New Threats to Vehicle Sales

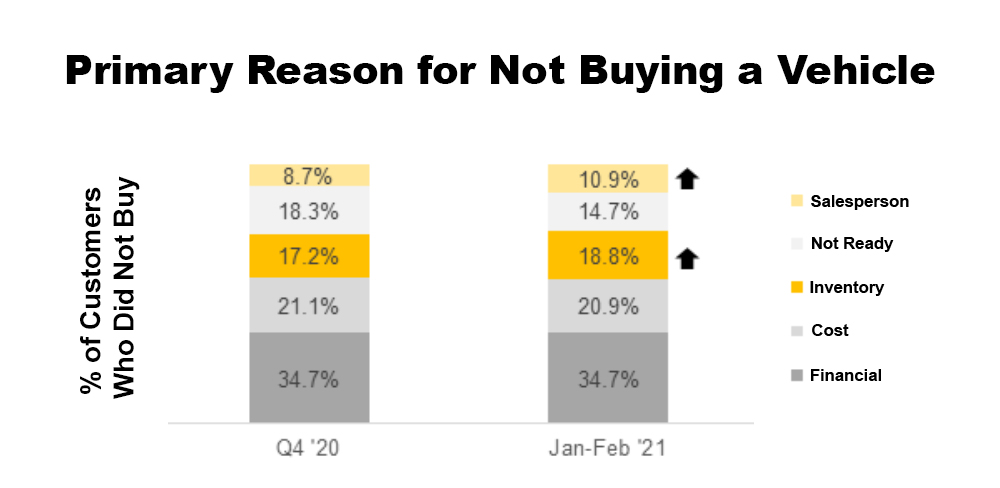

Through Affinitiv’s XRM solution, we survey more than 20,000 auto consumers every year who visit a dealer showroom but choose not to purchase a car. We asked the showroom visitors why they didn’t purchase a vehicle and then classified their responses into a few categories. While a person’s financial situation and the vehicle price are the most common reasons not to purchase a vehicle, an increasing percentage of consumers chose not to buy due to inventory-related reasons, e.g. the specific model they wanted was out of stock. Non-buyers were also more likely to cite concerns with the salesperson as a reason to keep shopping in early 2021 compared to Q4 2020.

Through Affinitiv’s XRM solution, we survey more than 20,000 auto consumers every year who visit a dealer showroom but choose not to purchase a car. We asked the showroom visitors why they didn’t purchase a vehicle and then classified their responses into a few categories. While a person’s financial situation and the vehicle price are the most common reasons not to purchase a vehicle, an increasing percentage of consumers chose not to buy due to inventory-related reasons, e.g. the specific model they wanted was out of stock. Non-buyers were also more likely to cite concerns with the salesperson as a reason to keep shopping in early 2021 compared to Q4 2020.

Approximately half of the consumers who did not purchase due to inventory reported that the dealer did not have the exact style they wanted, e.g. wrong color or size of vehicle. For consumers who identified the salesperson as the primary concern, the most common issue was a lack of follow-up related to a specific question a consumer needed to answer before they would purchase the vehicle. Lower staffing levels due to COVID are likely a key contributor to the lack of follow-up by dealer associates.

Manufacturers and dealers have the opportunity to overcome these new threats by better utilizing smart technologies. For example, Affinitiv’s technology incorporates proven workflows for sales associates to follow when interacting with customers. To ensure customers always receive a response, our technology also incorporates AI-driven chat and emails to respond to requests from leads. Overcoming inventory issues is a far greater challenge for dealers as they are at the end of the supply chain and it can take months to get the exact vehicle a customer wants. A key opportunity for dealers is utilizing intelligent marketing programs to promote the vehicles in inventory a customer is more likely to buy. Driving demand for existing inventory is critical to converting leads into buyers and lessening the likelihood of frustrating customers with the wrong inventory.

Interested in learning more? Read our latest industry trends guide to keep a pulse on the automotive market.

Affinitiv

Prepare for Disappearing Drivers

On-demand driver services such as Uber are on the rise. The approaching disruption of driverless vehicles shouldn’t come as a surprise, but dealers need to find a way to keep up with customers who want alternatives to owning a vehicle. It comes down to this: complacency can cause suppliers to lose touch with their customers. To remain successful and compensate for declining vehicle owners, it’s time to face the facts.

What’s driving demand?

In a recent study of 1,000 consumers, we found that 1 in 4 U.S. drivers said they always or typically prefer someone else to drive them. This is not a new demand. Transportation options have remained the same for nearly a century, so it’s likely that this preference has existed for quite some time. Rather, the disappearing driver phenomenon stems from a lack of innovation around supply.

Sudden increases in supply

Vehicle manufacturers, dealers, and leasing companies had little reason to change until the Great Recession of 2008. When our economic bubble burst, consumers suddenly stopped buying cars and started looking for less expensive transportation. As major automotive manufacturers teetered on the brink of extinction, a couple of guys decided it was time to fulfill an unmet need and forever change the industry.

Cue: Garrett Camp and Travis Kalanick. These two started Uber in 2009 after the last straw with an age old problem—trying to hail a cab. In just seven years, they created a business worth more than Ford and General Motors. Multi-billion dollar disruptions like this don’t go unnoticed. Uber quickly got the attention of large technology companies like Google and Apple, who are determined to reshape transportation as we know it with self-driving vehicles.

Measuring the impact

Given the growing popularity of Uber—which currently racks up over a million rides per day—and the emergence of driverless vehicles, we felt compelled to answer an important question for dealers: how much will mobility alternatives impact vehicle sales?

To find the answer, we went to the most reliable source: vehicle owners. In our survey, we asked them how they expect driverless vehicles will impact the number of vehicles they own in the next five years.

- 16% of drivers said they would own more vehicles in 5 years

- 21% of drivers said they would own less vehicles

- 10% said they won’t own any vehicles[1]

As a result, as much as 15 percent of vehicle owners will disappear—virtually guaranteeing an unrecoverable decline in sales.

What does this mean for dealers?

The 15 percent of drivers without vehicles still need ways to get around; yet they won’t need the same number of vehicles to support them. Consider this: a typical driver spends an average of 46 minutes per day in their car[2]. So if 50 percent of vehicles are used for ownership alternatives (e.g. driverless cars), we estimate that one vehicle will soon support up to 15 former drivers—which means the majority of the 15 percent decline in drivers will translate directly to a drop in SAAR.

And that’s only the beginning. It’s uncertain how the majority of vehicle owners will respond once they see their friends and family members enjoying the perks of going vehicle-less.

Dealers can’t afford to sit idle and watch their vehicle sales erode in the wake of on-demand driver services and self-driving vehicles. Instead, they need to work on new revenue sources to make up for the decline in vehicle owners. They should also consider ways to enhance the experience of customers with new, more innovative options for owning a vehicle. Now is the time for dealers to embrace the inevitable—disappearing drivers—and find their place in the new mobility economy.

No Comments

No Comments