AutoHook powered by Urban Science

What You Need To Know About DMPs

DMPs are a topic gaining escalating attention as we head into 2017. A dark cloud of big, irrelevant data still lingers above the automotive industry, just waiting to be analyzed. What are DMPs? For those of you that don’t know, the acronym stands for Data Management Platforms. Think of a DMP as a digital warehouse of data, designed to consolidate and organize consumer data from multiple sources all in one place so that it can be put to good use.

eMarketer addressed the need for advertisers to utilize DMPs back in 2013 – a near decade ago in digital time. “If data is digital marketing’s currency, then the DMP is its bank.” So, when it comes down to whether or not to use DMPs either at the dealer or manufacturer level, really dig deep and ask yourself… do you like money?

If the answer is yes, DMPs exist to give you insights that will help you make more and save more (money that is). DMPs consolidate past and real-time consumer purchase and behavioral data across ad exchanges, networks and devices. This allows for granular audience segmentation and targeting that goes far beyond standard demographics.

DMPs aren’t just a place to aggregate and store information. They help us find the most important data points that will actually help our business. And I don’t mean help down the line or months from now, but this very second. DMPs empower us to take action and deploy personalized campaigns with quantifiable conviction. These platforms are the secret to affirming what every advertiser claims they will do, which of course is to “place the right ad, in front of the right consumer, at the right time.” Sound familiar? Without DMPs, these empty promises would remain just that - empty and unproven.

DMPs are the ultimate source of budgetary efficiency for both digital and traditional spending. By illuminating a clean, 360-degree view of a consumer’s online and offline actions, DMPs pinpoint how far along car shoppers are in the buying process. They identify who in the market has already purchased a vehicle and if they bought it from a competitive dealership or brand. On the contrary, they show which consumers are just beginning their research journey, still months away from a buying decision.

Put simply, DMPs hold your campaigns accountable for their performance and help to guide your ongoing efforts to be more relevant, impactful, and efficient with where you spend your money and who you spend your money on. Specifically for the automotive sector, DMPs may be the solution to a lot of our sales attribution problems. Everyone wants to stake claim for a vehicle sold. A DMP may be just what we need to properly assign credit where credit’s due.

When asked about DMPs, Erik Lukas, Retail Operations Manager of Subaru of America said, “If there’s ever any hope of attributing all these touch points along the shopping journey, you’ve got to have some place where all the data rolls up and you can analyze it as one set.” Aside from attribution, another much-needed use for DMP-derived insights would be for one-to-one marketing and campaign personalization. Both are becoming increasingly necessary in order for a message to stand out and resonate with car shoppers.

According to MarTech Today, “A DMP offers a central location for marketers to access and manage data like mobile identifiers and cookie IDs to create targeting segments for their digital advertising campaigns.” This is a tremendous asset for automakers when it comes to eliminating waste. For example, if you are a luxury vehicle manufacturer, DMPs can help you only target individuals or households that you know have a net income of at least $200,000 per year.

In summary, the biggest uses for DMPs in the auto industry include:

- More accurate sales attribution

- More opportunities for personalization and one-to-one marketing

- Ideal audience targeting and segmentation

Data management platforms are about unification – unifying consumer data from one source to the next as their shopping journey becomes more and more complex. Big data fails to hold value unless it can be applied to better influence your most lucrative audience segment. Other industries have been using DMPs for years. Automotive has such a complex business model given our three-tier system and the fact that most transactions happen offline. Therefore, we need DMPs more than anyone.

The opportunities DMPs provide are limitless. But don’t get too wrapped up in all the ways you could use them to your advantage. Remember your one objective at the end of the day is to increase dealership revenue by selling more units and obtaining more ROs. Above all, SALES is the metric that matters and DMPs should be used primarily to generate more sales. Everything else is just noise.

AutoHook powered by Urban Science

We’ve Got The Data! Now What? (Top 3 Takeaways From The J.D. Power Data Expert Panel)

If anyone experienced the great misfortune of not being able to attend AutoHook’s J.D. Power AMR panel that had attendees lined up against the walls, I’ve got you covered. Below is a condensed collection of key insights from the session, We’ve Got the Data! Now What?

If anyone experienced the great misfortune of not being able to attend AutoHook’s J.D. Power AMR panel that had attendees lined up against the walls, I’ve got you covered. Below is a condensed collection of key insights from the session, We’ve Got the Data! Now What?

I know you’re probably all tired of hearing the term “big data.” You may even be a little nauseous from it – thus the critical need for this panel and the recap below.

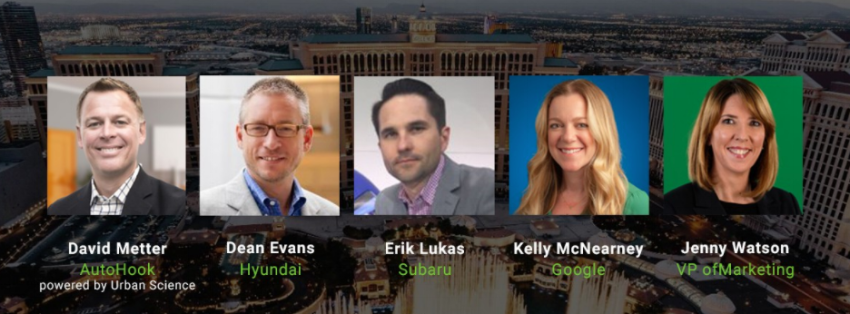

First, let me formally introduce our superstar lineup. I do have to take a moment to say these leaders are not just auto experts with impressive titles. Each has proven a genuine desire to improve the way our industry operates and the way we share data for the benefit of all – and that’s huge.

- Dean Evans | Chief Marketing Officer, Hyundai Motor America

- Erik Lukas | Digital Operations Manager, Subaru of America

- Kelly McNearney | Senior Automotive Retail Strategist, Google

- Jenny Watson | Digital Strategist (formerly of AutoNation & Expedia.com)

It’s funny (and a little ridiculous) how often the solutions to the world’s biggest problems come from plain old common sense. We all have a tendency to overcomplicate even the most evident of concepts. Perhaps the secret to solving all this big data ambiguity is to take a step back and “under-complicate” the idea.

Three overarching themes dominated our big data discussion:

1. The largest obstruction to big data in the automotive industry is the automotive industry itself.

I’m not pointing any fingers, but it’s no secret that our three-tier system makes things more difficult. It creates large disconnects in communication from one layer to the next. Dean Evans points out, “We know at Hyundai you can’t do decent business today unless you are connecting those layers.”

We also know it’s rare for what happens at the dealer level to be properly recorded and communicated at the OEM level. That’s just how it is. Allow me to propose an idea. If knowledge is power, then sharing data is power. Imagine the influence we could claim if we all stopped being selfish with our data. A united industry is an unbreakable industry.

Kelly McNearney adds, “The challenge for tier three in this big data game is getting some team spirit going where dealers will actually share with the OE and the OE will share with the dealers, and then you’ve got really powerful stuff you can use. Then you can really start to understand who your consumer even is and what their actions are.”

We’ve completed step one, identifying the problem. Now it’s time to complete step two, taking action to solve the problem. So, who’s taking action? AutoHook already has by opening our API and the attribution data that comes with it to the entire industry free of charge. CDK and Dealer.com are doing it by creating centralized data dashboards so OEMs can have a better view of the consumer sales data collected at the dealership level. So who’s next?

2. More data is not necessarily better.

The secret is not obtaining more data. Sometimes it’s about doing more with what you have at your fingertips. It’s about taking smarter, more efficient actions. What’s the end goal? Jenny Watson says, “At the end of the day it’s really about units sold and the number of repair orders generated,” and she’s right! More is not better. It’s just more. An emphasis on obtaining more data may be the root cause of why the subject has become so complex.

It’s also important to note that each channel has its own specific set of measurable KPIs. Regardless of what they are, if you can’t validate that these channels resulted in a sale or a service order, then don’t waste your money advertising on them. It’s that simple.

3. Data Management Platforms (DMPs) are important to use and understand, but never at the cost of simple, actionable insights.

DMPs have been around in other industries for years. In a lot of ways, they’re starting to replace that “big data” term. Both dealers and OEMs should take advantage of these systems in order to better serve their network. Dean Evans says, “Feeding the dealer network is always paramount.” In addition, because of our three-tier system, the auto industry has the most complicated business model in existence. Therefore more than anyone, we need DMPs. They exist and are designed to help us – so use them.

Erik Lukas shined a lot of light on this subject. “There’s room for both,” he says. “There’s the big insights that come from DMPs that we need to unlock, but you still can’t ignore some of the things that are right in front of your face.” Erik gives the example of Subaru’s highly successful Dog Tested campaign and how it all began. “A key insight for us that we spawned a whole campaign off of was that 2/3 of Subaru owners own pets, and of those, 70% are dogs. Clearly, that’s not a big data or DMP derived result, but we built a whole disruption campaign around this one key insight and it’s really resonated with our customers.”

Kelly McNearney is a big advocate of DMPs especially for the automotive vertical. However, she speculates DMPs are perhaps given too much credit. “Some of the best data we have is actually something quite small, but that we can take action on,” said Kelly. She followed that up with a great example. “In the month of November for the past three years in a row, searches for tires have been at an all time high. That is a useful piece of data and that’s not from a machine, it’s not from a DMP, it’s just a simple Google Trend.”

To conclude, if you’re going to remember anything, remember these three things:

-

The only way for us to overcome barriers across tiers is to knock down the egotistical walls that separate us and work together.

-

Instead of more, more, more, when it comes to big data, remember that the end goal is to increase sales and revenue at the dealership level.

- And lastly, do your research on DMPs and allow this tool to help you – but never ignore the immense potential of a single statistic such as 67% of Subaru owners are animal lovers.

Click here to watch the complete live recording of the J.D. Power AMR panel, We’ve Got the Data! Now What?

No Comments

AutoHook powered by Urban Science

Your Q4 Reality Check: 5 Reasons Online Buying Is NOT Everyone’s Reality

People buy everything online these days. Or do they? In reality, there are some items people simply prefer to touch, see, feel, taste, smell, ordrive before they consider signing on the dotted line or forking over their credit card. Several automotive leaders have recently come out in the media claiming a vehicle is still in so many ways, one of those items.

People buy everything online these days. Or do they? In reality, there are some items people simply prefer to touch, see, feel, taste, smell, ordrive before they consider signing on the dotted line or forking over their credit card. Several automotive leaders have recently come out in the media claiming a vehicle is still in so many ways, one of those items.

Online car buying models have been a ubiquitous topic of conversation over the past year – one that has made many in our industry uneasy about what to expect in the future as companies like Carvana, Drive Motors, and Vroom claim their place in the market.

We’re now in the fourth quarter of 2016, the time when we line up our budgets for the year ahead. Which technologies will thrive and which will die? Will the option to offer a complete online buying method for our new and used vehicles become necessary? According to DealerSocket, “There’s a false sense of urgency to take car buying online.” If you were to ask me, I’d say the vast majority of consumers are still not ready for it.

In a recent article from Automotive News, they highlight the results of DealerSocket's 2016 Dealership Action Report. “While there is a segment of car shoppers who want to buy vehicles online in an Amazon-like experience, a new report indicates dealers may be overestimating how strong consumer demand for this capability really is.”

Actual responses are shown below:

Without a doubt, there are items consumers prefer to purchase online, things like books, electronics, or your go-to cologne. It’s also true that there is a current market of buyers that want the ability to purchase a vehicle online. However, relatively speaking, that number is still small - small enough that we can all take a big deep breath and let go of worries about completely changing our buying models and the way we market our inventory.

When it comes to big-ticket items, people overwhelmingly still choose to visit actual brick-and-mortar stores. A new eMarketer study revealed it’s not just the large items. When it comes to packaged goods or groceries, the market is not budging despite having the option for online grocery shopping and at home delivery. eMarketer emphasized several valid reasons why 90% of internet users still prefer to do their grocery shopping in-store. These same reasons for opting out of online buying can be directly applied to the car business.

If your dealership is contemplating integrating an online sales platform in 2017, make sure you consider the following five facts before taking on this monster:

1). When people are ready to buy, the ability to purchase immediately in-store is still very desirable as there is comfort in seeing, touching and testing products (or vehicles) in person.

2). Completing a lengthy online purchase request may be too time-consuming for customers to follow through with the entire process.

This past August, Alex Jefferson, eCommerce director of Proctor Dealerships said, “Where online buying is going I don’t necessarily know, but I do know that it did personally have an adverse effect on us when we integrated with the tool. I will tell you after a year of testing it, our lead volume went down by about 30-40%.”

3). Less tech-savvy customers or older generations who have the dealership experience ingrained in their mindset may struggle with the concept or dismiss it altogether.

4). Consumer income levels largely dictate their level of interest in whether or not they would prefer to buy a vehicle online.

“Half of surveyed consumers earning $100,000 to $149,000 annually would like to bypass the dealership and buy vehicles online, DealerSocket said. In contrast, 29 percent of people making $25,000 to $49,000 said they'd like to buy vehicles online.”

5). Online buying models may be better suited for luxury or high-end electric vehicles only – one of the reasons Tesla has been successful selling almost exclusively online.

Forbes explained why a direct sales model works for Tesla. “Since electric vehicles do not need as much regular service and the company does not offer financing schemes, a dealership model would put pressure on its margins.”

Marylou Hastert, DealerSocket's Director of Product Marketing advises dealerships, “Stores should prepare for the digitization of car buying, but not at the expense of in-store processes.” Simply put, an online buying model may not be right for your dealership. It could even be harmful to your conversion rates, which dealerships have reported over the last year.

My expert opinion? Get your fundamentals down first before heading full-speed down the click-to-buy road. Online buying has been effective with some of the larger dealer groups, but they have already conquered the essentials. After you have mastered the art of securing a high-converting website and high converting forms across devices, and once your inventory is immaculately merchandised with video walkarounds, photos, and custom comments, THEN and only then should you experiment with an integrated online buying model.

No Comments

AutoHook powered by Urban Science

More Data More Problem$: 3 Big Data Problems & How to Solve Them

| by David Metter

“Just because it can be counted, doesn’t mean it counts,” said Tom O’Regan, CEO of Madison Logic in a recent IAB study. “As you rise up the scale of performance measurement tactics, you find the increasing convergence of both attribution and value.” These are incredibly wise words to live by. There are dozens of performance metrics that we’re capable of tracking. But just because we can, doesn’t mean we should.

We are deep inside the epicenter of the information age. With all this big data comes an overwhelming opportunity to derive knowledge and take action. Nothing, (not even money) is more powerful than knowledge. We have all this information literally at our fingertips, yet automotive marketers still struggle to validate which solutions delivered the highest ROI or led to a sale. Having this knowledge (and knowing what to do with it) will make everything we do moving forward make a lot more sense.

As technologies become smarter, more integrated, and more systematic, automotive marketers face three big data obstacles:

- Access to accurate, useful data

- Access to faster, more timely data

- The ability to turn big data insights into beneficial, executable actions

Let’s dive into each problem and how we can diminish these issues as we plan for 2017.

Useful Data:

First, you need to know what to look for. It’s not just about obtaining more and more data. It’s what we can to do with the knowledge we extract from the data that ultimately matters. So many advertisers still fail to acknowledge that there is life beyond the click. The number of clicks a campaign generated or the number of unique users it sent to your website is a microscopic fraction of the full picture, and frankly, it's an irrelevant metric.

In today’s world, clicks just don’t hold their weight. Clicks don’t prove conversion and clicks don’t move inventory. Furthermore, you could have the highest rate of website traffic in your market, but if your conversion rates are low, that “traffic” is just a number – which at the end of the day, means nothing.

Going into a new year, when you’re considering which technologies and vendors to work into your budget start with the ones that can prove they can consistently deliver the following:

- A high conversion rate with proof of lead exclusivity

- An incremental increase in showroom visits

- (And most importantly) An incremental increase in sales

Access to this type of data is the most beneficial, as it gives dealers the freedom to stop guessing and start knowing what works – and like I said before, nothing is more powerful than knowledge.

Ask the right questions upfront so you can better determine if a vendor and their data will be of use to you. Start with the following:

- At what rate do their solutions convert?

- What is their showroom visit rate?

- How do these rates compare to industry averages?

- What is their method of tracking sales?

- Can they link a vehicle sold to a specific user or campaign?

If they don’t have the validation stats to prove these things to you, they are not worth your time or money.

No-nonsense data tells you how many showroom visitors purchased (either from you or a competitor) and what specifically drove them in. It can tell you if your buyers are repeat, loyal customers or if they’re new to your brand. Did they visit your store but end up purchasing somewhere else? What brand did they buy and why? These are the types of questions legitimate reporting should be able to answer.

Faster Data:

IBM’s recent whitepaper, From Data to Insights to Opportunities, points out the clouded view of actionable data due to systems not communicating with each other. “Different platforms in different departments can’t talk to each other, so reporting is slowed. And it’s difficult to take proactive steps when your view of the total customer experience is a little blurry.”

The goal is to spend less time compiling data and more time using it to uncover new growth opportunities. Aim for a single, unified and cohesive structure when it comes to analytics and reporting. Ask vendors if they allow other solutions to integrate with their dashboards or APIs? The more people you can get working together towards a common goal, the better your chances become of achieving that goal. It’s the “two heads are better than one” approach. An industry-wide holistic viewpoint must be adopted for all parties to benefit from both faster and more comprehensive data models.

Also, choose to only work with the players that have near real-time reporting capabilities. With each day that passes after a purchase is made, that sales data becomes less and less valuable. What good are insights that remain unseen? The faster we can access sales data, the more we can do with it to extend our finite budgets.

Actionable Data:

Integrated, cross-channel and cross-device attribution reporting is essential to following the consumer’s buying path. These capabilities illuminate trends in the purchase cycle and allow dealers to make more lucrative decisions with their ad dollars. Behavior across mobile, desktop, and online and offline channels all need to be considered to get a complete, accurate view of the attribution path.

Knowing which solutions are working for your dealership is the key to correcting all your big data problems. Use attribution data to build predictive models that identify trends or patterns in purchase behavior. Pragmatic data can tell you which vehicles to keep in stock, how many of each model, and in which colors. It can tell you how to better allocate every dollar so you can rest assured your money is being spent in the right places.

Remember that useful automotive data is largely derived from the two most important KPIs: conversions and sales. The focus of your reporting should include data that shows a complete attribution path from an advertising source to a sale.

The Marketer’s Guide to Cross-Channel Attribution states, “When organizations are able to measure marketing’s impact on the metrics that truly matter to the business, then and only then are they in a position to make confident decisions about future marketing investments. And that’s just the tip of the iceberg.”

These roadblocks need to be obliterated in order to reverse the rate in which we’re inundated with useless, irrelevant information. The time has come where we’re capable of maximizing revenue across all marketing initiatives. It’s time to show big data who’s boss! If we work together, we can close gaps in communication and better track consumer actions throughout the purchase cycle for the benefit of all.

Heading to Vegas for the #JDPowerAMR? Be sure to catch the Big Data problem-solving Panel, We’ve Got the Data! Now What? Moderated by David Metter, featuring digital marketing experts from Hyundai, Subaru, Google, AutoNation & more! Panel starts Wednesday, October 26th @ 11:25 AM (Breakout Room #2)

David Metter is the President of AutoHook, powered by Urban Science. David brings a wealth of automotive knowledge and experience to AutoHook, both from a dealer and service provider perspective. Prior to joining AutoHook, David served more than six years as Chief Marketing Officer for MileOne Automotive, a large, privately-held automotive dealership group. At MileOne, he built an industry-leading marketing organization, leveraging technology and the internet to increase market share while dramatically decreasing advertising spend per vehicle sold. David previously headed sales for Autobase, where he helped grow the company from a small start-up to the leading automotive CRM software vendor. He began his career on the showroom floor. As an early adopter of arising technologies, he built a prospecting and follow-up system that helped him rise to become one of the top Chrysler salesmen in the country, and eventually General Manager of a dealership. David is regarded as one of the foremost experts in the automotive marketing and e-commerce space and is a frequent speaker at industry events including Digital Dealer, the Global Automotive Conference, and the J.D. Power Automotive Marketing Roundtable. David is an avid automotive enthusiast and is actively involved with the American Cancer Society.

No Comments

AutoHook powered by Urban Science

The Naked Truth Part IV [EXECUTIVE EDITION]: Big Data & Attribution

Big Data & Attribution…Who Has It & How Do We Get It?

There’s good news and bad news on this topic…but mostly good. The bad news is AutoHook’s panel of marketing experts had so many dealer-submitted issues to solve they didn’t have time to address data and attribution at Digital Dealer 21 (as this subject could take 50 minutes alone). The good news is I now have the opportunity to step in and shine my headlights up on the industry-wide struggle I’m most passionate about. This final piece of our Naked Truth Exposed series will represent the most momentous road block dealers face today: proving without a doubt the one source that led to a sale.

on the industry-wide struggle I’m most passionate about. This final piece of our Naked Truth Exposed series will represent the most momentous road block dealers face today: proving without a doubt the one source that led to a sale.

First, let me fill you in on a quick story about a guy named Dayn Riegel. Dayn is the eCommerce Director of Loganville Ford and he was AutoHook’s winner of our all expenses paid trip to DD21. Why would we invest so much money in a person we had never met? Because he asked the right question. In our nation-wide poll conducted over the spring and summer of 2016, Dayn submitted the following inquiry:

“The best marketing in the world can’t save a dealership from itself – it’s own greed, ineptitude or lack of drive…lack of willingness to succeed, and I don’t mean just talk about it, do something about it. So, my question is: With all the hype around SEO, SEM, PPC, Bing, etc., who is taking all the big data and marketing know-it-all and applying it? Exactly. Nobody really, truly is. Why not?”

Thank you Dayn for giving me the opportunity to take on this challenge. This question is the reason I do what I do, as I experienced the same problems during my time as CMO at MileOne Automotive. I know firsthand, one of the most common pain points for dealers exists in the gaps (or the disconnects in communication) that form when two vendors don’t properly work together. As competition rises in the digital space, and as more and more companies enter the game, these lapses in digital communication will only continue to grow - creating more cracks in our already distressed methods of attributing a sale to a single source.

During my time at MileOne, I was fortunate enough to have the resources, contacts, a great team, and insight to do something about this problem. One of our biggest strengths, and arguably the reason we had such a competitive edge was in our ability to see the unique advantages of two different vendors, and bring them together in a way that benefitted our needs. We quickly learned that combining the exclusive technologies of two (or even three) vendors made it easier for us to sell more cars. More importantly, we had the power to track the latter half of a specific customer’s buying process, which eventually led to the creation of AutoHook’s award-winning sales attribution engine.

People in general have a tendency to overcomplicate common sense concepts. But this isn’t rocket science. If you need green paint, you take some blue paint and some yellow paint and simply mix them together.

So how do we paint the automotive marketing landscape green? I can tell you since I’ve been on the other side (the vendor side) I’ve seen a need for these types of alliances to happen now more than ever. It’s monumental to think of how much we can accomplish if we open up our strengths to others to generate a mutual benefit. What I’m suggesting, is we need to change the focus from beating our competitors, to working in conjunction with competitors to accomplish a goal that guarantees success for all parties - and not just for vendors, but for dealers and OEMs as well.

As Dayn referenced, there is an undertone of greed throughout both dealer and vendor communities. Everyone wants to make more money. Everyone wants to be #1. Everyone wants to keep proprietary technology a secret. But let’s take a step back. Let me spell this out in the simplest way I possibly can. In order to solve the ambiguity that shadows big data and accurate attribution in our industry, we have to do one thing: change our mentality.

Here’s how. What if instead of keeping secrets, we shared knowledge and worked together? What if we connected the automotive universe and created one cohesive, more efficient railroad system? Wouldn’t this drastically reduce disconnects in our data and reporting? Right now, we are on the precipice of change. No one can argue that there is strength in numbers. We need to unite, rather than surround our solutions with egotistical walls, in order to reap the benefits of the bigger picture.

Going back to Dayn’s question of, “Who is taking all the big data and marketing know-it-all and applying it?” The answer is, WE ARE. AutoHook, powered by Urban Science has the fastest, most reliable sales attribution path data in the industry - 99.7% to be exact, and 95% of that data is updated daily. No one can compete with that! Furthermore, we know how to apply this data to prove our solutions directly led to a sale. So not only do we have the data and know what to do with it, but we’re willing to SHARE our AutoHook rail system and API technology with the entire industry…FOR FREE.

Imagine that, an open API that gives all automotive entities the power to finally attribute vehicle sales to a single campaign. What? Why? How can we do this? First of all, we know for a fact we have access to the most reliable and timely sales data from Urban Science. We also know that achieving accurate attribution is trifold.

First, the solution needs to execute. Second, it needs to be validated with performance reports that show concrete evidence of incremental sales and lift in conversion. This requires vendors to surpass irrelevant vanity metrics such as clicks, impressions, and site traffic. Is there any paid search company out there that can prove to a dealership that one of their search campaign clicks resulted in a sold vehicle? The answer, just as Dayn suggested, is absolutely not!

The third piece of our bulletproof attribution model is that it’s personalized and unique to each customer, further eliminating breakdowns in sales data. By assigning a unique code to every user, we can track all post-interaction behavior. How many people walked into your showroom as a direct result of our solution? Did they end up purchasing or not? What model did they purchase? Are they new to your brand? And what led them to your store?

What if the solution to this problem afflicting dealerships, OEMs, and vendors could be as simple as breaking down the walls that separate and limit us? What if we stopped nickel and diming dealers for every integration they request? The ideal solution for obtaining actionable data must be suited for omnichannel use, meaning available to all publishers and vendors across all types of media outlets, hence the concept of an open, free API.

My friends, this is the beginning of an era. This is how we provide the world with access to big data and the reporting needed to turn it into a story worth sharing. This is how our industry becomes more efficient, more streamlined, and more powerful. If we can patch the holes of automotive’s digital rail system, every vendor and dealership can finally validate the true ROI of their marketing investments.

Stay tuned for more to come on how AutoHook will be providing free API access to all.

If you missed part I, II, or III of our Naked Truth Exposed series, check them out below:

No Comments

AutoHook powered by Urban Science

AT LAST: Attribution Claims its Throne

It’s an exciting time in digital history. Automotive marketers are finally catching on to the critical importance of attribution – AND more importantly, the associated consequences if accurate attribution is not accomplished. Maybe it’s something about the hot summer air. Or maybe digital leaders are just coming to their senses. Or maybe dealerships are just plain tired of spending thousands or even millions of dollars on advertising with not much to show for it at the end of the month. I hear this from Dealer Principals over and over as I speak at different events across the country. Most likely, it’s a combination of factors. But regardless of how or why, an attribution miracle is taking place as we speak in our industry.

Attribution is claiming its rightful throne as one of the most essential (if not THE most essential) elements in digital advertising. At last, dealerships and marketing experts alike are starting to realize the widespread scarcity of vendors that provide accurate sales attribution metrics. Furthermore, automotive leaders are more openly recognizing the subsequent wasted spend that results from not being able to draw a straight line from an ad source to a vehicle sold. The problem is, there is a group of decision makers (Dealer Principals, C-Level Executives, etc.) that are either making vendor decisions by looking at their monthly docs or relying on their under-trained digital team members.

Mark my words - 2017 is going to be THE YEAR OF ATTRIBUTION. eMarketer just published an article admitting companies have been slow to adopt proper attribution methods due to a number of obstacles. “Marketers have always acknowledged the benefits of accounting for every marketing channel and brand-imposed touchpoint, but in spite of such awareness, adoption of these types of practices has been slow and labored.” In addition, they estimate over 50% of American businesses will make multichannel attribution a priority for their marketing efforts in the year ahead.

If you’re smart, you’ll make sure you’re a part of that +50%. You will also require proof from your vendors and partners that they are providing you with services that incrementally and exclusively lift both your website conversion and your sales. And to be clear, the word “incremental” translates to regular, consistent, and measurable actions that are exclusive to one source.

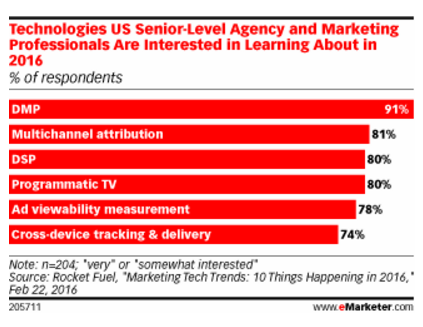

Jon Schulz, CMO of ad tech firm Viant stated, “It’s really all about attribution and closed-loop measurement.” In other words, “What am I getting? What’s working and what’s not working?” Rocket Fuel also reported a prevalent increase in attention to attribution metrics among senior-level marketing professionals, with 81% wanting to learn more about multichannel attribution.

It’s important to note, automotive vendors primarily fall into one of two buckets: traffic drivers and conversion specialists. Paid search, display, and retargeting are the most prevalent traffic drivers. However, this traffic must be properly tracked for one very important reason - an increase in website traffic does NOT necessarily result in an increase in sales. LotLinx for example, is a company that does a great job tracking conversions on your site, as well as how many of those customers took action or visited your showroom.

It’s important to note, automotive vendors primarily fall into one of two buckets: traffic drivers and conversion specialists. Paid search, display, and retargeting are the most prevalent traffic drivers. However, this traffic must be properly tracked for one very important reason - an increase in website traffic does NOT necessarily result in an increase in sales. LotLinx for example, is a company that does a great job tracking conversions on your site, as well as how many of those customers took action or visited your showroom.

Attribution may be a head-spinning topic, but the reason it’s gaining so much attention is very simple. If you can better track your marketing efforts, you can see exactly where you’re losing money, opening up an entire world of new opportunities. Not to mention, your limited ad dollars will go further. This new leap of attribution faith is such an incredible movement, as the days of trying to guess which methods actually drive sales are coming to an end. Dealers are no longer forced to play the guessing game of which marketing efforts sold cars. At last, we can stop guessing and start measuring the REAL return on our marketing investments!

7 Comments

Automotive Group

Finally! I can't wait..

Attribution has been on the front of my mind for the last couple of years. Money is real and results should be real too. None of this "well, this is like this because of this" wishful BS crap..

Clarivoy

Chris - You won't have to! I hope you're coming to the Driving Sales Conference. If so, you'll be able to hear our CEO Steve White speak about Multi-Touch Sales Attribution. If you can't wait until October, I can set up a one on one. Just let me know!

CRMSuite Corporation

The only issue that is seen in some attribution models, funny enough, is the accuracy of said attributing conversion. There are some large companies, who adhere to an IP address based model of attribution. This is VERY interesting, in the case of one such company, who uses no forms or collection areas to collect information to connect an IP address to a sold customer. Which in fact is not impossible, but requires more than algorithms, it requires legal authority and/or ISP authority, both of which we believe not to be given.

Long story short, attribution can be done to perfection, and we're very excited to see it come true, but it needs to be as clear in its results as it claims to give to the dealerships they're providing to.

Callsavvy

This is a very serious topic wrought with many new technological and marketing possibilities. The starting point for every marketing efforts should be the vehicle in inventory itself. Matching inventory vehicles with potential buyers and digitally going after those buyers with availabiility of many marketing tactics and platforms is the future. There are many third party data appending services which keep a detailed repository of countless customer/online user profiles. Such as social handles, used IP addresses, emails and etc. I believe the next big thing in auto marketing would be a solution that integrates all that into a dealer view that matches in real-time "in market customers" with "in inventory" vehicles.

Wikimotive

Hi David. Great article! I hope you are correct which is why I'd love if you could share more specifics about how this will affect auto directly. The reason I mention this is that the primary roadblock to full attribution (in most cases) is the dealer's website vendor. This plagues auto largely due to the OEM mandated providers which largely prevent this due to expertise/competence and OEM bueraucratic red tape.

Consider all of the 3rd party elements that often exist on site... Due to IP concerns much of the data ends up in a black hole when someone ends up on a 3rd party chat tool or lead driver, for example.

While there are certainly website providers who do operate competently and transparently, they are largely the minority in use at the tier 3 level. Do you really think there will be a mass exodus by dealers of the BIG providers? Thanks for the excellent post!

Wikimotive

Lastly, is the sale truly the exclusive measurement of the marketing? David mentioned consistency. If traffic and leads (forms, chat, phone, etc) consistenly grow and sales fluctuate, at what point does the dealer need to be accountable to their in-store process? Sales training? Reputation as a function of that process? Phone training? Shouldn't proper attribution include all of this context?

AutoHook powered by Urban Science

Winning Starts With WHY: The Critical Role of the "Why Factor" in the Auto Industry

The why factor is what makes baseball America’s pastime and not just a sport. You don’t have to be a diehard fan to enjoy a baseball game. It’s the atmosphere - the sights, the sounds, the smells, the contests - the experience the ballpark offers that makes it an exciting event for the whole family.

I’ll admit, compared to other pro sports, baseball is relatively slow-paced. But regardless, people love going to baseball games. Why? Because there is something memorable that comes to life within the stadium. The ballpark experience has become a vibrant aspect of our culture.

Apple, like baseball, has also become a part of our culture due to their unique marketing plays. The question becomes, what does Apple have that competing brands lack? I’ll give you a hint. It starts with why and ends with factor. It’s the why factor alone that has made Apple more successful than Dell. Their business model takes the traditional, “outside-in” approach and reverses it from “What-How-Why” to “Why-How-What.”

Leadership guru, author and acclaimed TED Talks speaker, Simon Sinek has created his own diagram that demonstrates the why factor, which he refers to as “The Golden Circle” shown below. Sinek says, “The inspired leaders, the inspired organizations, regardless of their size, regardless of their industry, all think, act, and communicate from the inside out.”

Still with me? Let’s further break down how Apple has mastered the all-powerful “why factor.”

IF (and that’s a big if) Apple communicated like everyone else, they would say what they do, how they do it and why they’re better. Then they would expect the action or behavior of people wanting to purchase their products. This is the “outside in,” commonplace approach. This tactic fails to guarantee longevity or more importantly, loyal customers.

Sinek demonstrates how Apple’s marketing messaging would sound if they were just like everyone else (outside in)…

- What: “We make great computers.”

- How: “They’re beautifully designed, simple to use, and user-friendly.”

- “Want to buy one?”

Apple’s Actual Model (inside out):

- Why: “Everything we do we believe in challenging the status quo, we believe in thinking differently.”

- How: “The way we challenge the status quo is by making our products beautifully designed, simple to use, and user-friendly.”

- What: “We just happen to make great computers, want to buy one?”

The difference between these two angles of approach is in the values behind the company that define why they exist. Sinek emphasizes,“People don’t buy what you do, they buy why you do it.” Such a simple idea, but so incredibly powerful. If you don’t believe me, look at any great car salesperson vs. an average car salesperson and you will see what I mean.

In order to stand out, you can’t just say you’re different. You have to know exactly why you’re different. The why factor must be overflowing within your inherent system of beliefs. It should dictate why you get out of bed in the morning. It is this factor that conquers competitors and challenges the current way the game is played.

It’s not about if you win or lose. It’s about WHY you play the game. Same thing applies for dealers. Whether you sell the car or not, it’s essential you deliver a ball park-inspired, grand slam experience. People who have negative dealership interactions are more likely to tell their friends about them. Positive experiences equate to satisfied, loyal customers. The article, 9 Ways Your Business is Like Baseball also emphasizes the point, “The experience your customer has with your company can make or break their overall view of you and your products. Filling the seats isn’t enough. You want those seats filled by people who are happy they came.”

For your dealership’s message to resonate, you have to simply reverse the order of the information you deliver from “What-How-Why” to “Why-How-What” – always pushing forward from the inside out – never the other way around. Dealers can go about their day (and their marketing strategy) in one of two ways: they can sell cars, OR they can inspire people. Which will you choose moving forward?

No Comments

AutoHook powered by Urban Science

10 Baseball Movies that Will Improve Automotive Sales

America's pastime offers valuable lessons that can be taken off the field and activated in the showroom. Each baseball film shown below contains powerful insights that car dealers can utilize to further increase sales and improve their overall strategy.

No Comments

AutoHook powered by Urban Science

The Automotive Marketing Home Run

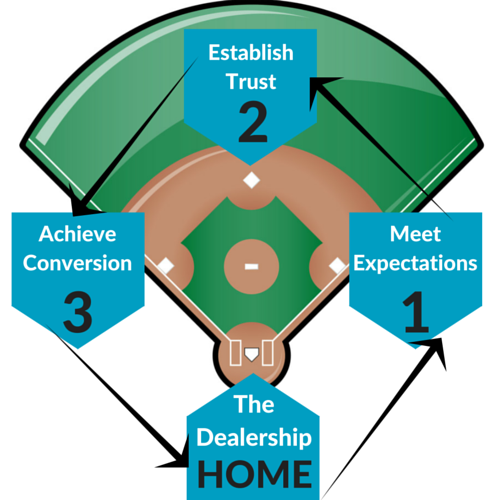

The four bases that make up a baseball diamond can be directly related to the car shopper’s journey. We all know the path begins online. The final destination, or home base, is the dealership. The goal is to surpass all your bases and arrive back at home, or rather, get buyers into your store. You can’t get a home run without rounding the other three bases - that would be cheating. Similarly, in the car business, there are three obstacles you have to conquer first and foremost, before returning home for the win.

First Base: Meet Expectations

The expectations of today’s digitally equipped consumers have skyrocketed. Souring shopper standards have caused additional complexities within the marketing landscape. There are more media outlets than ever before. New developments in mobile and wearable devices are generating more buzz than an overcrowded group text. Our access to data is exploding. Social media advertising opportunities are #Trending. But with all this technological innovation has come consequences. These advancements mean one thing for dealers and marketers: more competition. The following are guidelines to rise above and defeat the competition.

In a recent study, eMarketer reported 97% of US corporate executives say their customers expected an efficient, fast, cost-effective, and personalized level of experience. The two most critical components in automotive marketing today are speed and personalization. Cost aside, if you don’t offer a seamless, personal experience that spans from your digital advertising all the way to your showroom, having the lowest price in town isn’t going to matter - because buyers won’t make it to your dealership if you lack the first two pieces of the equation.

When a pitch is thrown to home plate, the batter has less than a tenth of a second to make a decision on whether or not to take a swing. When it comes to your website and mobile site, the same holds true. The modern-day consumer is flat out impatient. Google says 70% of smartphone users will leave a site that has a lagging load time and 67% will switch websites if it takes too many steps to get the relevant information they’re looking for. Dealers have a total of two seconds to ensure their mobile site experience prevails – slightly more time than a player at bat, but a very small window nonetheless.

According to AutoConversion, personalization of messaging is something we can and should be measuring. “Consumers now expect and respond better to messaging that is better customized to them personally, thus customization has become a key measurable characteristic with marketing attribution, an idea unimagined only a few years ago.”

Second Base: Establish Trust

I don’t care how you do it. Or at what inning in the game you earn their trust. But trust is paramount when it comes to selling cars. Choosing which vehicle to purchase and where to buy it is a large, emotionally dense decision. Whether it’s trust in a brand, a dealership, or a salesperson, it is ultimately that sense of security that makes people feel like they’re being provided with a personal, reliable experience. That feeling of comfort will translate across channels into vehicles sold.

Salespeople are already at a disadvantage when it comes to trust. A new survey from HubSpot says, “Only a mere 3% of people consider salespeople to be trustworthy.” Dealers need to be cognizant of this when staffing sales and BDC staff. Your team’s ability to communicate with honesty and transparency should be equally as important as their experience and knowledge of your inventory.

The same rules apply in marketing. Your brand, your digital campaigns, your “why buy” messaging, and your reputation management, all must collectively paint a picture of trust. A dependable brand provides helpful tips and easy access to information. Dealers can establish integrity by sharing useful advice or articles throughout their digital endeavors, not necessarily related to their given product.

Third Base: Achieve Conversion

We know vehicle details page (VDP) visits are important. There is no denying the correlation between VDP views and units sold. But what is even more important is the experience your VDP offers once the customer gets there. Your landing pages need to do three things: be easy to navigate, load fast, and above all, convert. Ask yourself, how do your VDPs incentivize customers to take that next step toward home base (your showroom)? KissMetrics says a one second delay in page response can result in a 7% reduction in conversions.

And finally…

Home Plate: Your Dealership

The culmination of the home run occurs when all these factors are simultaneously in play. The trajectory includes every digital touch point (base) that ultimately drove a buyer into your showroom. Just as players must work together as a team, these micro-moments must all work in harmony in order to meet expectations, establish trust, and offer a fast and personal experience.

1 Comment

CDK Global

This is a great article, David! I love a good Baseball metaphor.

This is so key: Your brand, your digital campaigns, your “why buy” messaging, and your reputation management, all must collectively paint a picture of trust.

Thanks for sharing!

AutoHook powered by Urban Science

Auto Attribution: Are We Stuck in the Minor Leagues?

There are a lot of rookie players in the game when it comes to accurate attribution reporting (measuring your digital sales return on investment). More often than not, the task of obtaining valuable sales attribution metrics is put on the bench due to their roaring complexity. The problem is not the data. The data is there; we just need the right  Obscure conundrums of the digital world can be “attributed” to the ongoing development of new media channels and information available. This new-age, omni-channel playing field has resulted in an upheaval of brand interaction opportunities – leaving the one source that led to a sale increasingly difficult to pinpoint. Keyword being difficult, not impossible.

Obscure conundrums of the digital world can be “attributed” to the ongoing development of new media channels and information available. This new-age, omni-channel playing field has resulted in an upheaval of brand interaction opportunities – leaving the one source that led to a sale increasingly difficult to pinpoint. Keyword being difficult, not impossible.

The concept of attribution itself is relatively simple. According to Ryan Gerardi, “Attribution allows you to understand which elements of your marketing mix were involved in the purchase decision process, and ideally, which were the most effective.” The problem lies in securing truthful statistics. What use is big data when you can’t put it into perspective and draw logical conclusions? If we knew which touch point led to a sale, wouldn’t we have a much better gage on how and where to spend our ad dollars?

In Google’s recent article, they highlight one consumer’s 900+ digital interactions that took place preceding her final vehicle purchase.

· The Good News: That’s 900 opportunities for dealers and manufacturers to engage customers with relevant, impactful information. Or in Google’s words, 900 chances to “be there and be useful.”

· The Bad News: The more digital interactions that make up a single consumer’s online profile, the more difficult it becomes to identify which interaction was the tipping point that led to the purchase.

Experian’s Global Marketer Report highlights the current depth of the issue. “The biggest hurdles and key priorities for marketers this year are dependent on having accurate, enriched data, linked together in a central location for a complete customer view.” In 2016, 81% of marketers are still struggling to attain this information. “Proper revenue attribution is crucial to determining each channel or touch point’s role in the customer journey.” But the reality is too many marketers have very little, if any understanding of which investments are paying off.

So let’s get to the point. The answer to the title of this blog is an obvious YES. Overall as an industry, we are stuck in the minor leagues when it comes to correctly measuring ROI. It’s a huge problem for marketers. But I assure you there is hope. If we only had the reporting to know which interaction point transformed a browser into a buyer, we could make much smarter, more efficient decisions with our money.

So, what are we going to do about it? First, manufacturers and dealers need to hold themselves accountable for seizing the limitless opportunities to connect. Second, ask yourself if you’re holding your vendors accountable for providing you with the attribution metrics that led to a sale? And I don’t mean how many clicks, impressions or unique site visitors your vendors have sent your way. That’s all great to know. But the major league players know that those executions drove traffic into your showroom and they know how many sales they got you.

CDK’s eBook, Automotive Moneyball says it best. “Leads, clicks, visits and VDP views all have value—as do inventory searches and hours & directions lookups. They just can’t tell the whole story when viewed in isolation. No single number can. They’re simply incomplete—pint-sized, partial pictures of the shoppers they represent.”

The major league players have the good stuff: clear, proven, and complete attribution models. However, it is up to you to key up your bases with ONLY major league vendors.

As the former CMO of one of the largest dealer groups in the country, I know from experience how difficult this can be. I also know that dealers are not getting the most out of their vendors for a variety of reasons - one being lack of time, another being the fear they may try and upsell you during a meeting...I get it. But the truth is, vendors are the experts (think of a player using better equipment) and their expertise is up for the taking - just make sure your scouts know how to draft the players with major league talent. Auto Attribution: Are We Stuck in the Minor Leagues?

1 Comment

AutoStride

Clarivoy is offering automotive multi-touch attribution tools, which can greatly help a dealership.

1 Comment

Jon Nigbor

Media272, Inc.

Thank you for the insights David!