VinWhiz, LLC

How did the UAW strike influence GM's sales strategy?

General Motor’s UAW workers got back to work this past week, resuming production at plants across North America and ending a 40-plus day work stoppage. GM and its dealers went into the strike well prepared in terms of inventory, with new-vehicle stock well above the industry average.

GM’s new-vehicle sales in the U.S. in Q3 were strong, thanks in part to aggressive incentive work. October auto sales will be reported on Friday, November 1, and our team is forecasting GM to come in at approximately 230,000 units, a 5% drop versus October 2018. The market is expected to be mostly flat.

Considering the strike dragged on for most of October, our Cox Automotive Rates & Incentives team took a careful look at GM incentive programs during the month to assess the company’s motivation at a time when new products were not being built to replenish supply. What we found: It was Business as Usual with the GM sales department, as they didn’t lift their foot off the incentive throttle.

For the most part, GM incentives in October were equal to or greater than the incentives in September. In some cases, the incentive packages improved significantly. Consider the Chevrolet Equinox: The general incentive package of guaranteed and conditional consumer cash was unchanged for 2019 models, September versus October. The incentive package increased by $500 for 2020 models. The same story is true with the popular new Silverado. Incentives on the 2019 models stayed consistent. For 2020 model year vehicles, the offer increased by $3,000 during October, all guaranteed customer cash.

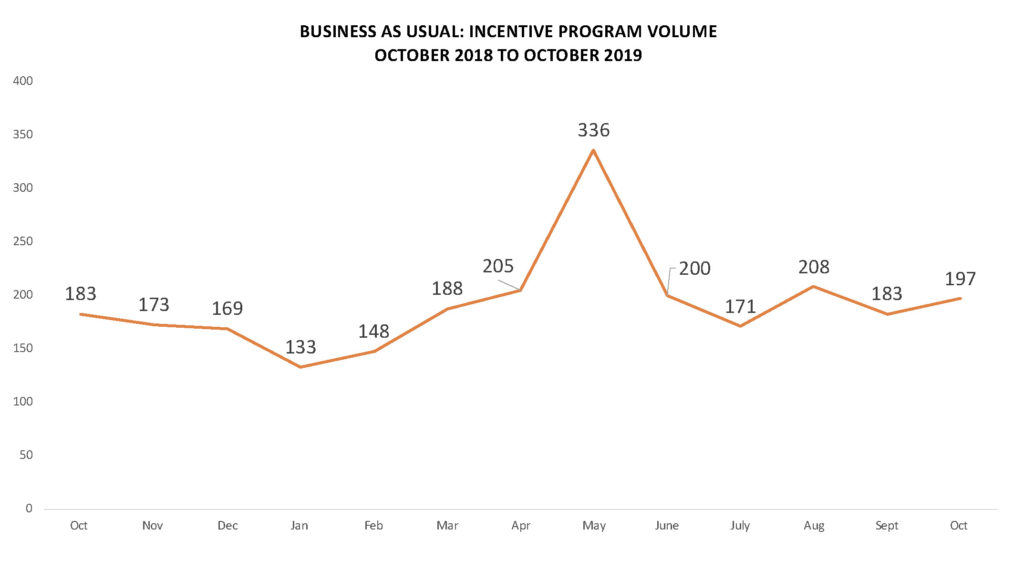

Reviewing total incentive programs tracked by our rates and incentives team shows a similar business-as-usual story in October. By the end of the month, GM had posted 197 different programs across all its brands, a number very similar to its 12-month average of 193.

In other words, the 40-day strike, at this point at least, had no discernible impact on GM’s incentive strategy. From a sales incentive point of view, GM and its dealers continue to focus on moving the metal.

We know many factors shape a company’s incentive strategy, and inventory is just one measure. Certainly, GM’s competitors continued to be aggressive in October, forcing GM to maintain or increase incentives to help their dealers maintain competitiveness – strike or no strike. As long as there is inventory, the sales march must continue.

Our industry insights team will take a careful look at GM inventory at the beginning of November. How that number impacts GM’s incentive behavior through the end of the year is yet to be seen.

Brad Korner is general manager of Cox Automotive Rates & Incentives. The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 88,000 applications are relying on CAR&I data every month, providing valuable information to 40 million shoppers.

VinWhiz, LLC

Model Year Sell Down Season in High Gear

*This article was originally posted to the Cox Automotive newsroom.

As 2019 continues to deliver strong new vehicle sales, we’re seeing a consistent transition from general incentive offers to more specific discounts, which is driving record volume of incentive programs being offered to consumers and dealers (see chart below). This transition is indicative of an industry moving from fewer, broad-brush offers to many, very specific bonuses based on, among other factors, geography, vehicle option packages, and length of time in dealer inventory. We continue to track more VIN-specific incentive packages as well.

September is typically the time of year dealers are carrying up to three model year vehicles (2018, 2019 and 2020), and OEM’s are applying rates and incentives to each in different ways. This adds a level of complexity in the offer structures for both dealers and consumers.

Here are examples of how the triage of model years are being handled:

- 2018 models (4.1% of July retail sales) are transitioning to final pay incentives—direct to dealer—allowing more discounts on the transaction. We also see attention-grabbing, advertising-driven offers such as “22% off MSRP” on Buick Regal Sportbacks.

- 2019 models (90.4% of July retail sales) have a wide variety of VIN-level incentives, package/option code discounts, special APR offers and regional incentives. This variety of incentives are marketing tools for inventory reduction. For example, GM is now offering a 60-month lease on select models in select markets.

- 2020 models (5.4% of July retail sales) typically have far fewer programs being used at this point in the year, however, the trend is toward broad-brush, general incentives with more emphasis on vehicle attributes and option packages.

The majority of incentives currently active are focused on model year 2019 product which dealers and OEMs need to move to replace with 2020 models. Heavy emphasis from OEMs are on regional discounts to help address inventory glut or use increased discounts on specific model/trim combinations to win payment battles for market-share gain. This is the height of price and payment competitiveness to close out the 2019 model year inventory and a great time for consumers to get great deals.

Auto makers are also working closely with their dealers to maximize attributes and option packages that customers value (i.e., infotainment/navigation, heated/cooled seats, adaptive cruise control, power lift gates, second-row captain’s seats, etc.). These packages are built by the OEMs at a relatively low cost and can be used as a discount with minimal effect on profitability. These special package incentives result in far less margin compression compared with traditional offers such as discounted APR, bonus cash or special lease rates.

The U.S. auto market continues to be hypercompetitive, which is driving the large volume of unique rates and incentive programs. Incentive volume was high in September, even without a Labor Day weekend. As this is “sell down season” and with the industry working through a lengthy GM strike, the chances of incentive volumes being reduced is very low. We expect to see an increase of program offers to earn consumers who are in the market for a great product looking for end-of-year discounts.

What’s not to like about buying a vehicle this time of year?

No Comments

VinWhiz, LLC

Optimizing Advertising Promotions Using Rebates & Incentives

Optimizing Advertising Promotions Using Rebates & Incentives

Improving response and ROI for advertising investments while gaining consumer trust and brand equity

New vehicle sales continue to be dependent on a combination of multi-channel advertised specials, rebates and incentives promotions. These offers (i.e., buy this vehicle for $349 a month, 1.9 percent financing and $5,000 off MSRP) play a prominent role in enticing consumers to purchase their next vehicle.

Kelley Blue Book’s recent Leasing and Incentives Study, however, shows that over 70 percent of consumers have only some to no knowledge of incentives. The same research reveals a $2,500 offer motivates shoppers to move from buying within months to purchasing within a week. What’s more, over 90 percent of consumers are shopping for a vehicle online.

Leveraging these OEM offers across all advertising tiers is an effective promotional tactic for motivating consumers to purchase. Making incentive and specials information easily accessible across all marketing and advertising channels can improve shopping traffic and engagement for dealers and dealer service providers (DSPs).

A key foundation for improving response rates is to promote and use the same incentives and messaging across the entire shopping landscape. Consumers who see the same offers through multiple shopping channels (i.e., paid search, display ads, third party listings/dealer websites, price and payment tools online and in-store) are motivated by trust in the offer consistency. This allows dealers (through DSPs) to align with national advertising efforts, creating additional value through all marketing and advertising campaigns which reflect OEM-driven offers.

Research conducted by Cox Automotive Rates & Incentives (CAR&I) analyzed the accuracy of data used for calculating pricing and payment information presented through DSP tools. In the study, CAR&I compared APRs, cash and conditional incentives through these various tools for seven new vehicles in the East Coast and West Coast markets. The analysis looked at data from three competitive incentive providers, including CAR&I.

The study found significant variations across the three providers, ranging from $0 to $6,750 in pricing for the same vehicle, resulting in monthly payment fluctuations of up to $122 per month for 60 months. The analysis also showed that both unnamed vendors incorrectly applied incentives for two vehicles, resulting in $500 to $750 in overstated incentives applied, costing dealers valuable margin.

These disparities have wide-ranging consequences for dealers, including loss of credibility in pricing and loss of profits on transactions. It’s not just that consumers might walk away from one purchase; it can affect repeat purchases and referrals too. Rebate and incentive information must be accurate for advertising and marketing to effectively build trust and transparency while improving the customer experience.

The use of rebates and incentives for advertising across Tiers I – III creates a consistent, credible message that supports a customer experience while driving brand equity and buyer loyalty. With dealers paying from $.50 to $20 + per VDP visit according to Generations Digital (https://www.generationsdigital.com/), choosing the correct data partner for a single source of accurate and complete rebates and incentives leads to improved response rates, increased lead conversion and greater profitability.

Brad Korner is general manager of Cox Automotive Rates & Incentives.

No Comments

VinWhiz, LLC

The Many Views Of New Vehicle Incentives

Our world is crowded with marketing messages about what to buy and why. As consumers we shop multiple places to make sure we’re receiving the best deal and that the offers we are being presented are consistent, valid and apply to our specific needs.

The world of automobile shopping has taken this ubiquitous shopping experience to a new level with multi-channel advertising, paid search, auto research/listing sites, tiers 1 – 3 websites and many on line pricing tools. There are so many tools at our disposal that getting pricing has never been easier. Since consumers cross shopping sites, it is more important than ever for the auto retail industry to have consistent pricing across all tiers.

Technology now allows OEM’s, dealers and advertising agencies to apply incentives to a price configuration for customized transactions that meet a consumer’s budget. The accuracy, consistency, speed and comprehensiveness of this information is the difference in converting shoppers to buyers for auto retailers that advertise on multiple digital properties.

The openness of information for consumers fosters candor and trust that are like a carrot as opposed to a stick method of engagement. Studies support this approach which has seen rapid adoption by dealers, shopping sites, finance companies and OEM’s. This is a more specific application of the offers available on public domains and presented through omnichannel communication (traditional, digital & social) with specific inventory or advertised specials from OEM’s.

Our clients are seeing a collaborative effort by the industry (OEM’s, dealers, ad agencies, software providers, lenders, etc.) to present consistent information for targeting shoppers and their position in the purchasing process. Use cases have surfaced about how this information is being applied as a competitive pricing/feature analysis of brand/makes, influencing the transaction (price and financing), qualifying requirements (credit score, eligibility, used vehicle trade value . . .) and the strategy of using incentives as part of a payment lowering for winning market share battles. These examples have tactical value and will continue to help us with analytics for improved spending and ROI from inventive investments.

Analytics will continue to drive where and how incentives will be applied for achieving both volume and margin requirements. Transitioning incentives from “showroom traffic drivers” to strategic discounts for payment conscious shoppers looking for the right vehicle at an affordable cost is an example of moving incentive use further down the funnel to a transactional level. This dynamic will continue to drive the collaboration between all players in the industry for providing guidance on the sales effectiveness of incentives based on their targeted intent.

These areas are key to dealer and OEM profitability which is under attack because of margin compression at many levels. Initiating a new car sales strategy by maximizing inventory, advertising/marketing and inventory turn (see Brian Finkelmeyer’s post https://www.linkedin.com/feed/update/urn:li:activity:6443198218871332864/) shows the many ways factory incentives support all facets of new vehicle pricing, advertising, marketing, digital retailing transacting and data base mining (equity). Incentives are not a one trick pony used for driving showroom traffic, rather a key component in 100% of all new vehicle promotion and sales.

No Comments

No Comments