Affinitiv

Supercharging Vehicle Sales During the Recovery Phase

As auto sales start to rebound across the country, auto retailers may be tempted to slowly ramp up their marketing investment until customers return in larger numbers. Our research into the state of recovery in the auto industry during the COVID-19 crisis identified some specific challenges with the wait-and-see approach that may stifle a fast recovery. Affinitiv evaluated the sales trends across 1,800 auto retailers in the US to understand the current level of recovery and to help retailers better manage their business throughout the recovery phase. Based on the findings of our study, retailers need to proactively manage key segments of their local market to ensure they recapture all of their lost business and avoid losing customers to competitors.

As auto sales start to rebound across the country, auto retailers may be tempted to slowly ramp up their marketing investment until customers return in larger numbers. Our research into the state of recovery in the auto industry during the COVID-19 crisis identified some specific challenges with the wait-and-see approach that may stifle a fast recovery. Affinitiv evaluated the sales trends across 1,800 auto retailers in the US to understand the current level of recovery and to help retailers better manage their business throughout the recovery phase. Based on the findings of our study, retailers need to proactively manage key segments of their local market to ensure they recapture all of their lost business and avoid losing customers to competitors.

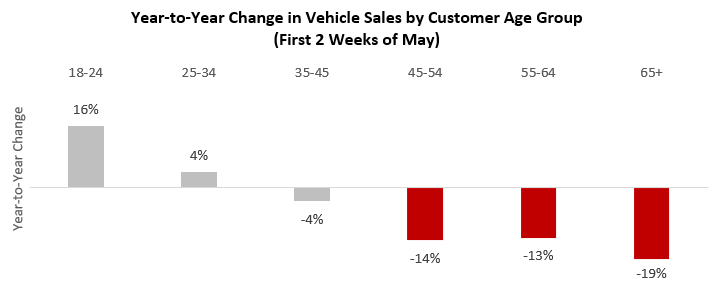

Alleviate Concerns of Older Consumers

While sales in early May were only down 11% on average across much of the nation, specific groups of customers were slower to return to the market. In particular, customers aged 45 or older brought down sales across the industry. In contrast, younger customers, who were more likely to be impacted financially by the COVID-19 crisis, are re-entering the market at a faster rate and taking advantage of the strong incentives offered by manufacturers.

One of the primary reasons for the delay relates to concerns when visiting a retailer for a test drive. Based on an Affinitiv survey of 900 auto consumers conducted during the COVID-19 crisis, 36% of older customers delayed their vehicle purchase to avoid a test drive compared to only 24% of younger consumers. A key opportunity for retailers is to implement policies that keep customers safe when they visit for a test drive and ensure customers are made aware of those policies during every touchpoint of the buying process. The top policies that made consumers more likely to visit for a test drive included requiring employees to wear face masks, enhanced sanitization of frequently touched surfaces, and cleaning vehicles after each use.

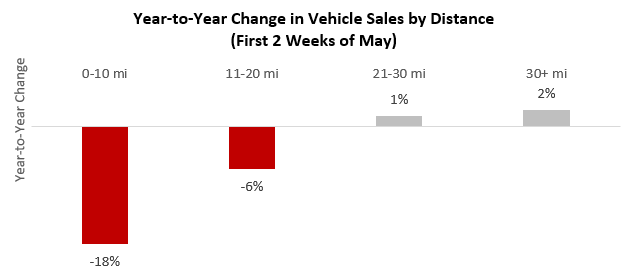

Attract Nearby Shoppers

Another opportunity for auto retailers is to focus on customers within a specific proximity to their location. Our research found customers located within 20 miles of an auto retailer were significantly slower to re-enter the market and buy cars. Nearby customers are particularly important since they represent approximately 70% of a typical auto retailer’s sales volume.

Retailers need to invest more marketing dollars into customers in the local trade area to overcome the negative trend. Promoting at-home services, such as pick-up of trade-ins and delivery of vehicles for test drives and after purchase, is one way to attract local customers, since those strategies are easier to execute for nearby customers than for customers that live farther away.

Auto retailers have an opportunity to dramatically change the trajectory of their recovery and recover faster than their competitors. By focusing their marketing investment and tailoring their messaging on specific segments of customers who are slower to return, such as older customers and those located closer to the store, retailers can accelerate their growth during the critical recovery phase of COVID-19 and get back to positive profitability sooner. Retailers who act quickly to capture this opportunity will reap the rewards and rapidly build market share as the economy recovers.

Affinitiv

Is Your Delivery Process Sabotaging the Customer Experience?

Service retention rates in dealerships have been steadily declining over the last three years, according to Affinitiv’s recent Automotive Loyalty Trends study, which analyzed data from more than 1,000 auto dealerships.

Service retention rates in dealerships have been steadily declining over the last three years, according to Affinitiv’s recent Automotive Loyalty Trends study, which analyzed data from more than 1,000 auto dealerships.

In domestic brand dealerships, service retention rates have dropped from 61.2% to 60.2%. At import brand dealerships, service retention rates have dropped from 67.8% to 66.4% and luxury brand dealerships have seen service retention rates drop from 67% to 65.3%.

At a time when fixed ops generates half of dealership gross profits, dealers can ill afford to lose any customers, let alone see a decline this significant. As part of our loyalty study, we surveyed 1,000 automotive consumers who had recently had their vehicles serviced at a dealership, and asked them about their service experience.

According to our survey, 33% of these customers felt that the dealership did not meet all of their expectations on their last service visit. And it turns out that to the majority of customers, the most important part of the service experience is having their vehicle ready and delivered to them at the promised time.

The three most important factors in the customer service experience were ranked as follows:

Vehicle ready when promised—74%

Advisor reviews services completed—55%

Fast payment process—45%

By a wide margin, failing to complete service and delivering a customer’s vehicle late, is the most common reason for a sub-par customer experience in the service department.

To help dealers improve their vehicle delivery process, we also asked how long after the promised time does a dealership have before customers consider the vehicle as “Late.” Here are the responses:

Less than five minutes—8%

Five to fifteen minutes—29%

Sixteen to thirty minutes—34%

More than thirty minutes—28%

Although a majority of customers grant a little leeway, dealers should strive to guarantee their vehicles are ready within five minutes of the promised delivery time.

Prioritizing the value of your customers’ time is the first step in meeting and exceeding customer expectations, and crucial to high customer satisfaction.

Includes contributions by Jeff Giere, Strategy Analyst at Affinitiv.

No Comments

Affinitiv

How to Increase Customer Repurchase Rates

Repeat buyers account for an increasing share of new vehicle sales and now represent 31% of all new vehicles purchased at a dealership, compared to 29% a few years ago. This trend is good news for dealers due to the lower cost of retaining vs. acquiring customers.

Repeat buyers account for an increasing share of new vehicle sales and now represent 31% of all new vehicles purchased at a dealership, compared to 29% a few years ago. This trend is good news for dealers due to the lower cost of retaining vs. acquiring customers.

Unfortunately, this trend is expected to decline due to a lack of improvement in customer repurchase rates. Despite the greater share of repeat buyers, customer repurchase rates have stayed within a relatively stagnant 23.5% to 24% range over the past few years.

The flat repurchase rate trend is masked by the strong SAAR over the past 10 years, which has created a larger pool of buyers available to repurchase, thus creating more repeat buyers. As SAAR slows down, we expect the share of repeat buyers to drop unless dealers adopt a new approach to retaining sales customers.

Affinitiv recently performed an in-depth analysis of the underlying trends in repurchase rates and identified a unique opportunity for dealers based on financing trends for repeat buyers. First, we separated buyers into three distinct groups based on their initial purchase: cash, lease, or loan. Next, we followed those customers over a 5-year period and compared their finance choice on the original purchase to the next vehicle they purchased. As expected, most buyers chose the same financing option for their repeat vehicle purchase.

In fact, 77% of lessees, 87% of loan buyers, and 91% of cash buyers repurchased a vehicle using the same financing choice as their original purchase. The trend to use the same financing on the repurchase creates a significantly opportunity for automakers and dealers to better tailor their marketing to each individual buyer.

Based on an Affinitiv survey with 1,000 consumers who recently purchased a vehicle at an auto dealership, a customer’s financing choice also helped us to identify their unique preferences relating to buying habits. Since cash buyers pay in one lump sum, their only concern is the total price of the vehicle. Lessees primarily care about the payment amount since they are locking themselves into a monthly payment.

Loan buyers are mixed. However, we found a strong correlation between their preference and their down payment amount. Customers with a down payment amount below $10K had preferences in line with lessees presumably because a lower upfront payment leads to a higher monthly payment throughout the loan. However, customers with a large upfront payment of $10K or higher had preferences similar to a cash buyer.

In addition to price vs. payment preferences, we also found differences in the primary reason for the last vehicle purchase. Cash and loan buyers were more interested in buying a vehicle with the latest technology during their last purchase. Lessees were more likely to be motivated by a strong incentive compared to other buyers.

Dealers have an opportunity to dramatically improve their customer repurchase rates by aligning their marketing strategy with the unique characteristics of different types of buyers. Here are some key strategies to apply to each group of buyers:

Cash buyer or loan buyer with high down payment (>$10K): promote the total price of vehicles in inventory. Highlight the technology features of vehicles.

Loan buyer with low down payment (<$10K): promote monthly payments of loan. Highlight technology features of vehicles.

Lessee: promote monthly payments of lease. Promote dealer and factory incentives.

Ensure your marketing programs properly segment customers and deliver the right financing option and vehicle selling points. By adopting a more personalized approach to marketing, dealers have the opportunity to improve repurchase rates and lessen the impact of the projected declines in SAAR.

No Comments

Affinitiv

How to Win Cash Buyers’ Elusive Loyalty

Cash buyers are an important but often overlooked segment of customers who pose a significant risk to auto dealers and manufacturers if left un-managed. In the first half of 2019, customers who purchased vehicles with cash accounted for 24% of all new vehicle sales. For some luxury brands, cash buyers are even more important since they can represent close to 40% of all new vehicle sales. However, their lack of loyalty to auto dealers often goes unnoticed, presenting a significant risk over time.

Cash buyers are an important but often overlooked segment of customers who pose a significant risk to auto dealers and manufacturers if left un-managed. In the first half of 2019, customers who purchased vehicles with cash accounted for 24% of all new vehicle sales. For some luxury brands, cash buyers are even more important since they can represent close to 40% of all new vehicle sales. However, their lack of loyalty to auto dealers often goes unnoticed, presenting a significant risk over time.

From a dealer’s perspective, cash buyers are composed of two distinct groups: customers who write a check with available cash on hand, and customers who financed their vehicle with a third-party. Since a dealer doesn’t have visibility into the personal finances of individual buyers, they can’t distinguish between the two groups and ultimately are forced to treat them the same.

Based on Affinitiv’s analysis of over 200K vehicle purchases in 2018, we found cash buyers are unlikely to return to a dealer for service and are significantly less loyal than other buyers. In 2018, only 39% of cash buyers returned to a dealer for service in their first year of ownership, compared to 65% of lease buyers and 68% of loan buyers. Cash buyers are also less likely to repurchase at the same dealer. We found the 5-year repurchase rate was only 10% for cash buyers compared to 16% for loan customers.

Through our research we also identified unique behavior patterns of cash buyers, which create an opportunity for dealers to improve the relevance of their marketing and thereby win their loyalty.

We analyzed the results of Affinitiv’s national consumer study with 1,000 recent car buyers and found cash buyers are significantly more likely to choose an auto service provider due to convenience of location, the ability to get service without an appointment and speed of the service. As a result, dealers are more likely to convert cash buyers to service customers if they offer and promote express service and have extra capacity available for walk-ins.

Dealers need to re-evaluate their retention marketing programs and ensure they deliver relevant messaging to cash buyers. By offering express service and promoting no-appointment service visits, dealers can dramatically improve the number of cash buyers who return for service and increase the likelihood of customers purchasing another vehicle at their dealership.

No Comments

Affinitiv

Convert More Prospects With Smarter Trade-In Tools

When your customers decide to trade in their current vehicle, you know exactly what to do first: make sure they get an appraisal as quickly as possible, since that’s the number one priority for most buyers. Right?

When your customers decide to trade in their current vehicle, you know exactly what to do first: make sure they get an appraisal as quickly as possible, since that’s the number one priority for most buyers. Right?

Not so fast.

AutoLoop recently surveyed 1,000 recent car buyers and analyzed over 100,000 leads from various trade-in valuation companies—and we discovered a significant gap in what consumers expect and what dealers think consumers expect. Accordingly, even though many dealers are making significant investments in digital retailing, the trade-in tools on their websites are actually turning away some of their best prospects. In fact, the typical online trade-in tool on dealer websites falls dismally short of consumers’ expectations, resulting in a poor customer experience and lost sales.

It’s all about the guarantee

Case in point: over half of customers surveyed said the most important factor for them in an online trade appraisal is receiving a guarantee of value for the trade. But countless dealers are still focusing primarily on the benefits of a fast appraisal—which, in reality, very few customers care about. In fact, only 1 in 5 customers said they wanted a quick appraisal.

However, many trade-in tools don’t offer guarantees because the process requires more time and intelligence. More specifically, it requires intelligence from a live person, rather than just a machine. Consumers are already distrustful of trade-in valuations from dealers—and our research indicates that without some type of guarantee, many consumers simply move on to another dealer.

Raise rates with the right tools

The good news? Dealers can still get a dramatic jump on the competition by migrating to consumer-friendly trade-in tools that deliver what buyers want most. We analyzed the conversion rates achieved by trade-in tools from various companies and discovered that those offering a guarantee of value have 3x to 4x higher conversion rates. That means dealers who are using a less intelligent trade-in tool are losing 10-15 deals per month! And that’s just the start—according to our survey, consumers who utilize the smarter trade-in tools with guaranteed values also convert to buyers in 10% less time than customers using outdated resources. Since faster conversions mean less time chasing down consumers with phone calls and emails, staff can spend more time selling.

With trade-in tools, the “work smarter, not harder” adage is key. By simply improving the intelligence of your trade-in process, you’ll avoid wasting money on leads and hours lost from your employees. In return, you’ll ensure your dealership is in sync with the real preferences of your customers—and the one they’re more likely to choose when it’s time to purchase.

No Comments

Affinitiv

Insights For a Competitive Edge

What do customers expect during the vehicle purchase process? What do they value most? In a survey included in the AutoLoop 2017 Digital Experience Study, we discovered valuable insights to these questions and more – insights that can give your dealership the competitive edge when customers start shopping. Read on to grasp a better understanding of what customers want, and how to meet their needs to capture more sales.

What do customers expect during the vehicle purchase process? What do they value most? In a survey included in the AutoLoop 2017 Digital Experience Study, we discovered valuable insights to these questions and more – insights that can give your dealership the competitive edge when customers start shopping. Read on to grasp a better understanding of what customers want, and how to meet their needs to capture more sales.

Promote Price Over Payment

In our studies, nearly 40% of consumers preferred the right price overall, as compared to 23% who were looking for the right monthly payment and 38% who wanted the right combination of both. Catch the customer’s eye by keeping the price point prominent in your email and direct mail marketing communications. Providing the right price also builds trust through transparency, making customers more likely to visit your showroom to seal their desired deal.

Stay Top-of-Mind – and Top of Their List

Just over 70% of consumers preferred to negotiate in person rather than online and planned to visit two dealerships. Make sure your dealership is one of them by sending consistent, targeted communications through a variety of channels for maximum reach. And make it personal by emphasizing the extra comforts your dealership offers to better the customer experience, such as no-pressure sales, a simplified shopping process, and, of course, the vehicle they want at a desirable price point.

Highlight the Features They Love

What are customers looking for in a vehicle? Newer technology was most sought after by 40% of consumers, and 39% simply wanted a newer vehicle in general. Other features to spotlight in your marketing communications include:

- Higher quality

- Better fuel economy

- More seating and/or cargo room

No Comments

Affinitiv

Open Rates by Weekday: The Best Days to Launch Campaigns

Does the day of the week an email campaign is launched affect whether that email is opened? It does! And boosting your open rates ultimately increases response rates – meaning more ROI for your store.

Does the day of the week an email campaign is launched affect whether that email is opened? It does! And boosting your open rates ultimately increases response rates – meaning more ROI for your store.

In a recent study, we identified how dealers could drive ROI by analyzing on-demand email campaign launch dates. In our research, we were able to pinpoint the best days of the week as related to email open rates. Read on to learn how to improve your campaign engagement by optimizing your launch days.

What We Discovered

We analyzed all on-demand email campaigns launched through our system between January 2015 and September 2017. And in our analysis, we found that the beginning and middle of the week showed higher volume and open rates. While the weekend showed lower volume, the open rates were significantly higher than during the week – a strong indicator of customer engagement.

How to Maximize Your Results

For non-premium brands, target the first half of the week, Monday through Wednesday, as your prime days to drive engagement. For premium brands, the ideal campaign launch days are Tuesday and Thursday. Although the weekend shows lower volume, all brands should consider trying a Saturday or Sunday campaign launch to find out how it performs for your store.

No Comments

Affinitiv

Drive Sold-to-Service Converts

Almost half of a dealership’s sales customers never return for their first service appointment – that’s a hefty chunk of a dealer’s lifetime service potential! What causes this pattern in car buyers, and how can you channel more of them from your showroom to your service lane? AutoLoop surveyed our subscribed dealers and their customers, and we discovered vital insights that will enable you to establish a long-term relationship with your customers – and generate more consistent revenue.

Almost half of a dealership’s sales customers never return for their first service appointment – that’s a hefty chunk of a dealer’s lifetime service potential! What causes this pattern in car buyers, and how can you channel more of them from your showroom to your service lane? AutoLoop surveyed our subscribed dealers and their customers, and we discovered vital insights that will enable you to establish a long-term relationship with your customers – and generate more consistent revenue.

Why Customers Go Elsewhere for Service

Studying a large sample of dealers and finding that nearly half of sales customers don’t return for their first service visit prompted the need to dig deeper. So we surveyed customers who purchased a vehicle in the last 12 months at a dealership and discovered that the biggest reasons they bolted for the aftermarket service providers was due to comfort and cost-related factors. The primary reason customers did not return to the dealer for service was due to an inconvenient location to their home or workplace. Other reasons include:

- Competitive prices

- Speed of service

- No appointments required

- Price options

Address Pain Points to Win Them Back – and Keep Them

In addition to marketing to your dealership and informing customers of Service Department amenities and specials, target the pain points listed above to overcome customer perceptions. If a new car buyer misses their first scheduled maintenance appointment, offer deeper discounts or savings on bundled maintenance packages to overcome the inconvenience of your location and compel them to choose your dealership over the competition. Emphasize the acceptance of walk-ins and the availability of loaner vehicles or shuttle service, if available, to solve the comfort factor. And promote your factory-trained technicians and genuine OEM parts selection. That way, your customers will know that in your service lane, their vehicle will receive the utmost care – something the other guys can’t guarantee.

No Comments

Affinitiv

The Growing Gap Between Retail and Automotive Customer Experience [VIDEO]

Doug Van Sach explains the growing gap between retailers and automotive consumer experience in this video blog.

No Comments

Affinitiv

What Is the Best Predictor of Customer Loyalty? [VIDEO]

AutoLoop VP, Analytics and Data Services shares findings about the best predictor of customer loyalty from AutoLoop's recently published white paper, "Life After Loyalty."

No Comments

No Comments