Clarivoy

Making a Better Mousetrap: Leverage Consumer Behavior to Increase Conversions

As I have mentioned in past blogs, few customers complete lead forms, making it very difficult for dealers to track the source of their sales. Without this information, it’s virtually impossible to make educated decisions about how to spend your marketing dollars. It’s time to build a better mousetrap so that dealers get insight into the behavior of online shoppers, even those who never fill out a lead form, ultimately increasing conversions.

As I have mentioned in past blogs, few customers complete lead forms, making it very difficult for dealers to track the source of their sales. Without this information, it’s virtually impossible to make educated decisions about how to spend your marketing dollars. It’s time to build a better mousetrap so that dealers get insight into the behavior of online shoppers, even those who never fill out a lead form, ultimately increasing conversions.

The first thing we need to know to build a better solution is why consumers aren’t filling out lead forms. I think some of the reasons include:

1. Information Availability – There is more information available online than ever before. Consumers can gather this information 24 hours a day and obtain instant results. They don’t need to fill out a form and wait for a response to get what they need when most of it is at their fingertips.

2. Trust factor - This information is not only convenient, but they also trust that it’s accurate.

Frequently, consumers report that a dealer they contacted online is unresponsive, doesn’t answer their questions, or simply invites them for a test drive without helping them first.

3. Time investment – In general, consumers don’t like the traditional car buying process. The perception is that buying a car is an all-day task and they simply don’t have the time to invest. Filling out a lead form, in their mind, is the first step of a time-consuming process they may not be ready to start.

Obviously, if you can increase the number of lead-form submissions, you would have access to more accurate information about your consumer’s behavior. Today it’s crucial to know which sites influence the consumers’ decisions and which ones don’t. Knowing the answer to that question can easily give your dealership a competitive digital advantage.

But while there are lots of tools on the market today that give you access to some of this data, not many can help you fill in the activity of those anonymous buyers. If you’re only relying on the straight line between a click and a conversion for someone that filled out a lead form, there’s no way to know what’s really influencing consumers and producing ROI. You need to know all the influencers for all your customers.

You can’t build a better mousetrap if you don’t know how that mouse will react to different stimuli -- a little cheese here and a little cheese there can easily motivate the mouse to follow the path that you want it to.

Without taking all the mouse’s behavior into account, however, you’ll never know which things are moving it closer to the desired destination and which are moving it farther away. Remove cheese at this place and perhaps the mouse takes a different path… put some cheese in this spot and perhaps they make a beeline to the destination.

Don’t make your marketing decisions solely based on where the mouse was when he ate the cheese. Rather, figure out what led the mouse from the entrance to that point.

Clarivoy

When Knowing What You Don’t Know Slays the Marketing Dragon

A massive amount of data is now available on every potential car buyer, with a multitude of ways to use it. And, when it comes to targeting your audience, most ad platforms try to make it easier for you. The thought process is usually something along the lines of, the more detailed you are in your targeting, the more likely that your ads, messages, video, etc., will be shown to the right people – or at least for the most part.

A massive amount of data is now available on every potential car buyer, with a multitude of ways to use it. And, when it comes to targeting your audience, most ad platforms try to make it easier for you. The thought process is usually something along the lines of, the more detailed you are in your targeting, the more likely that your ads, messages, video, etc., will be shown to the right people – or at least for the most part.

But what about what you don’t know?

I recently read an interesting article on Business2Community which had me thinking about this very point. According to the article, there are four types of data: Facts we know, information we don’t have but know how to find, gut feeling, and things we don’t know we don’t know.

I love the last one because it makes sense and made me start to wonder how exactly DO we get information that we aren’t even looking for? Maybe we simply don’t know to look for it because nobody ever has. Perhaps we don’t look for it because, on the surface, it appears irrelevant. The trick, however, is this: all your competitors are attempting to target people utilizing the first two types of data – things we know (demographics, location, etc.) and information we don’t have but know how to find (such as targeting through AdWords, Facebook, etc.)

If everyone else is doing the same thing, targeting in similar ways and then sitting back in their chairs high-fiving themselves, what does that mean for the customer? It means that, while everyone is congratulating themselves about how great their marketing is, the customer is bombarded with noise from all these sources. While the intent of these sources may be to be relevant, when bombarded and over-saturated with messages, the customer reacts to everyone’s message as if it is irrelevant and just more noise.

Think about it, what would happen if you visited a website and each ad was for the same product or service, the only difference being that each ad was from different companies? You’d quickly ignore them all. Even if they’re relevant.

Perhaps then, a better strategy would be to stop focusing on the data that everyone else has and try to find insights using the two other types of data: gut feeling and things we don’t know we don’t know. According to the article, this can help you discover things about your audience that your competitor doesn’t know. Then you gain an advantage both in ad delivery and marketing spend. Why? Because if you use your gut or dig deep through your data to find trends and commonalities that you aren’t used to looking for, you’d be able to bid less for display and paid search, simply because there will be less people bidding against you.

So how do you find these insights? Using data, you probably aren’t tracking right now. For example, let’s simplify it to data gathered from a website. The article suggests utilizing tools such as heat-mapping and text tracking widgets to really understand that the customer visited this or that page on your website and what they actually looked at, read or engaged with. Having this information can provide valuable insight and the opportunity to learn things about your customers that you never did before.

Start thinking outside-the-box and analyze data you may never have deemed important before. You could find yourself with a competitive marketing advantage and, at the end of the day, have more money left in the bank.

No Comments

Clarivoy

Are Autonomous Vehicles the Future of Automotive Marketing?

If you backtrack through the history of advertising and marketing, you’ll find it’s always been about pushing the message to the consumer. In the old days radio and television were the dominant media and consumers had little choice but to watch and listen.

If you backtrack through the history of advertising and marketing, you’ll find it’s always been about pushing the message to the consumer. In the old days radio and television were the dominant media and consumers had little choice but to watch and listen.

Then, as increasing numbers commuted to work, marketers took their messages to the roads in the form of billboards. Fast forward, and, as consumers ventured online, banner ads and popups vied for their attention; and as video game popularity increased, advertisers started putting ads inside the games themselves.

But then consumers rebelled.

Along came the DVR which has invaded just about every household, allowing consumers to skip commercials altogether. At first there was massive pushback against this by television stations and advertisers. In fact, the first DVRs didn’t allow you to skip commercials.

As technology continues its forward march, consumers can now stream music or listen to ad-free satellite radio. They have their iPods in the car, or Apple CarPlay playing their music, avoiding radio ads.

In addition, ad blockers prevent websites from serving ads. And, due to new technology, those same ads have largely become invisible for many consumers. The question is, where will consumer’s eyeballs be next, and how can advertisers take advantage of it?

Well, automaker Renault seems to think the future of marketing is with the captive audience in autonomous vehicles. According to an article on Bloomberg.com, Renault just purchased 40 percent of the Challenges magazine group, publisher of a weekly economic magazine and four monthly science and history journals.

It looks like Renault believes future revenue will come from this deal because, as stated by Renault in the article, “users will have more time to spend on other activities while in the car.” And that means there will be more opportunities for marketers to once again push messages to consumers who, in a very real sense, will be a captive audience. When the vehicle is driving, it’s not like the consumer can jump out. And, since they don’t control the vehicle, who’s to say what functionality will be available.

It’s not inconceivable that consumers could watch movies, television, or play video games while traveling. Some vehicles already have this technology, although the driver isn’t participating -- or at least shouldn’t be.

What future possibilities will exist for manufacturers, advertisers and marketers to find even more creative ways to deliver marketing messages to consumers?

By current estimates, a society with 100% autonomous vehicles is decades away. While many challenges exist in implementing this transformation, the one thing that’s certain is that people sitting in a vehicle that does everything for them are going to get bored and will search for ways to entertain themselves. This, in turn, provides new opportunities for marketers.

It’s hard to believe that people will be able to turn the car off to avoid marketing -- and almost a certainty that autonomous vehicles won’t even belong to the passenger.

Could Renault be onto something here? Will they show the automotive world exactly where the future monetization of the automotive industry lies -- in a world of autonomous vehicles?

No Comments

Clarivoy

Are Dealers Really Ready for Multi-Touch Attribution?

By Steve White

First, let me be clear in saying that Multi-Touch Sales Attribution is still the Holy Grail of marketing measurement for auto dealers. But for many dealers, no matter how attractive the benefits of Multi-Touch Attribution might be, using it might be like using a nail gun to hang a picture. Overkill.

First, let me be clear in saying that Multi-Touch Sales Attribution is still the Holy Grail of marketing measurement for auto dealers. But for many dealers, no matter how attractive the benefits of Multi-Touch Attribution might be, using it might be like using a nail gun to hang a picture. Overkill.

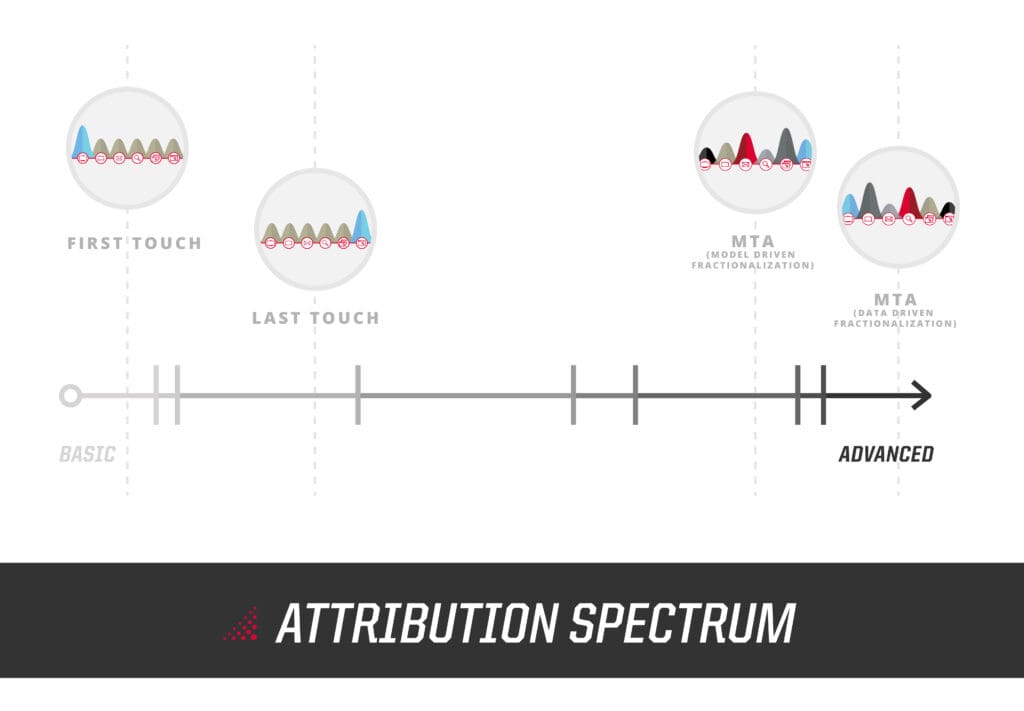

If you think about it on a spectrum, you’ve got last-click or first click on one end as the most basic type of attribution, and data-driven multi-touch attribution that fractionalizes credit across all of the touchpoints contributing to a sale on the other. While most dealer’s analytics efforts fall at the beginning of the spectrum with last and first-click attribution, they are beginning to recognize the value of multi-touch attribution at the other end.

Based on my conversations with hundreds of dealers, I’d say that only about 20% of them have the budget, resources, and sophistication to really make good use of Multi-Touch Sales Attribution. The remaining 80% just want someone to tell them what channels are contributing to sales, especially in an environment where their leads are declining. Dealers, for the most part, don’t care about how credit is fractionalized across channels. Because, at the end of the day, they don’t have the resources or time to use that information. They just want to know “Is Vendor X contributing to our sales?”

So, as an industry, maybe we should stop (at least for now) pushing the idea that every dealer should adopt what we feel is the Holy Grail (data-driven Multi-Touch Sales Attribution), and instead give them something that’s useable in the here and now. A tool that simply tells dealers if a vendor has contributed to a sale.

I’m calling this new attribution model “Any Click.” It allows dealers to see all of the clicks and ad exposures that influenced a sale without the complexity of fractionalizing credit across influencing touchpoints - even if that customer never submitted a lead (something we call “Anonymous Attribution”). The fractionalization of credit is typically theoretical anyway, unless a data-driven approach is used. And believe me - if you want to see someone’s eyes glaze over - start discussing the intricacies behind the creation and use of data-driven attribution models.

It’s my belief that once dealers start seeing which vendors are contributing to sales, they will then want to know “how much.” And that will lead them straight to Multi-Touch Sales Attribution - at a time that’s right for them!

I’d really like to hear what you think! Email me with your thoughts at steve@clarivoy.com.

No Comments

Clarivoy

The Data Doesn't Lie: Shocking Discoveries In Automotive Attribution

Written by Steve White and David Metter

Written by Steve White and David Metter

One of the hottest topics for dealers today is attribution – and it’s been a long time coming! Technology now exists which finally allows dealers to get a true picture of how their marketing influences consumers along their car buying journey. For eons dealers have been forced to rely on last-click attribution, simply because that’s all they had.

It is very easy to see a lead pop into the CRM and trace it to a sale. However, dealers doing this are missing the other marketing efforts which contributed to that conversion. And that data is important to know.

While AutoHook and Clarivoy solve attribution problems from two different perspectives, we are in complete agreement that the dealer’s perspective is what matters most. Dealers are not, nor should they ever be expected to be data analysts or mathematicians. It should never be a dealer’s responsibility to scrutinize the 20 different vendor reports received in a typical month and find trends that point to sales and marketing success or failure. Nor should it be the dealer’s job to assign fractionalized credit to the multiple touchpoints that led to a sale.

Too often, dealerships are debilitated by the excessive amount of vendor reports that flood their inbox every month. What good is all that data if you can’t understand it and basically need an instruction manual to sift through and try to pinpoint exactly what’s working and what’s not?

If you use outdated attribution models, you’re essentially making marketing decisions based on 10% of what is happening. Did you know that only 10% of consumers self-identify? Therefore, decisions are made without knowing what most consumers are doing, and/or which marketing efforts are influencing them. That is a HUGE marketing blind spot that leads to tens of thousands of dollars wasted on sources that don’t convert.

Wouldn’t it be refreshing if you could simply get a clear view of your sales and defection trends, all in one place? Or quickly identify deficiencies in both your internal and external processes so that you can more efficiently assign responsibilities to your staff? And, what if you could get more ROI out of your third-party lead or traffic drivers?

Most dealers have been lacking a complete, 360° view of their sales operations, along with a view of any sales lost to their biggest competitors. How can you improve the way you sell cars if you are unaware of the leads in your CRM that have already purchased elsewhere? There is a reason for every lost sale, and that reason is exactly what you should use to act and reclaim lost opportunities.

Without accurate data, you cannot make marketing decisions which can be relied upon. You need data you can trust to provide the correct insights into the buying habits of your consumers and the performance of your marketing partners.

Technology has brought us more current attribution models which show the big picture of your marketing performance. It can enlighten you and help make decisions that improve performance and stimulate sales without necessarily having to increase budgets. You can define the sources responsible for your greatest opportunities and losses, down to an individual salesperson, lead traffic source, competing brand or dealer, and more.

Make the decision to take control of your marketing by leveraging technology. Stop trying to make sense of 20 different vendor reports with 20 different attribution models. By adopting more current attribution models, you’ll be able to spend less time guessing and more time knowing. And that’s most of the battle.

No Comments

Clarivoy

Clarivoy Launches Measurement NetworkTM for Marketing Vendors; Partners with Dealer Inspire

80% of a Dealership’s Sales cannot be linked back to a Lead

80% of a Dealership’s Sales cannot be linked back to a Lead

New Tools for Marketing Vendors Solve this Problem

Columbus, OH, October 17, 2017-- Clarivoy, the auto industry’s most trusted source of truth for optimizing the performance of marketing campaigns, today announced the launch of its Measurement NetworkTM. Designed specifically for marketing vendors to help them “prove their results,” vendors who join Clarivoy’s Measurement Network can now demonstrate to their clients a commitment to supplying accurate, unbiased attribution results, independently verified by the auto industry’s leading marketing attribution provider. Clarivoy provides these results to Network members by utilizing its Anonymous Attribution customer identification tools and unbiased Multi-Touch Attribution algorithms, delivered through API’s that integrate data directly into vendor dashboards.

As the automotive industry’s recognized leader at helping auto dealers “discover what works,” Clarivoy is now helping marketing vendors “prove what works” to their customers. Dealer Inspire, an award-winning website developer, digital marketing strategy and implementation company that creates sustainable platforms to enhance and promote the sales process and customer experience, is the first marketing vendor to join Clarivoy’s Measurement Network and integrate Clarivoy’s Attribution APITM solution. Their dealers now have ROI insight for sales from verified website leads, as well as the missing piece: anonymous online shoppers.

“This is truly an exciting announcement as two of the industry's most progressive analytics companies have created a partnership to push the envelope even further,” said Dealer Inspire CEO, Joe Chura. “We built Roxanne℠, our proprietary, patent-pending event tracking technology, to bring dealers true ROI for their website and marketing efforts. Partnering with Clarivoy takes that insight to the next level by connecting sales to anonymous shoppers. Filling in these gaps from customers who didn’t submit a website lead will give our dealer partners unprecedented visibility into how their digital marketing is generating sales,” Chura continued.

According to Google, only 20% of a dealership’s sales can be linked back to a lead. But what happens to the other 80%? Auto dealers utilizing ‘Roxanne’ to attribute sales back to leads on a website now have Clarivoy’s attribution technology which provides visibility into the 80% of customers who chose to remain anonymous online.

“As form submissions become increasingly rare, ‘walk-in’ traffic has mysteriously increased because so many customers choose to shop anonymously and withhold their information. Up until now, dealers lacked visibility into these anonymous shoppers,” said Clarivoy CEO Steve White. “Clarivoy solves this problem by tagging a vendor’s website, ingesting their sales data and ‘converting cookies into customers.’ Once we are 100 percent sure we have a match, the data is rolled up and displayed in the vendor’s dashboard,” White added.

Dealer Inspire is looking for a limited number of innovative dealers to pilot this new capability. Go to http://clarivoy.com/dealerinspire to sign-up.

Marketing Vendors interested in joining Clarivoy’s Measurement Network should contact Ben Hadley, VP of Strategy at ben@clarivoy.com.

# # # # #

About Dealer Inspire

Dealer Inspire is an innovative and award-winning website development SAAS company specializing in the automotive retail industry. Founded in 2012, Dealer Inspire is focused on creating more than websites, but rather sustainable platforms to enhance and promote the sales process and customer experience. The Dealer Inspire products are comprised of a next gen website platform, AI powered messaging/chat software, digital retailing and dynamic advertising software.

Dealer Inspire has been selected as the certified website and digital advertising provider for their retailers by 17 of the world's leading automotive brands and works with thousands of clients across U.S., Canada and Mexico.

Clarivoy is the auto industry’s most trusted source of truth for optimizing the performance of marketing campaigns. Their Multi-Touch Attribution solutions reveal more about their clients’ customers, their advertising and their path to success so they can drive more sales. The company’s proprietary TV Analytics solution was named the winner of the 2016 DrivingSales Innovation Cup Award for the Most Innovative Dealership Solution of 2016. Clarivoy’s proprietary technology grants marketers incomparable visibility into their customers and campaigns – across all channels, all devices – online and offline. Armed with this new information, marketers can stop guessing and start knowing what is working and what is not. http://www.clarivoy.com.

No Comments

Clarivoy

Traffic Attribution vs Sales Attribution: What’s the Holy Grail of Marketing Measurement?

Part 2: Sales Attribution

In part 1 of this series, I discussed Web Traffic Attribution, how that works and why most dealers are using it as their primary measurement tool when making marketing spend decisions. While web traffic is certainly important, the ultimate reason the measurement of web traffic is so prevalent is because it’s what is available and what most vendors provide in their monthly reports to dealers. Stands to reason that, as a dealer, you would want to compare apples to apples.

In part 1 of this series, I discussed Web Traffic Attribution, how that works and why most dealers are using it as their primary measurement tool when making marketing spend decisions. While web traffic is certainly important, the ultimate reason the measurement of web traffic is so prevalent is because it’s what is available and what most vendors provide in their monthly reports to dealers. Stands to reason that, as a dealer, you would want to compare apples to apples.

But relying on Web Traffic as your main KPI can lead to some incorrect decisions because it only tells you what channels were most effective at driving traffic to your website - but not sales in your dealership. This is where Sales Attribution comes in. Sales Attribution helps vendors correctly attribute sales and thus provide dealers with data they can trust. So, what exactly can Sales Attribution tell you?

In a nutshell, Sales Attribution can show you which vendors are actually converting into sales. Ultimately, that’s what any dealer and vendor wants to know. Sales Attribution can take your sales data, combine it with your web traffic data and, using a Multi-Touch Attribution model, show you how productive a given vendor is, with data you can TRUST.

A great example of this is a General Manager we recently worked with who had a suspicion that his email vendor was not as effective in driving sales as reported. The vendor’s report was all traffic-based and neither the vendor, nor the dealer, had any way to match that traffic to sales. The conquest email campaign was run via the vendor’s proprietary list, so it was very difficult for the dealer to measure, since he had no access to whom those emails were sent.

We helped the dealer apply Sales Attribution tracking to determine how many of the customers that clicked on the vendor’s emails actually made a purchase. Using Multi-Touch Attribution the dealer was able to see how many customers actually had email clicks in their purchase path -- and there were many. The GM learned his suspicion was unfounded and that the email vendor was not only driving a lot of traffic, but that traffic was also converting.

The results won’t always be this rosy. However, with the right attribution infrastructure in place, both dealers and vendors can better see and trust their results.

I am sure there have been many times when you had to scratch your head and had no clue what data to trust when it comes to other forms of attribution. Consider those vendors who use last-click attribution and take all the credit for a sale. It’s a well-known fact that consumers simply don’t take just one action in their purchase journey. It would be silly to think that the only thing a consumer did was go straight to your pop-up and convert.

In summary, while Traffic Attribution is easier to measure than Sales Attribution, I like to refer to Sales Attribution as the Holy Grail because it ultimately allows you to identify which of your vendor marketing investments are actually leading to sales, not just driving traffic.

The fact is, a combination of both is what works. Web Traffic Attribution and Sales Attribution can provide you with more accurate data, enabling you to make more informed marketing investment decisions while holding your vendors accountable. This will lead to an increase in ROI simply because you no longer have to guess or rely on inaccurate or erroneous data. You can then reallocate money to those channels or vendors that are producing, and eliminate those that aren’t.

Stop guessing and start knowing. Take full advantage of Web Traffic and Sales Traffic Attribution tools that exist and start maximizing your marketing investments.

Don’t you want to know for sure what’s working and what isn’t?

No Comments

Clarivoy

Traffic Attribution vs. Sales Attribution: What’s the Holy Grail of Marketing Measurement?

Part 1 of a 2-part blog discussing the value and pros and cons of Traffic vs. Sales Attribution

Historically, there have been few ways for dealers to accurately measure if their marketing spend is providing ROI – and really, truly trust the data. Traffic Attribution has been, and remains, the primary KPI dealers use to measure the success of their marketing campaigns; and Google Analytics the primary tool.

Historically, there have been few ways for dealers to accurately measure if their marketing spend is providing ROI – and really, truly trust the data. Traffic Attribution has been, and remains, the primary KPI dealers use to measure the success of their marketing campaigns; and Google Analytics the primary tool.

Relying on traffic as your primary measurement is troublesome if you use the results to help reallocate your marketing spend. If Google Analytics tells you that your display ads drive the most traffic at the lowest cost, while your Third Party Vendor drives the least - it stands to reason that you’d use this data from GA and spend more of your marketing budget on display ads and less with your Third Party Vendors.

Web traffic alone only shows data indicating how many people visit the dealer’s website. What about accurately tracking all the referral sources for sales? It’s what web traffic doesn’t show that is most important, and that is missing if you use this as your primary KPI.

Luckily, Sales Attribution techniques are becoming more common in the automotive industry and we’re seeing more dealers adopting new measurement approaches. In my next blog I’ll outline some of the surprising results dealers are seeing using Sales vs. Traffic Attribution. But in this blog I’d like to focus on Traffic Attribution because, while Sales Attribution is the Holy Grail, you can still extract valuable information from free out-of-the box web traffic measurement tools like Google Analytics.

Let’s face it, Google, in itself, is a vendor in our industry. And, while claiming to be unbiased, its long-time attribution model is flawed. Not only is it flawed, but most dealers have it set up poorly, so have trouble getting accurate data.

We recently conducted some in-depth research with a number of dealerships who rely on Google Analytics for web traffic measurement and found that many have it set up incorrectly. This makes it almost impossible to understand what’s going on, even from a last-click perspective -- let alone a multi-channel approach!

Even those a little more technologically-inclined were forced to spend way too much time manually adding data to spreadsheets, attempting to decipher what’s working, and what is not.

We were also shocked to discover that many dealers didn’t have the proper goals set up in their accounts. This is extremely important as the data will be flawed and inaccurate if Google Analytics is not set up properly. In fact, you will not be able to gain any valuable information.

Before all the data in Google Analytics makes any real sense, no matter which attribution model, vendor, or method your dealership uses to calculate results, you need to ensure you properly set up a complete set of goals in Google Analytics itself. What I suggest as a minimum is as follows

- New SRP Views

- New VDP Views

- Used SRP Views

- Used VDP Views

- Certified SRP Views

- Certified VDP Views

- Finance Form Submissions

- Lead Form Submissions

- Service Form Submissions

- Trade-In Form Submissions

- Print Coupons

- Visits to Hours and Directions Page

- Views of Dealership Review Page

In studying several dealers, when they correctly organized the data in Google Analytics, ensuring that each traffic source was assigned to the appropriate channel, while also assigning referral sources that were falling through the cracks (such as third-party ads), the data provide information that was much more valid. These dealers could finally trust this data to make better informed decisions.

Relying solely on Google Analytics out of the box set up has some other pitfalls, including the fact that it does not allow you to see performance between brand and non-brand search and display. If you cannot break this out, you can only view the performance of paid search and display as a group. In addition, you cannot break out Tier 1 and Tier 2 marketing campaigns, or your own email campaigns. The inability to see granular level results such as these (and more), can easily lead to poor marketing decisions.

In part two of this blog series, I will discuss the holy grail of attribution – Sales Attribution. I’ll explain the different types and why it’s so difficult to measure. So, stay tuned for more……….

1 Comment

DrivingSales, LLC

Wow. This is chock-full of good information. Thanks for posting this, Steve. Attribution is huge, and it's so important not to rely solely on one method or source.

Clarivoy

Attribution: Do Auto Dealers Really Know What’s Happening?

Things have changed considerably with the state of marketing measurement and we wanted to know how dealers are adapting to new measurement tools like Multi-Touch Attribution. So, in April 2017, we decided to ask and surveyed approximately 120 dealers for our State of Automotive Attribution study.

know how dealers are adapting to new measurement tools like Multi-Touch Attribution. So, in April 2017, we decided to ask and surveyed approximately 120 dealers for our State of Automotive Attribution study.

In general, the survey found most dealers feel accurate measurement of their marketing campaigns is important. Most rely on in-house reporting (68%) and/or vendor reporting (64%). However, a key point in this survey is that only 30 percent of dealers report being satisfied with how they currently measure their data.

Out of the many reports dealers use, each puts emphasis on different metrics and different attribution models. This leads to a confusing mess of data forcing dealers to, in a way, compare apples to oranges.

In response to the question, “Which vendor categories need the most blind faith as to if they are working?” 40 percent of dealers stated display ads, followed by third-party listing sites at 38 percent.

The display ad answer is a little curious as, set up properly, they should be easy to measure. However, the third-party listing site answer is not that surprising. The actions a consumer takes following a visit to a third-party listing site and viewing a vehicle of interest can vary over an entire spectrum of possibilities: they could submit a lead on the third-party listing site; call a phone number; bounce to the dealership’s website and convert there; call the dealership; or simply show up. The effectiveness of a third-party listing site can be far from black and white in terms of measurement. And, more often than not, attribution depends on proper sourcing by the salesperson or last-click attribution models – both of which have huge gaps in accuracy.

As far as what dealers want from an attribution tool, 46 percent would like a multi-touch attribution solution. They believe last-click is unreliable for reporting accurate sources and what really influenced the sale.

When asked what their ideal attribution solution should include, 59 percent stated the ROI contribution of each marketing channel, 57 percent replied that they want analytics that deliver actionable insights; 48 percent want a transparent view of a customer’s full purchase path and 41 percent desire reporting accountability and accuracy.

When asked, “How knowledgeable are you about marketing attribution?” 30 percent think attribution and analytics are important, but don’t know where to begin, and 20 percent do not know anything about marketing attribution.

Overall, 68 percent of dealers aren’t effectively using, or are failing to use any type of marketing attribution to measure the results of their advertising. This is a glaring hole and effectively makes measuring marketing efforts and spending a guessing game.

First and last-click attribution is the most commonly used attribution model, used by a full 77 percent of respondents. This is largely due to the fact that these attribution models are used by most vendors, as well as Google Analytics. While widely used, these models give poor results and a skewed picture of what sources truly influence customers in their decision to buy at the dealership.

If dealers can’t – or aren’t – getting the data they need to make intelligent decisions, what are their biggest challenges? According to the survey, 57 percent replied proving ROI for marketing spend, followed by targeting marketing to the best audience, at 41 percent, and evaluating vendor performance, at 35 percent. These challenges, of course, lead full circle back to the same question asked since dealerships first came into existence “Did it sell cars and, if so, how many?”

The survey results show that dealers certainly know the importance of attribution. Vendors increasingly recognize that dealers need and want this data. So, slowly but surely, the back end of marketing is becoming more transparent as vendors are more open to new attribution models and are starting to integrate with attribution solutions. This is a great trend that will see dealers and vendors creating stronger partnerships while bringing confidence and true accountability to both.

These pain points for dealer marketing and decision-making prove that better and more accurate reporting and attribution models are necessary for dealers to maximize their marketing dollars and feel confident that they are not wasting money.

Knowing which sources lead the customer down the road to your dealership, and which are simply a waste of money, can empower you when making your marketing decisions. You no longer have to rely upon skewed metrics, follow different attribution models and then attempt to make sense of it all.

To download a copy of the State of Automotive Attribution study visit:http://content.clarivoy.com/auto-attribution-study.

No Comments

Clarivoy

Clarivoy Releases Results of Attribution Study

Clarivoy’s 2017 Attribution Study Reveals What’s Really Going On With Auto Industry Marketing Measurement

Clarivoy’s 2017 Attribution Study Reveals What’s Really Going On With Auto Industry Marketing Measurement

Columbus, OH, August 2, 2017 -- Clarivoy, the auto industry’s most trusted source of truth for optimizing the performance of marketing campaigns, today announced the results of an industry-wide study to better understand the current state and usage of marketing measurement in the retail automotive industry.

“Things have changed considerably with the state of marketing measurement and we wanted to know how dealers are adapting to new measurement tools like Multi-Touch Attribution. So, in April 2017, we decided to ask and surveyed approximately 120 dealers for our State of Automotive Attribution study,” said Steve White, Clarivoy CEO.

In general, the survey found most dealers feel accurate measurement of their marketing campaigns is important. Most rely on in-house reporting (68%) and/or vendor reporting (64%). However, a key point in this survey is that only 30 percent of dealers report being satisfied with how they currently measure their data.

“Out of the many reports dealers use, each puts emphasis on different metrics and different attribution models. This leads to a confusing mess of data forcing dealers to, in a way, compare apples to oranges,” said White.

In response to the question, “Which vendor categories need the most blind faith as to if they are working?” 40 percent of dealers stated display ads, followed by third-party listing sites at 38 percent.

“The display ad answer is a little curious as, set up properly, they should be easy to measure,” said White. “However, the third-party listing site answer is not that surprising. The actions a consumer takes following a visit to a third-party listing site and viewing a vehicle of interest can vary over an entire spectrum of possibilities: they could submit a lead on the third-party listing site; call a phone number; bounce to the dealership’s website and convert there; call the dealership; or simply show up. The effectiveness of a third-party listing site can be far from black and white in terms of measurement. And, more often than not, attribution depends on proper sourcing by the salesperson or last-click attribution models – both of which have huge gaps in accuracy,” White explained.

As far as what dealers want from an attribution tool, 46 percent would like a multi-touch attribution solution. They believe last-click is unreliable for reporting accurate sources and what really influenced the sale.

When asked what their ideal attribution solution should include, 59 percent stated the ROI contribution of each marketing channel, 57 percent replied that they want analytics that deliver actionable insights; 48 percent want a transparent view of a customer’s full purchase path and 41 percent desire reporting accountability and accuracy.

In response to the question, “How knowledgeable are you about marketing attribution?” 30 percent think attribution and analytics are important, but don’t know where to begin, and 20 percent do not know anything about marketing attribution.

Overall, 68 percent of dealers aren’t effectively using, or are failing to use any type of marketing attribution to measure the results of their advertising. “This is a glaring hole and effectively makes measuring marketing efforts and spending a guessing game,” said White.

First and last-click attribution is the most commonly used attribution model, used by a full 77 percent of respondents. This is largely due to the fact that these attribution models are used by most vendors, as well as Google Analytics. However, according to White, while widely used, these models give poor results and a skewed picture of what sources truly influence customers in their decision to buy at the dealership.

If dealers can’t – or aren’t – getting the data they need to make intelligent decisions, what are their biggest challenges? According to the survey, 57 percent replied proving ROI for marketing spend, followed by targeting marketing to the best audience, at 41 percent, and evaluating vendor performance, at 35 percent.

“These challenges, of course, lead full circle back to the same question asked since dealerships first came into existence ‘Did it sell cars and, if so, how many?’” said White. “The survey results show that dealers certainly know the importance of attribution. Vendors increasingly recognize that dealers need and want this data. So, slowly but surely, the back end of marketing is becoming more transparent as vendors are more open to new attribution models and are starting to integrate with attribution solutions. This is a great trend that will see dealers and vendors creating stronger partnerships while bringing confidence and true accountability to both,” White continued.

For more information visit: http://www.clarivoy.com, or to view study results click here.

# # # # #

Clarivoy is the auto industry’s most trusted source of truth for optimizing the performance of marketing campaigns. Their Multi-Touch Attribution solutions reveal more about their clients’ customers, their advertising and their path to success so they can drive more sales. The company’s proprietary TV Analytics solution was named the winner of the 2016 DrivingSales Innovation Cup Award for the Most Innovative Dealership Solution of 2016. Clarivoy’s proprietary technology grants marketers incomparable visibility into their customers and campaigns – across all channels, all devices – online and offline. Armed with this new information, marketers can stop guessing and start knowing what is working and what is not. http://www.clarivoy.com.

No Comments

No Comments