VinWhiz, LLC

Build It Right From The Start

Build It Right From The Start

Automotive digital transacting has exploded over the last year. April 2021 sales doubled over April 2020 and we are forecasting an estimated 17.1 SAAR! Research shows over 70% of buyers would prefer to do their shopping, credit application, purchase configuration and negotiations online saving the final paperwork for digital, in store or at home completion. Anything that was guarded by proprietary technology has been shredded for the good of transparency in this new paradigm.

Vehicle content comparison, pricing, payments, financing, and aftermarket purchases have transitioned the sales process online supported by many of the digital retailing applications and tools. This has created a strong need for accurate vehicle build data, rates, rebates, and the ability to define a vehicle with the specific VIN options, packages and incentives. Getting these pieces right with build data is required content across advertising Tiers I – III by OEM’s, dealers, integrators, and software/technology providers.

The most challenging areas are vehicle specific option and equipment packages describing a VIN or unique attributes of a vehicle. Some full-size pickups having close to 3 million unique ways a model can be built, and it is critical to know the exact content of the vehicle for matching incentives 1:1 with the vehicle option/package codes leading to correctly pricing the vehicle for the type of transaction (cash, finance or lease). Also include distributor options and VIN Specific offers which require assignment to the VIN after delivery from the manufacturer and as part of the accessorizing or incentivizing of slow selling inventory.

Solving the “last 6 mystery” continues to be an online stumbling block for much of the industry. This has been an issue within the industry for many years, however, we are seeing the gap in accuracy close significantly with the harvesting and validation of build data through syndicated listings, OEM MSRP specs, or a combination of all of these data sources. This is clearly an advantage for advertisers, software providers and consumers.

Consider the importance of using this information to correctly advertise pricing, payments, and incentives for an industry spending over $50 billion dollars on customer discounts annually. The importance of getting the pricing and payments right, the incentives assigned correctly at the VIN level supports cost reductions in BILLIONS of dollars. OEMs, captive finance companies and auto lenders must get this right for consumer lending regulations and supporting a smooth transition from online transacting to contracting payments based on the tier, term, lender, consumer demographics, incentives, location and tax, title, and license fees.

Based on the type of transaction and term of the financing, we have seen differences in payments of hundreds of dollars for the same vehicle on multiple websites. You can see the lost credibility, advertising costs and sales when the consumer realizes their payment is increasing by that amount once they decide on the vehicle they are ready to purchase.

Additionally, extended warranties, insurance (and insurance replacement costs) carriers are all dependent on getting accurate build data for correct menu pricing online. Using these attributes also supports requirements for meeting compliance and disclosing a fundable offer to the consumer.

Consider the importance of using build data and incentives correctly across all advertising, pricing and payment publishing compared with the wasted spend of not including this level of detail. These vehicle attributes are available and are a requirement for correctly transacting online and in store.

Automotive retailing has advanced quantum leaps over the last 12 months. The industry is facing lean inventory and profitability on every sale is vital for the industry. Advertising a vehicle correctly with these attributes is the most cost-efficient method of maximizing multi-channel publishing, digital commerce tools and consumer search using content description tools like photos, CGI, videos, and vehicle side-by-side comparisons. Consumers have expectations that the correct description, price and payments are being advertised and technology allows this to happen today.

Get it right by using build data and incentives and realize advantages through technology partners, integrators, advertisers, and dealers. The risk and rewards are higher than ever for using build data and incentives to power pricing and payments correctly across all marketing, advertising, and sales channels.

Brad Korner is a co-founder of VinWhiz and managing partner of New Plateau Enterprises. VinWhiz is a middleware service which optimizes vehicle descriptions and incentives matching supporting ecommerce and digital retailing. New Plateau Enterprises consults with data and software companies for improving the use of vehicle data across multiple digital and conventional applications.

VinWhiz, LLC

The New Incentives Playbook - 2020-04-24

As COVID-19 restrictions continue, automotive retailing is experiencing guarded consumer activity that has manifested itself in avoiding dealerships – whether shopping, taking test drives or processing paperwork on site. During the last six weeks, automakers and their dealer networks have moved aggressively to shift from incentives that promote option/trim convenience packages (the vehicle) to incentives that help the in-market shoppers feel more confident physically and economically. It’s been some time since the auto world has been this dependent on needs-based incentives as opposed to incentives that play to consumers’ wants and emotional desires.

While auto manufacturers and dealers are struggling with their cost viability, they are also simultaneously working together to create market demand with a series of financial offers, digital retailing upgrades and remote delivery incentives. These incentives are helping to keep a fragile industry afloat by enabling consumers who are concerned about the purchase process to feel more confident about shopping, buying and taking delivery of new, CPO and used vehicles through the dealer network.

Here is a quick assessment of the three key incentives strategies and how well the industry is implementing them.

1. Shopping Incentives

Most OEMs, dealers and even individual shopping portals are promoting online shopping tools (e.g., FCA’s newly-improved Online Retail Experience; GM’s Shop-Click-Drive; Accelerate My Deal by Autotrader) to help consumers better understand exact pricing and payment ranges online earlier in the process, as vehicle price and monthly payment details have become far more important as the economy slows.

Consumers are now able to better evaluate monthly budget requirements prior to engaging further down the purchase funnel. Likewise, dealers have implemented multiple price and payment tools which help consumers view, engage and structure transactions without having to visit the dealership. These initiatives, when done correctly, have the benefit of consistent pricing across all advertised platforms.

Currently the biggest unknown in any deal is used-vehicle values – the trade-in. Recent drops in wholesale values have made the process difficult and getting a true assessment of the quality of a trade-in is challenging online. Buyers with lease terminations and agreed on residual values will have the least amount of ambiguity throughout the process. Tools such as Kelley Blue Book Instant Cash Offer (ICO) can help, but still rely partly on owner assessment of the vehicle and can change the deal late in the process.

Assessment – MAKING PROGRESS. According to recent data from Cox Automotive shopping sites, including Autotrader.com and KBB.com, website visits were up 14% and vehicle description page views were up 17% over the same period last year. The improvements being made in digital retailing may be helping keep consumers engaged, but there are still opportunities to streamline the process.

2. Transaction Incentives

We are all in the same position of not wanting to overextend ourselves with the uncertainty of potential furloughs, layoffs and other employment cutbacks. OEMs and their dealers are addressing affordability concerns (0% up to 84 months) across their entire fleets in many instances, possible work interruptions (payment deferrals and payment forgiveness) and providing the ability to shop, evaluate and transact with financing options using captive and third-party lenders (banks & credit unions) from a mobile device or computer.

These are important steps to support transparent shopping and consumer benefits like introducing finance and insurance products online for the buyers to research as part of their purchase.

Assessment – WORKING. Data suggests that the many 0% offers are driving traffic and helping close sales. The percent of vehicles purchased with 0% financing has increased from 2.6% in January to nearly 20% in April, according to the Cox Automotive Industry Insights team. At least for consumers who are ready to buy now, 0% financing is an incentive that seems to be working. And our recent research indicates that 69% of consumers would be likely to purchase a vehicle sooner than planned for the right deal or incentive.

3. Delivery Incentives

Automakers, dealers and marketplace portals, such as Autotrader.com, KBB.com and Dealer.com, are offering a number of new services that help bring dealership capability directly to the customer, following safe, social-distant guidelines – home test drives, sales delivery, consumer workflows leading to electronic signatures where available, as well as service pickup and delivery.

These fresh initiatives that help facilitate sales in a time of social distancing are reaching new levels of digital shopping and transaction creativity, which began nearly a decade ago and will likely become mainstream offerings in the months ahead.

Assessment – IMPROVING. Carvana and Vroom were big first-movers in the home delivery business model, which is now being adopted by many dealers. Dealertrack Digital Contracting is up 65% over the same time last year. Dealer Home Services by Autotrader has been adopted by more than 10,000 dealers. Since this is a new way of operating for many dealers, more work needs to be done.

While our current bear market incentives are different from the OEM/dealer incentives offered earlier this year, we’re seeing consumers react positively to the new collection of financial incentives, digital retailing tools for shopping/purchasing, and new options for vehicle delivery. All these incentives can help stimulate confidence in the vehicle buying process right now, and some of them are also much-needed improvements that are long overdue for the automotive retail industry.

No Comments

VinWhiz, LLC

March Madness Shifts the Landscape for Vehicle Incentive Strategies

March madness typically springs buyers back into the market as many consumers benefit from the extra cash of a tax return. This March, however, saw most shoppers sent home amid COVID-19 concerns to guard against infection, severely impacting our economy and teaching us new terms like “social distancing.”

extra cash of a tax return. This March, however, saw most shoppers sent home amid COVID-19 concerns to guard against infection, severely impacting our economy and teaching us new terms like “social distancing.”

The entire distribution chain for new and used vehicles has nearly idled, with major slowdowns from manufacturing to retail, auctions to transportation. Dealerships are under a multitude of federal, state and local restrictions which have caused confusion and have effectively ground the industry to a halt.

In mid-March, when the slowdown accelerated, most all automakers dusted off the playbook from post-September 11 and the financial crash of 2008, shifting their incentives from transactional offers (dealer and consumer cash) to offers that help address the severe drop in consumer confidence.

By mid-March, we saw a flood of offers that generally fell into three categories:

- 0% financing for 84 months

- 1st three payments paid by the captive lender

- Payment deferral and forgiveness guarantees due to employment uncertainty

These are strong value propositions for consumers who need to buy a vehicle as soon as possible, for example, when a lease is up, or there is a vehicle accident replacement. Consumers can see these many offers on shopping sites across the internet, including Cox Automotive’s Autotrader and Kelley Blue Book and on the multitude of dealer websites run by Dealer.com. Kelley Blue Book is publishing a continually-updated summary of programs from automakers and lenders.

Many consumers can apply these new incentive offers to in-stock vehicles and lock the deal online, perform a virtual 360 walk around, and in some cases, they can receive home delivery if they have concerns about visiting the dealer facility.

Similar confidence-building incentives got the U.S. auto industry rolling again in the aftermath of the September 11 tragedy. Back then, the market rebounded quickly. This time may be different, however, as the impact on the economy and the global nature of this disease is new to everyone.

We know the auto market in the U.S. is falling fast and will drop significantly from last year’s 17 million level. More importantly, though, what’s next? When will consumer confidence return?

From experience, we know our automakers and dealers will batten down the hatches and weather this storm. But the landscape will be different when it passes, with a shift toward more digital retailing, online purchasing tools, and home delivery services for new and used vehicle sales as well as service and repairs.

These are not new concepts. They are, however, quickly becoming a core function of good auto retailers. While this pandemic will pass, memories of social distancing will stay in people’s minds. In other words, the pandemic will likely drive a paradigm shift in consumer expectations and auto retailing services. OEMs and dealers will need to improve their online skills to make online retailing more efficient and seamless.

In our new world, the ability to provide an accurate, timely price to would-be buyers – quotes that accurately incorporate all relevant and current incentives – will become more important than ever.

No Comments

VinWhiz, LLC

2019 Was a Record Year for Incentives - 2020-01-10

Auto sales in 2019 came in above the magic 17-million mark, according to our team at Kelley Blue Book, but just barely. Vehicle sales of 17,042,363 kept the streak alive, but that number includes medium duty pickups and exotic cars. As our Chief Economist Jonathan Smoke notes, it was fleet sales that got us to 17 million. Fleet volume was up last year, likely at a record level, while retail sales were down, a sign that consumers are buying fewer new cars and the market is under pressure.

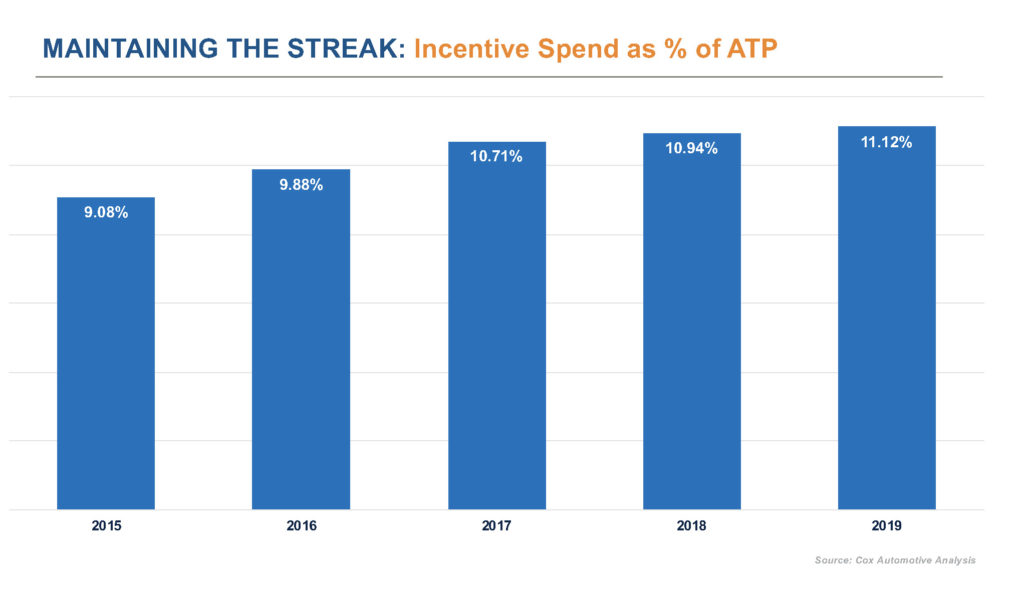

If we use incentive activity as a measure, it’s clear the automakers were working hard last year to maintain the strong sales pace and protect profit margins. Production and new vehicle launches helped make 2019 a record year for incentives, according to our team at Cox Automotive Rates & Incentives.

It is true that incentive volume tapered off in December – the low point for the year, in fact – but the volume was still enough to push 2019 to a record level as seen in the chart below. The lower volume in December was likely due to many Black Friday-type incentives introduced in November and carried over unchanged through December. GM and FCA, for example, moved to employee pricing in effect lowering the MSRP and incentives needed through much of the final two months. The record volume of incentives were applied at VIN/vehicle levels in order to target spending only on vehicles which needed discounting while protecting margins on more desirable vehicles or fresh product not needing large discounts. We know consumers had a large selection of vehicles to consider from both 2019 and 2020 model years at year’s end, with large discounts and favorable pricing and payments to help buyers stay within budget. Still, even the heavy incentives were not enough to drive strong sales numbers, which came in lower than forecast in December.

We know consumers had a large selection of vehicles to consider from both 2019 and 2020 model years at year’s end, with large discounts and favorable pricing and payments to help buyers stay within budget. Still, even the heavy incentives were not enough to drive strong sales numbers, which came in lower than forecast in December.

While incentive volume was lower in December, the value of those incentives remained high. In fact, 2019 ended at what is likely a record for incentive spending as a percentage of average transaction price (ATP). Incentive spending has been consistently climbing for the past five years, as the industry has kept alive its streak of 17 million. In fact, incentive spend in 2019 was 22% higher than it was in 2015, climbing from 9.08% of ATP to 11.12%. The year ahead won’t be any easier. With inventory levels low, we can expect incentive volume and spending to be held in check. But lower incentives could also spell a slower than normal Q1 for retail sales. Our Industry Insights team is forecasting full-year sales in 2020 to come in at 16.7 million vehicles, as measured by Kelley Blue Book.

The year ahead won’t be any easier. With inventory levels low, we can expect incentive volume and spending to be held in check. But lower incentives could also spell a slower than normal Q1 for retail sales. Our Industry Insights team is forecasting full-year sales in 2020 to come in at 16.7 million vehicles, as measured by Kelley Blue Book.

Are automakers ready to give up on the streak? Incentive activity in early 2020 will likely tell.

Brad Korner is general manager of Cox Automotive Rates & Incentives. The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 90,000 applications are relying on CAR&I data in a given month, providing valuable information to 40 million shoppers.

No Comments

VinWhiz, LLC

Labor Day Weekend is New-Vehicle Clearance Time

*This article was originally posted to the Cox Automotive newsroom. How will new-car dealers and their manufacturing partners reduce bloated inventory on dealer lots? We’ll get a hint this coming weekend, as the Labor Day holiday puts focus on the trifecta of new-vehicle incentive strategies for clearing lots of older models. Right now, dealers are juggling 2018 (reported to be 3.5% of new-vehicle sales last month), 2019 and 2020 models in inventory.

*This article was originally posted to the Cox Automotive newsroom. How will new-car dealers and their manufacturing partners reduce bloated inventory on dealer lots? We’ll get a hint this coming weekend, as the Labor Day holiday puts focus on the trifecta of new-vehicle incentive strategies for clearing lots of older models. Right now, dealers are juggling 2018 (reported to be 3.5% of new-vehicle sales last month), 2019 and 2020 models in inventory.

The U.S. economy continues to show strength, but auto sales are under pressure due to affordability issues, a general saturation point with new-vehicle sales, and an influx of off-lease, nearly-new products that are particularly attractive to price-conscious shoppers. Vehicle inventories have been rising (see more at https://www.coxautoinc.com/market-insights/inventories-rise-automakers-cut-production/) and that’s leading to new incentives to keep sales flowing.

The volume of new-vehicle incentive programs available remains at record levels due in part to how the automakers are allocating incentive spend for targeted offers on aged inventory, slow-selling product and poorly-equipped vehicles. We’re seeing more incentive offers assigned at VIN-specific levels, using “tagged cash” and “percent off,” along with more APR offers from the captive finance companies taking advantage of recent Fed interest rate reductions.

There are generally three tactics associated with the way incentives are being used to help drive inventory turns and sustain a desirable pace of new-vehicle sales.

• Tactic #1: Stimulate – These are Tier I/II-advertised specials designed to cast a broad net and engage casual shoppers. Essentially, these incentives are “advertising” incentives and traffic drivers, often 0% APR or 20% off MSRP, and are designed to spike interest in a given brand or specific vehicles that are old inventory or in low demand.

• Tactic #2: Manipulate – These incentives include many special APRs and cash offers available to make the deal even more attractive and turn active, on-the-lot shoppers into buyers. Manipulate-type incentives are often “bail out” incentives on specific, must-move vehicles, e.g. 2018 models languishing on the lots.

• Tactic #3: Motivate – The best dealers are tuned in to local market sales metrics for stocking, promoting and incentivizing high-demand, new vehicles. These smart incentives help keep the inventory moving, which is more important than ever as the math for floor plan carrying costs has changed significantly in the past few years. (See chart above from “Investment Minded New Car Inventory Management,” a Digital Dealer 27 presentation given by Brian Finkelmeyer, senior director of Conquest at vAuto. His presentation is available for download at the end of this blog.)

(Higher interest rates are directly impacting dealer profitability as aged inventory is significantly more expensive to hold. More than ever, dealers must be focused on the right incentives strategies to keep aged inventory in check.)

The long Labor Day weekend is an important milestone in any sales year. If sales are strong, we will be on course for a healthy, profitable fourth quarter. If sales come in weak, we will be watching for even more incentives and special offers to help move old inventory and make room for fresh 2020 vehicles.

Smart incentive strategies and production cuts by the automakers are helping prepare the industry for a lower SAAR, forecast by Cox Automotive to be 16.8 million in 2019, down from 17.3 million last year. Still, dealers need to maintain lean and desirable dealer inventory levels by embracing a higher discipline in new-vehicle stocking with a healthy dose of smart pricing and payment tactics.

Brad Korner is general manager of Cox Automotive Rates & Incentives. The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 87,000 applications are relying on CAR&I data in a given month, providing valuable information to 40 million shoppers

Brad Korner is general manager of Cox Automotive Rates & Incentives. The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 87,000 applications are relying on CAR&I data in a given month, providing valuable information to 40 million shoppers.

No Comments

VinWhiz, LLC

2019 is the Summer of Incentives

July 2019 is expected to be officially the hottest month in history, temperature wise. The same might be said for the level of sales incentives offered by the automakers. This time of year, we often see a slowdown in the number of incentives available, as model year changeovers and strong spring sales have dwindled vehicle supply on dealer lots.

That was not the case last month. (See chart below). The volume of unique incentive programs ran high in July 2019, as they have all year with the OEMs battling a trifecta of challenges impacting new–vehicle sales:

- Stubbornly high interest rates are driving higher payments for new–vehicle buyers.

- Increased content is pushing the Manufacturer’s Suggest Retail Price (MSRP) higher. The average MSRP through the first half of 2019 is north of $39,500, according to our Kelley Blue Book data team.

- There’s a large surplus of “nearly new” vehicles on dealer lots serving as smart alternatives to a new, zero-mileage vehicles.

Our team watches incentives carefully each month, to help both consumers and dealers calculate accurate price and payment data for new cars. In the past few years, we’ve seen the automotive manufacturers become increasingly strategic with their incentive disbursements, offering incentive programs at the VIN, option package/code and geographic levels. We’re also seeing numerous competitive offers, which helps retailers manage monthly payments and financing offers to meet the needs of buyers struggling with the affordability of new vehicles.

Our team watches incentives carefully each month, to help both consumers and dealers calculate accurate price and payment data for new cars. In the past few years, we’ve seen the automotive manufacturers become increasingly strategic with their incentive disbursements, offering incentive programs at the VIN, option package/code and geographic levels. We’re also seeing numerous competitive offers, which helps retailers manage monthly payments and financing offers to meet the needs of buyers struggling with the affordability of new vehicles.

All these factors are pushing higher the raw number of incentive programs in the market today. More programs mean more deals, so new-car buyers need to make certain they are receiving all available incentives. And it is worth noting, not all buyers are eligible of all special rates or incentives, so it pays to ask and do the research.

But just like sweltering July heat, incentive volume could cool off quickly, although chances are we won’t see a slow down until inventory levels drop another 10%. Pending July sales, the program count may stay hot into August.

Note: Chart shows total volume of unique incentive programs, across all makers. This number does not indicate value of the programs, only volume. For example, in July 2019, Toyota carried 137 unique incentive programs, Nissan had 252 and Honda 68. Ford, conversely, which typically carries numerous regional and national programs across its vast line of vehicles, had 597 different incentive programs in play across the country. In total, there were 2,923 unique programs available in July 2019, up from 2,664 last month and up from 2,307 in July 2018.

No Comments

No Comments