Affinitiv

Overcoming the New Threats to Vehicle Sales

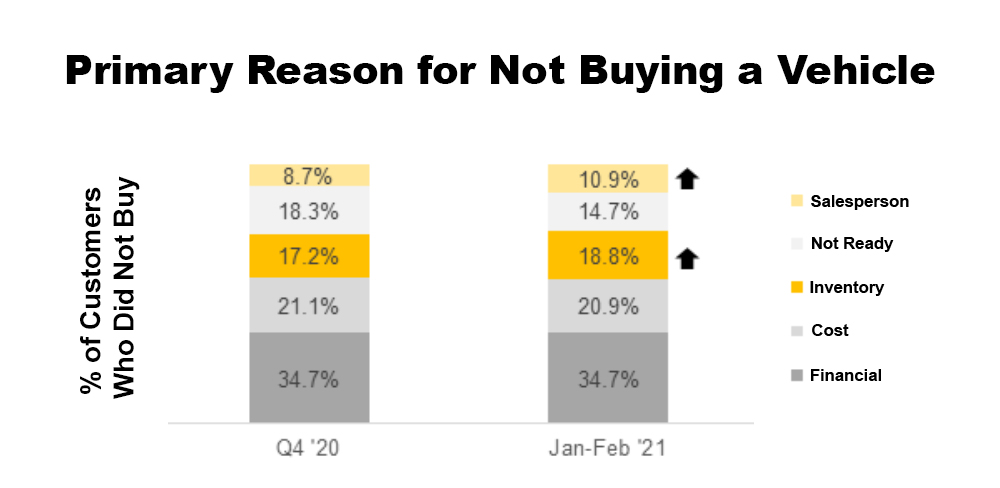

Through Affinitiv’s XRM solution, we survey more than 20,000 auto consumers every year who visit a dealer showroom but choose not to purchase a car. We asked the showroom visitors why they didn’t purchase a vehicle and then classified their responses into a few categories. While a person’s financial situation and the vehicle price are the most common reasons not to purchase a vehicle, an increasing percentage of consumers chose not to buy due to inventory-related reasons, e.g. the specific model they wanted was out of stock. Non-buyers were also more likely to cite concerns with the salesperson as a reason to keep shopping in early 2021 compared to Q4 2020.

Through Affinitiv’s XRM solution, we survey more than 20,000 auto consumers every year who visit a dealer showroom but choose not to purchase a car. We asked the showroom visitors why they didn’t purchase a vehicle and then classified their responses into a few categories. While a person’s financial situation and the vehicle price are the most common reasons not to purchase a vehicle, an increasing percentage of consumers chose not to buy due to inventory-related reasons, e.g. the specific model they wanted was out of stock. Non-buyers were also more likely to cite concerns with the salesperson as a reason to keep shopping in early 2021 compared to Q4 2020.

Approximately half of the consumers who did not purchase due to inventory reported that the dealer did not have the exact style they wanted, e.g. wrong color or size of vehicle. For consumers who identified the salesperson as the primary concern, the most common issue was a lack of follow-up related to a specific question a consumer needed to answer before they would purchase the vehicle. Lower staffing levels due to COVID are likely a key contributor to the lack of follow-up by dealer associates.

Manufacturers and dealers have the opportunity to overcome these new threats by better utilizing smart technologies. For example, Affinitiv’s technology incorporates proven workflows for sales associates to follow when interacting with customers. To ensure customers always receive a response, our technology also incorporates AI-driven chat and emails to respond to requests from leads. Overcoming inventory issues is a far greater challenge for dealers as they are at the end of the supply chain and it can take months to get the exact vehicle a customer wants. A key opportunity for dealers is utilizing intelligent marketing programs to promote the vehicles in inventory a customer is more likely to buy. Driving demand for existing inventory is critical to converting leads into buyers and lessening the likelihood of frustrating customers with the wrong inventory.

Interested in learning more? Read our latest industry trends guide to keep a pulse on the automotive market.

Affinitiv

Supercharging Vehicle Sales During the Recovery Phase

As auto sales start to rebound across the country, auto retailers may be tempted to slowly ramp up their marketing investment until customers return in larger numbers. Our research into the state of recovery in the auto industry during the COVID-19 crisis identified some specific challenges with the wait-and-see approach that may stifle a fast recovery. Affinitiv evaluated the sales trends across 1,800 auto retailers in the US to understand the current level of recovery and to help retailers better manage their business throughout the recovery phase. Based on the findings of our study, retailers need to proactively manage key segments of their local market to ensure they recapture all of their lost business and avoid losing customers to competitors.

As auto sales start to rebound across the country, auto retailers may be tempted to slowly ramp up their marketing investment until customers return in larger numbers. Our research into the state of recovery in the auto industry during the COVID-19 crisis identified some specific challenges with the wait-and-see approach that may stifle a fast recovery. Affinitiv evaluated the sales trends across 1,800 auto retailers in the US to understand the current level of recovery and to help retailers better manage their business throughout the recovery phase. Based on the findings of our study, retailers need to proactively manage key segments of their local market to ensure they recapture all of their lost business and avoid losing customers to competitors.

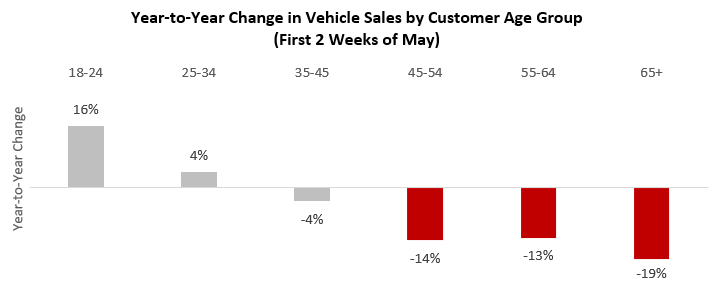

Alleviate Concerns of Older Consumers

While sales in early May were only down 11% on average across much of the nation, specific groups of customers were slower to return to the market. In particular, customers aged 45 or older brought down sales across the industry. In contrast, younger customers, who were more likely to be impacted financially by the COVID-19 crisis, are re-entering the market at a faster rate and taking advantage of the strong incentives offered by manufacturers.

One of the primary reasons for the delay relates to concerns when visiting a retailer for a test drive. Based on an Affinitiv survey of 900 auto consumers conducted during the COVID-19 crisis, 36% of older customers delayed their vehicle purchase to avoid a test drive compared to only 24% of younger consumers. A key opportunity for retailers is to implement policies that keep customers safe when they visit for a test drive and ensure customers are made aware of those policies during every touchpoint of the buying process. The top policies that made consumers more likely to visit for a test drive included requiring employees to wear face masks, enhanced sanitization of frequently touched surfaces, and cleaning vehicles after each use.

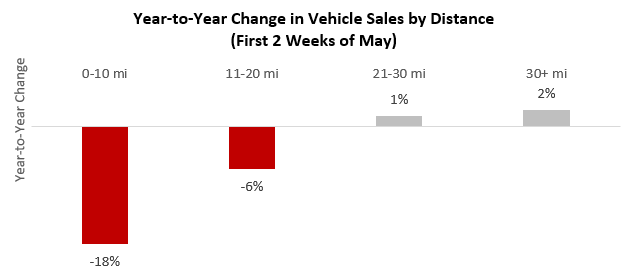

Attract Nearby Shoppers

Another opportunity for auto retailers is to focus on customers within a specific proximity to their location. Our research found customers located within 20 miles of an auto retailer were significantly slower to re-enter the market and buy cars. Nearby customers are particularly important since they represent approximately 70% of a typical auto retailer’s sales volume.

Retailers need to invest more marketing dollars into customers in the local trade area to overcome the negative trend. Promoting at-home services, such as pick-up of trade-ins and delivery of vehicles for test drives and after purchase, is one way to attract local customers, since those strategies are easier to execute for nearby customers than for customers that live farther away.

Auto retailers have an opportunity to dramatically change the trajectory of their recovery and recover faster than their competitors. By focusing their marketing investment and tailoring their messaging on specific segments of customers who are slower to return, such as older customers and those located closer to the store, retailers can accelerate their growth during the critical recovery phase of COVID-19 and get back to positive profitability sooner. Retailers who act quickly to capture this opportunity will reap the rewards and rapidly build market share as the economy recovers.

No Comments

Affinitiv

How AI Is Helping Dealerships [VIDEO]

Live from NADA 2020, Doug Van Sach shares how AI helps dealerships become more efficient and saves money.

No Comments

Affinitiv

Is Your Delivery Process Sabotaging the Customer Experience?

Service retention rates in dealerships have been steadily declining over the last three years, according to Affinitiv’s recent Automotive Loyalty Trends study, which analyzed data from more than 1,000 auto dealerships.

Service retention rates in dealerships have been steadily declining over the last three years, according to Affinitiv’s recent Automotive Loyalty Trends study, which analyzed data from more than 1,000 auto dealerships.

In domestic brand dealerships, service retention rates have dropped from 61.2% to 60.2%. At import brand dealerships, service retention rates have dropped from 67.8% to 66.4% and luxury brand dealerships have seen service retention rates drop from 67% to 65.3%.

At a time when fixed ops generates half of dealership gross profits, dealers can ill afford to lose any customers, let alone see a decline this significant. As part of our loyalty study, we surveyed 1,000 automotive consumers who had recently had their vehicles serviced at a dealership, and asked them about their service experience.

According to our survey, 33% of these customers felt that the dealership did not meet all of their expectations on their last service visit. And it turns out that to the majority of customers, the most important part of the service experience is having their vehicle ready and delivered to them at the promised time.

The three most important factors in the customer service experience were ranked as follows:

Vehicle ready when promised—74%

Advisor reviews services completed—55%

Fast payment process—45%

By a wide margin, failing to complete service and delivering a customer’s vehicle late, is the most common reason for a sub-par customer experience in the service department.

To help dealers improve their vehicle delivery process, we also asked how long after the promised time does a dealership have before customers consider the vehicle as “Late.” Here are the responses:

Less than five minutes—8%

Five to fifteen minutes—29%

Sixteen to thirty minutes—34%

More than thirty minutes—28%

Although a majority of customers grant a little leeway, dealers should strive to guarantee their vehicles are ready within five minutes of the promised delivery time.

Prioritizing the value of your customers’ time is the first step in meeting and exceeding customer expectations, and crucial to high customer satisfaction.

Includes contributions by Jeff Giere, Strategy Analyst at Affinitiv.

No Comments

Affinitiv

How to Increase Customer Repurchase Rates

Repeat buyers account for an increasing share of new vehicle sales and now represent 31% of all new vehicles purchased at a dealership, compared to 29% a few years ago. This trend is good news for dealers due to the lower cost of retaining vs. acquiring customers.

Repeat buyers account for an increasing share of new vehicle sales and now represent 31% of all new vehicles purchased at a dealership, compared to 29% a few years ago. This trend is good news for dealers due to the lower cost of retaining vs. acquiring customers.

Unfortunately, this trend is expected to decline due to a lack of improvement in customer repurchase rates. Despite the greater share of repeat buyers, customer repurchase rates have stayed within a relatively stagnant 23.5% to 24% range over the past few years.

The flat repurchase rate trend is masked by the strong SAAR over the past 10 years, which has created a larger pool of buyers available to repurchase, thus creating more repeat buyers. As SAAR slows down, we expect the share of repeat buyers to drop unless dealers adopt a new approach to retaining sales customers.

Affinitiv recently performed an in-depth analysis of the underlying trends in repurchase rates and identified a unique opportunity for dealers based on financing trends for repeat buyers. First, we separated buyers into three distinct groups based on their initial purchase: cash, lease, or loan. Next, we followed those customers over a 5-year period and compared their finance choice on the original purchase to the next vehicle they purchased. As expected, most buyers chose the same financing option for their repeat vehicle purchase.

In fact, 77% of lessees, 87% of loan buyers, and 91% of cash buyers repurchased a vehicle using the same financing choice as their original purchase. The trend to use the same financing on the repurchase creates a significantly opportunity for automakers and dealers to better tailor their marketing to each individual buyer.

Based on an Affinitiv survey with 1,000 consumers who recently purchased a vehicle at an auto dealership, a customer’s financing choice also helped us to identify their unique preferences relating to buying habits. Since cash buyers pay in one lump sum, their only concern is the total price of the vehicle. Lessees primarily care about the payment amount since they are locking themselves into a monthly payment.

Loan buyers are mixed. However, we found a strong correlation between their preference and their down payment amount. Customers with a down payment amount below $10K had preferences in line with lessees presumably because a lower upfront payment leads to a higher monthly payment throughout the loan. However, customers with a large upfront payment of $10K or higher had preferences similar to a cash buyer.

In addition to price vs. payment preferences, we also found differences in the primary reason for the last vehicle purchase. Cash and loan buyers were more interested in buying a vehicle with the latest technology during their last purchase. Lessees were more likely to be motivated by a strong incentive compared to other buyers.

Dealers have an opportunity to dramatically improve their customer repurchase rates by aligning their marketing strategy with the unique characteristics of different types of buyers. Here are some key strategies to apply to each group of buyers:

Cash buyer or loan buyer with high down payment (>$10K): promote the total price of vehicles in inventory. Highlight the technology features of vehicles.

Loan buyer with low down payment (<$10K): promote monthly payments of loan. Highlight technology features of vehicles.

Lessee: promote monthly payments of lease. Promote dealer and factory incentives.

Ensure your marketing programs properly segment customers and deliver the right financing option and vehicle selling points. By adopting a more personalized approach to marketing, dealers have the opportunity to improve repurchase rates and lessen the impact of the projected declines in SAAR.

No Comments

Affinitiv

How to Win Cash Buyers’ Elusive Loyalty

Cash buyers are an important but often overlooked segment of customers who pose a significant risk to auto dealers and manufacturers if left un-managed. In the first half of 2019, customers who purchased vehicles with cash accounted for 24% of all new vehicle sales. For some luxury brands, cash buyers are even more important since they can represent close to 40% of all new vehicle sales. However, their lack of loyalty to auto dealers often goes unnoticed, presenting a significant risk over time.

Cash buyers are an important but often overlooked segment of customers who pose a significant risk to auto dealers and manufacturers if left un-managed. In the first half of 2019, customers who purchased vehicles with cash accounted for 24% of all new vehicle sales. For some luxury brands, cash buyers are even more important since they can represent close to 40% of all new vehicle sales. However, their lack of loyalty to auto dealers often goes unnoticed, presenting a significant risk over time.

From a dealer’s perspective, cash buyers are composed of two distinct groups: customers who write a check with available cash on hand, and customers who financed their vehicle with a third-party. Since a dealer doesn’t have visibility into the personal finances of individual buyers, they can’t distinguish between the two groups and ultimately are forced to treat them the same.

Based on Affinitiv’s analysis of over 200K vehicle purchases in 2018, we found cash buyers are unlikely to return to a dealer for service and are significantly less loyal than other buyers. In 2018, only 39% of cash buyers returned to a dealer for service in their first year of ownership, compared to 65% of lease buyers and 68% of loan buyers. Cash buyers are also less likely to repurchase at the same dealer. We found the 5-year repurchase rate was only 10% for cash buyers compared to 16% for loan customers.

Through our research we also identified unique behavior patterns of cash buyers, which create an opportunity for dealers to improve the relevance of their marketing and thereby win their loyalty.

We analyzed the results of Affinitiv’s national consumer study with 1,000 recent car buyers and found cash buyers are significantly more likely to choose an auto service provider due to convenience of location, the ability to get service without an appointment and speed of the service. As a result, dealers are more likely to convert cash buyers to service customers if they offer and promote express service and have extra capacity available for walk-ins.

Dealers need to re-evaluate their retention marketing programs and ensure they deliver relevant messaging to cash buyers. By offering express service and promoting no-appointment service visits, dealers can dramatically improve the number of cash buyers who return for service and increase the likelihood of customers purchasing another vehicle at their dealership.

No Comments

Affinitiv

Are You Over Communicating To Your Customers?

When it comes to email marketing, frequency of communications plays an important role in getting customers to open your emails AND in getting them into your showroom.

When it comes to email marketing, frequency of communications plays an important role in getting customers to open your emails AND in getting them into your showroom.

However, flooding their inboxes with daily communications poses risks. Too many emails and your customers will lose trust in your business and unsubscribe from future marketing. Based on a 2018 Affinitiv survey, 56% of customers unsubscribed from a retailer’s promotional emails because they were contacted too many times. In a market saturated by digital promotions, how often should you contact your customers and how much is too much?

Affinitiv recently analyzed over 23 million emails sent to auto dealer customers to see what the impact of marketing frequency is on open rates and response rates. We calculated these at a customer level, meaning unique customers contacted made up the denominator for both of these metrics, while the numerator consisted of unique customers who opened at least 1 email, or had at least 1 RO after receiving a communication. Customers were segmented based on the monthly average number of communications they received.

Unsurprisingly, unique open rates see a steady trend upward as number of communications per month increases. On the other hand, unique response rates follow a similar upward trend but start to see a significant decrease starting at 7+ emails per month. This suggests that customers may start to lose trust in dealerships who they feel may be abusing their right to reasonably market to them.

Furthermore, we analyzed the impact of frequency on opt-out rates. The highest opt-out rates occurred for those receiving only 1 email per month. Since over communication can be ruled out, these customers likely fall into the category of those who find the content irrelevant.

Interestingly, increasing the number of communications has no significant impact on opt-out rates until customers start receiving 7 or more emails per month.

For maximum response, dealers should target their customers no more than 6 times per month with relevant content. Marketing strategies that pinpoint customers with targeted messaging based on where they are in their life cycle yield much higher returns compared to non-strategic approaches.

Dealers also have an opportunity to leverage targeted and relevant marketing through platforms that utilize artificial intelligence (AI). Getting in front of your customers is imperative for continual growth of your business but it’s equally imperative to maintain a balance, so as not to sacrifice their trust and loyalty.

Includes contributions by Jeff Giere, Strategy Analyst at Affinitiv.

No Comments

Affinitiv

Dealer Websites Fail to Meet Customer Expectations

A recent Affinitiv survey of 1,000 automotive consumers reveals that dealerships are falling short when it comes to delivering personalized, online shopping experiences to customers. In the same study, we analyzed a sample of 100 dealer websites to better understand the current level of personalization that dealers are offering.

A recent Affinitiv survey of 1,000 automotive consumers reveals that dealerships are falling short when it comes to delivering personalized, online shopping experiences to customers. In the same study, we analyzed a sample of 100 dealer websites to better understand the current level of personalization that dealers are offering.

Why the focus on website personalization?

Seventy-five percent of customers said they visited a dealer’s website prior to making their last vehicle purchase. Because this is often the first point of contact with your dealership, it’s critical that your website meets consumer expectations—and to understand how these expectations have drastically changed in the last few years.

Every day, consumers interact with non-auto retailers who provide a highly personalized online shopping experience. Amazon, Nordstrom and Apple are role models that consumers expect dealers to follow. Additionally, dealers must adapt to a new generation of buyers who have purchased virtually everything they ever needed online.

As consumer demand drives the growth of digital retailing, many dealers are being forced to retool a car-buying process that now begins on the website.

Personalization Gap

Our study revealed that 76% of recent car buyers said it was important for the dealer website experience to be personalized—yet only 26% of respondents agreed that dealers provide a highly personalized experience on their website. This large gap will have to be bridged in order to attract and retain car buyers who prefer to shop online.

Personalization is not as simple as remembering a customer’s name or giving customers the flexibility to search for vehicles with specific characteristics. Personalization requires a deeper understanding of customer preferences and an online experience tailored to each individual customer.

A key first step for dealers is to understand the specific aspects of the website that need to be customized. We asked customers what part of the website experience they wanted dealers to personalize and the top three items were (1) Vehicles of interest (2) Vehicle features and (3) Vehicles within my budget.

Vehicles of Interest

Sixty-five percent of consumers want websites to personalize vehicles of interest. In our website analysis, only 47% of dealer websites proactively recommend vehicles of interest based on a customer’s browsing behavior.

While some websites recommend “similar vehicles” to consumers when viewing a vehicle detail page, the recommendations typically relate only to the last vehicle viewed and did not reflect a consumer’s complete shopping history on the site or specific vehicles features they clicked on.

Vehicle Features

Fifty-eight percent of consumers said they want to be able to get vehicle recommendations based on specific features of interest, but in our sample not a single dealer website recommended vehicles based on features of interest.

Considering its high importance, recommending vehicles with relevant features is one of the single greatest opportunities for dealer websites to increase conversion rates and better meet the expectations of online shoppers.

Vehicles Within my Budget

Taking a consumer’s budget into consideration is critical to personalizing the online experience, since 52% of consumers expect a dealer’s website to help them find affordable vehicles. Additionally, 62% of consumers said that finding a vehicle with a specific monthly payment was as important, or even more important than finding a vehicle within a specific price range.

However, our analysis of 100 dealer websites found significant gaps when it comes to payments and the vehicle search.

* 9% of websites allow customers to search by payment range

* 55% of websites allow customers to estimate payments based on their true buying power, which includes the current equity position in their vehicle

* 11% of websites incorporated the credit score in the payment estimate

If websites aren’t dramatically improved to elevate the shopping experience and make personalized recommendations based on a consumer’s browsing behavior, dealers risk alienating potential buyers before they ever visit a showroom.

To remain competitive, dealers need to move beyond traditional approaches that attempt to optimize the same experience for every customer. Screen website vendors for personalization features and challenge vendors to demonstrate how their websites react to browsing behavior and deliver relevant vehicles with the right mix of features within a customer’s budget.

No Comments

Affinitiv

Take Control of Your Customer Experience By Breaking Down Your Data Silos

One of the biggest hurdles dealerships face when attempting to create a personalized experience for every customer is breaking down their data silos. Data silos are common in virtually every auto dealership today. They occur when information is accessible only to certain employees or only within one technology application. While many leading, non-automotive retailers have spent the last couple of decades integrating disparate systems to improve their customer experience, many dealers have fallen behind. Driven by the allure of small, startup tech companies, they put too much focus on continually adding non-integrated technologies that typically over-promise and under-deliver. As a result, dealers are facing the harsh reality of a significant digital-experience gap. We covered this––as well as the solutions––in our recent Mind the Service Experience Gap white paper.

One of the biggest hurdles dealerships face when attempting to create a personalized experience for every customer is breaking down their data silos. Data silos are common in virtually every auto dealership today. They occur when information is accessible only to certain employees or only within one technology application. While many leading, non-automotive retailers have spent the last couple of decades integrating disparate systems to improve their customer experience, many dealers have fallen behind. Driven by the allure of small, startup tech companies, they put too much focus on continually adding non-integrated technologies that typically over-promise and under-deliver. As a result, dealers are facing the harsh reality of a significant digital-experience gap. We covered this––as well as the solutions––in our recent Mind the Service Experience Gap white paper.

Not only do data silos make big-picture decisions––like which customers to target to grow your business––harder, they can negatively impact individual customer interactions in the showroom and on the service drive, leading to poor online reviews and risking the alienation of new customers. So it makes sense that eliminating data silos can increase your customer experience, CSI, and even your store’s revenue. And luckily, there’s a fix.

The Low-Down on Silos

The most noticeable data silo for dealerships is online data collection. All too often, when customers submit a lead form, schedule a service visit on your website, or value their trade online, their data gets buried in a single application managed by one of your vendors. Unfortunately, this crucial customer data is not typically shared with any of your other systems. Then, when those customers come in for their test drive or service appointment, the dealer associate assisting them has an incomplete picture of the customer or their vehicle. The unsurprising results are a sub-standard experience for the customer and missed revenue opportunities for the dealership.

Worse yet, the next time a customer makes a transaction online, the website doesn’t recognize them. They are then forced to provide the same information with every visit. Obviously, this practice is a problem and alienates customers as soon as the interaction starts. Every additional hurdle you create for a customer––an extra keystroke, tap, or click––leads to more frustration and abandoned transactions. And yet this situation occurs every day, resulting in lost sales and missed service revenue. That’s why it is so important to consolidate your vendors and centralize your customer data in one system. You also need to employ smart systems that continually recognize customers and eliminate unnecessary effort on their part.

One Customer, Fragmented Information

The best case scenario involving data silos is that all your customer information exists somewhere, scattered in the different applications used throughout your dealership. But unfortunately, “best case” doesn’t always equal “best practice.”

This kind of “data disconnect” can affect everything from sales interactions to marketing communications. In fact, a 2019 survey of 1,000 customers by AutoLoop found that 88% of customers value a personalized experience when visiting a dealership. If your customer information is siloed into different platforms and products, however, that crucial personalization data may be inaccessible or incomplete.

Say “So Long” to Data Silos

The immediate effects of eliminating your data silos include higher CSI scores, trust, and transparency and a significant lift in repeat business. And in the long run, it adds up to a lasting positive impact on your dealership’s revenue and profitability.

The solution is clear: integrate your data to enable a smarter customer experience. Your store might have the best individual technologies in the world, but if they don’t work together, they’re not much use at all. That’s why the best strategy for eliminating data silos is to adopt a seamlessly integrated sales and service solution. The ideal platform will do more than share valuable information across applications. It will also use the information intelligently, saving customers and employees time and effort.

Any sales or service professional knows the importance of a flawless first impression. Eliminating data silos in favor of a smart, integrated approach can upgrade that first interaction from “Hi, how can I help you today?” to “Hi, Bill, let’s test drive that F-150 Platinum you’re interested in” or “Hi, Diane, do you want to book your next service appointment at your usual time on Monday morning?”

No Comments

Affinitiv

Do You Know Your Customers’ Service Share of Visits? Here’s Why You Should

In the automotive industry, the ability to earn a greater share of a customer’s spend is the key to driving higher customer lifetime value. To that end, many dealers utilize flawed retention strategies designed to achieve a minimum number of service visits rather than maximize the revenue potential from every customer.

In the automotive industry, the ability to earn a greater share of a customer’s spend is the key to driving higher customer lifetime value. To that end, many dealers utilize flawed retention strategies designed to achieve a minimum number of service visits rather than maximize the revenue potential from every customer.

Unfortunately, today’s automotive retention measurement and marketing programs are often severely limited, and most only tell a partial story about a dealer’s retention performance. For example: a typical retention program used by dealers will identify which customers have exhibited some minimum level of activity in the last 12 to 18 months––e.g., made a service visit––vs. those who have shown no activity. The typical reaction is to invest more in the no-activity customers with the hope of converting them to a loyal customer.

However, this strategy has two key risks: first, inactive customers are often defecting for reasons outside of a dealer’s control––a factor corresponding directly to the frequent disconnect between a customer’s wants and a dealer’s value proposition. Second, and perhaps more surprising, if you are lucky enough to reactivate a customer, they are significantly less likely to return again for the next visit. We analyzed a national sample of over 2M dealer customers and discovered customers who were once inactive and recently visited a dealer are 50% less likely to be retained than a customer who was always active.

The predictable result: over-investing in inactive customers may eventually lead to a downward spiral of performance, where high-potential customers are replaced with lower-value customers over time. Dealers are then forced to find even more low-value customers in order to replace the lost revenue of their best customers, and the unproductive cycle continues.

What should dealers focus on instead?

Dealers can offset the limitations of retention management programs by shifting some of the focus (and marketing dollars) to capturing a greater share from their active customers. Identifying the untapped potential for each customer is a crucial first step. This is determined by evaluating an owner’s complete transaction history over the lifetime of their current vehicle. From there, dealers can determine a service share of visits, which compares a customer’s actual lifetime visits to the number of expected service appointments based on the manufacturer’s maintenance requirements. The service share of visits score is one of the most important metrics available for measuring a customer’s potential.

To provide a specific frame of reference and determine the real percentage of expected maintenance visits that dealers are currently capturing from vehicle owners, AutoLoop analyzed the service transactions from over 1,000 dealers. We found the average share of actual service visits was just 50%. Translation: dealers are only netting half of the existing service opportunity from their active customers.

By employing the service share of visits metric, dealers can identify which customers in their database offer the best potential (such as customers with a score below 50%), along with which services they’re missing. Although they may have had just one service visit in the last 12 months, the low-share customers are still active and receptive to marketing messages, and they provide the greatest possibility for service growth. In other words, since these owners are currently splitting their service spend between dealers and aftermarket service centers, dealers who can successfully recoup all the revenue potential instead of simply a small portion stand to see the most profit increase.

As well, dealers can further maximize their retention initiatives by pinpointing the particular service(s) a customer is missing. We analyzed the service history of consumers from a national sample of dealers who purchased new vehicles and discovered that in the first 5 years of ownership, only 25% bought tires from a dealer and only 13% bought brakes. Knowing and using the full history of each customer enables dealers to strategically target their marketing with messaging geared toward every individual's specific service opportunity.

The automotive service industry’s existing retention measurement and marketing programs, while useful to a point, only solve part of the problem. A more comprehensive approach would empower dealers with the information needed to make the most of their marketing investment. By utilizing share of services in combination with the current retention measurement offerings, dealers can capture the full potential from their most profitable owners and avoid the downward cycle of overinvesting in lost customers.

No Comments

No Comments